-

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

National MI set a record for new insurance written in the fourth quarter, but its parent company reported a net loss for the period due to tax reform.

February 16 -

The company that holds Washington Mutual's legacy reinsurance business has agreed to purchase a controlling interest in Nationstar Mortgage and invest in its growth.

February 13 -

Vermont’s first sustainability bond sale yielded strong demand to fund new affordable housing throughout the Green Mountain State, according to Gov. Phil Scott.

February 12 -

Ellie Mae's fourth-quarter and full-year revenue increased over the corresponding prior periods following its acquisition of Velocify.

February 9 -

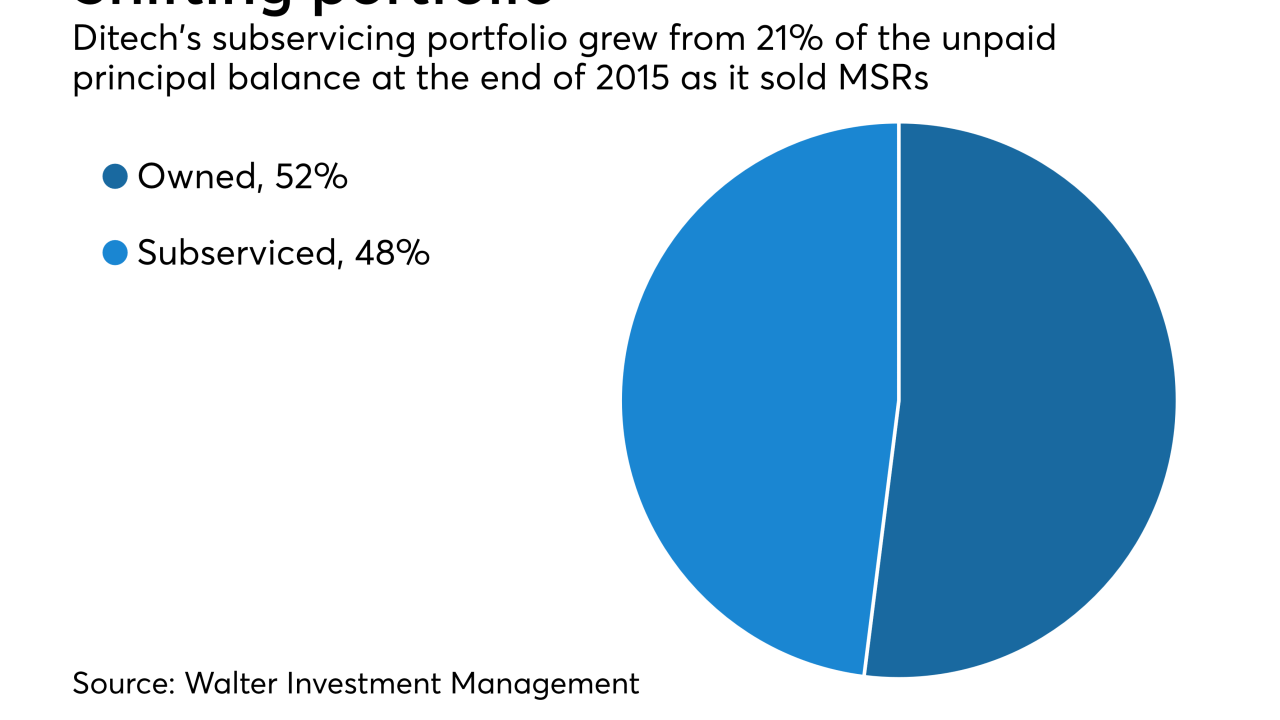

Walter Investment Management Corp. plans to emerge from Chapter 11 bankruptcy and start trading again under a new name in a matter of days.

February 8 -

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

The deal is backed by an unusually concentrated portfolio of just 19 loans on properties being rehabbed or converted to a new use; by property type, the biggest exposure is to hospitality, at 19.7%.

February 8 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

Shares of homebuilders are now in their 10th straight day of decline, the longest losing streak for the sector since 2002, when it lasted 11 days.

February 5 -

Bonus depreciation, Section 179, interest and loss limitations — what does it all mean?

February 5 Engineered Tax Services

Engineered Tax Services -

Anthony Renzi, the former Freddie Mac executive brought in to try and right the ship at Walter Investment Management Corp., will be leaving the company once a replacement is found.

February 2 -

Three senators have unveiled a bill that would allow captive insurance companies to regain full membership in the Federal Home Loan Bank System.

February 1 -

The changes to the tax code reduced Radian Group's fourth-quarter net income as the company took an incremental provision of $102.6 million.

February 1 -

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

Mick Mulvaney, acting director of the Consumer Financial Protection Bureau, said his zero-funding request for the agency is not meant to drain it of resources.

January 23 -

Financial firms have mostly shrugged off the government's budget woes, but Washington's gridlock might pose a bigger risk than they think.

January 22 -

U.S. home prices are surging to new records. Homebuilder stocks last year outperformed all other groups. And bears? They're now an endangered species.

January 22 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

Bank of America's mortgage banking business reported a loss for the fourth quarter driven largely by representations and warrants provisions.

January 17