-

Bonus depreciation, Section 179, interest and loss limitations — what does it all mean?

February 5 Engineered Tax Services

Engineered Tax Services -

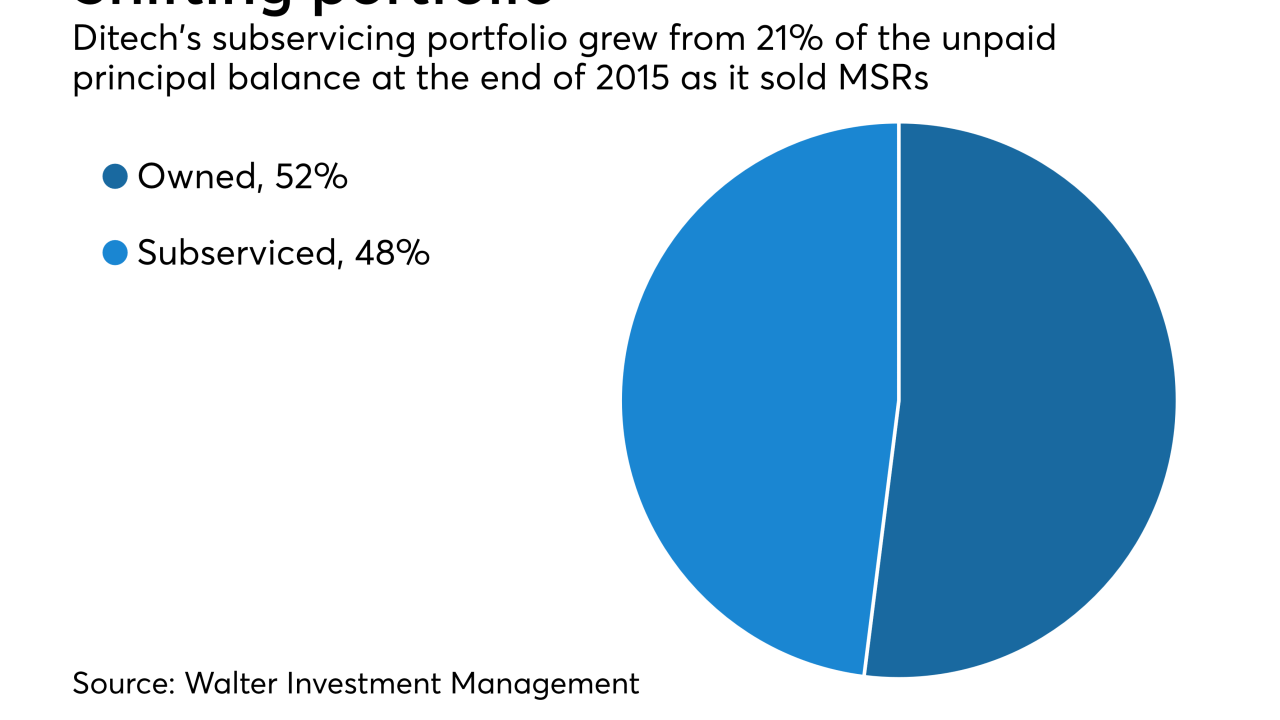

Anthony Renzi, the former Freddie Mac executive brought in to try and right the ship at Walter Investment Management Corp., will be leaving the company once a replacement is found.

February 2 -

Three senators have unveiled a bill that would allow captive insurance companies to regain full membership in the Federal Home Loan Bank System.

February 1 -

The changes to the tax code reduced Radian Group's fourth-quarter net income as the company took an incremental provision of $102.6 million.

February 1 -

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

Mick Mulvaney, acting director of the Consumer Financial Protection Bureau, said his zero-funding request for the agency is not meant to drain it of resources.

January 23 -

Financial firms have mostly shrugged off the government's budget woes, but Washington's gridlock might pose a bigger risk than they think.

January 22 -

U.S. home prices are surging to new records. Homebuilder stocks last year outperformed all other groups. And bears? They're now an endangered species.

January 22 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

Bank of America's mortgage banking business reported a loss for the fourth quarter driven largely by representations and warrants provisions.

January 17 -

Citigroup's fourth-quarter residential mortgage banking revenue was 22% lower from the previous year because the company sold the vast majority of its servicing rights.

January 16 -

JPMorgan Chase reported lower mortgage banking revenue in the fourth quarter as the returns from its servicing business declined from the previous year.

January 12 -

A group of reinsurers has committed to provide up to $650 million of coverage for credit risk on some $21 billion of 30-year, fixed-rate loans that the government-sponsored agency will acquire over the next two years.

January 4 -

The Vermont Housing Finance Agency is prepping the state’s first sustainability bond sale.

January 2 -

Fannie Mae's serious delinquency rate climbed to a high not seen since March 2017, but remained lower than it was 12 months prior.

January 2 -

The tax reform bill Congress sent to President Trump's desk this week is likely to prompt at least a short-term spike in mortgage rates.

December 21 -

The council is exploring legislation to collect around $492 million in delinquent real estate taxes that could aid the city’s school district.

December 14 -

From Ellie Mae to Remax, here's a look at seven publicly traded companies in the mortgage and real estate industries expecting accelerated growth in 2018.

December 12 -

As mall owners around the world seek a defense against Amazon.com, Europe's largest commercial landlord is betting the solution lies across the Atlantic.

December 12 -

HUD's decision to stop endorsing Property Assessed Clean Energy will have little impact; the widest segment of FHA borrowers "would not qualify anyway."

December 11