-

The Trump Administration’s anti-regulatory agenda has yet to permeate the Securities and Exchange Commission, which remains opposed to relief for collateralized loan obligations.

June 9 -

Three former Nomura Holdings mortgage-bond traders accused of cheating their customers called no witnesses in their defense against fraud charges, betting that prosecutors’ evidence is too weak to convict them.

May 31 -

An El Paso real estate investment trust, run by some of city's most successful business people, faces new allegations of fraud in a failed housing venture just as another lawsuit against the trust has been dismissed by a federal judge.

May 16 -

The IRS will allow Fidelity National Financial to distribute its entire stake in Black Knight Financial Services to FNF Group shareholders in a tax-free transaction.

May 11 -

Walter Investment Management Corp.'s first-quarter net income included a $42 million after tax gain from the sale of Green Tree Insurance Agency.

May 10 -

PHH Corp.'s first-quarter net loss more than doubled as the troubled mortgage company dumps its origination unit and servicing rights and rebuilds as a subservicer.

May 10 -

Thomas H. Lee Partners is selling approximately 13% of its stake in Black Knight Financial Services in a secondary public offering.

May 9 -

Essent Group Ltd., the Hamilton, Bermuda-based parent of Essent Guaranty, reported first-quarter net income of $66.6 million.

May 5 -

Fannie Mae said it expects to make a $2.8 billion dividend payment to the U.S. Treasury in June after reporting a first-quarter profit driven by a relatively stable mortgage market and a continued decline in delinquencies.

May 5 -

Regulator now has recovered nearly $4.8 billion in various suits related to the mortgage meltdown in 2008.

May 1 -

In an echo of the rescue deals of 2007 and 2008, New Residential's CEO framed the transaction as something undertaken to benefit the entire industry.

May 1 -

CoreLogic's first-quarter net income was down 54% from the prior year as lower mortgage origination volume reduced the need for some of its services.

April 27 -

Radian Group earned $76.5 million for the first quarter, up 16% from $66.2 million one year prior, helped by a 25% year-over-year rise in new insurance written.

April 27 -

Arch Capital Group's 62% first-quarter earnings improvement was driven by its acquisition of United Guaranty Corp.

April 27 -

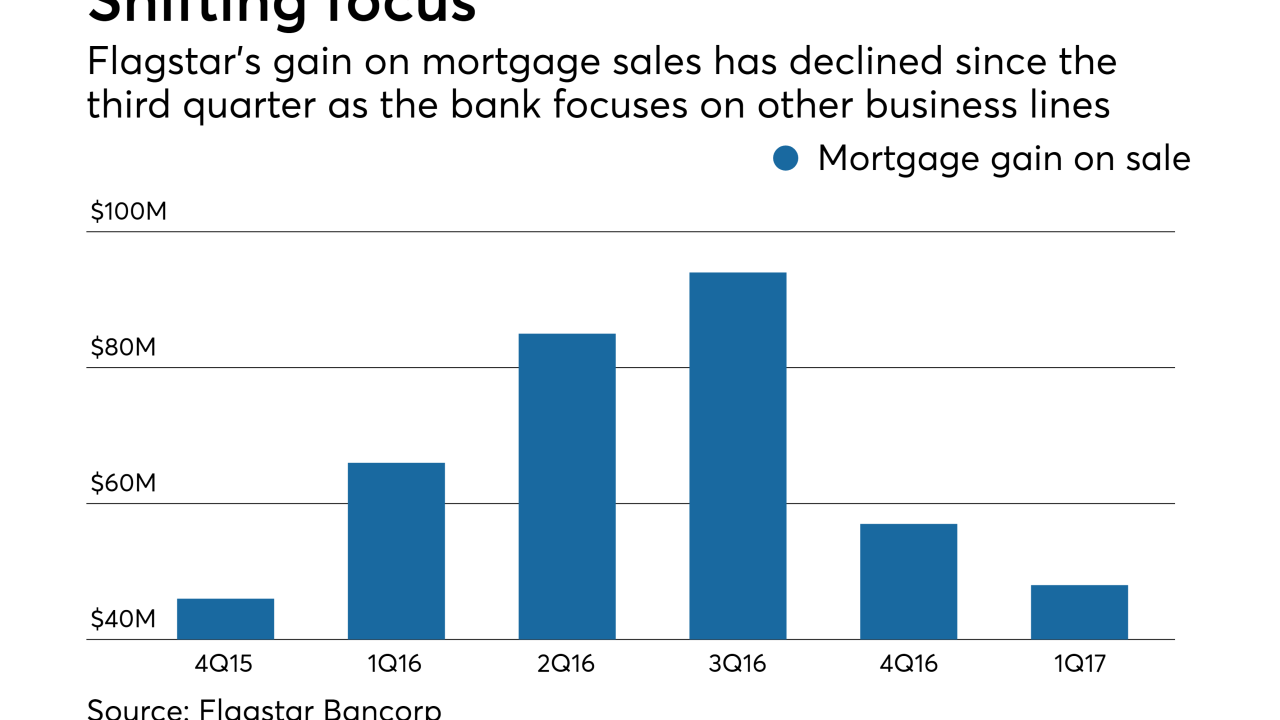

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Stewart Information Services Corp. posted net income in the first quarter of $4.1 million, a turnaround from the $11.2 million loss one year ago.

April 20 -

MGIC Investment Corp. had net income of $89.8 million for the first quarter, an increase of nearly 30% over the same period last year of $69.2 million.

April 20 -

Mortgage bankers' first-quarter earnings should be down from the fourth quarter in tandem with the reduction in origination volume.

April 19 -

Impac Mortgage Holdings sold $56 million of its common stock as part of a plan to securitize non-qualified mortgage loans.

April 19 -

The Loan Syndications and Trading Association is appealing directly to Treasury Secretary Steven Mnuchin to exempt collateralized loan obligation managers from rules requiring "skin in the game" of deals.

April 13