-

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

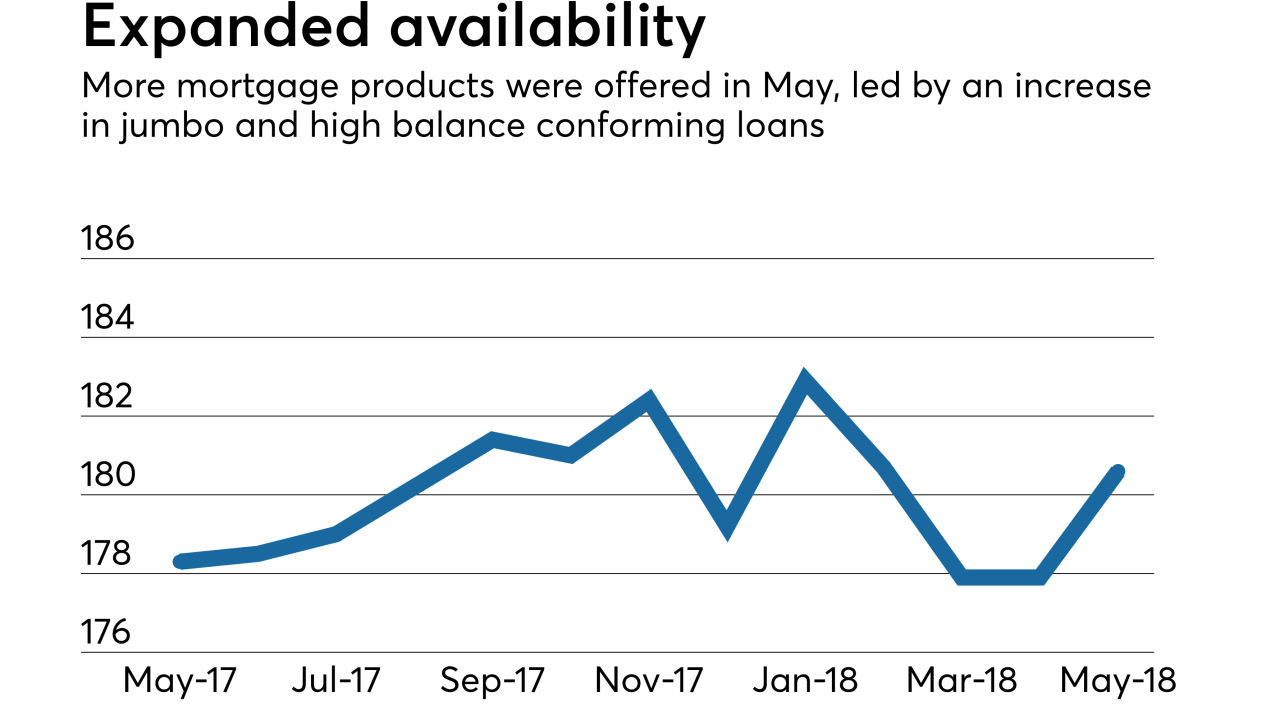

Mortgage credit availability increased in May by 1.5% as more jumbo and high-balance conforming loan products came on the market, the Mortgage Bankers Association said.

June 13 -

Mortgage credit availability was unchanged in April, as originators tightened their government lending programs but made more jumbo offerings available.

May 8 -

Lorie Shannon, recruited from SunTrust, will oversee a strategy that features large, non-QM mortgages in key markets.

May 7 -

Technology startup Eave is making a foray into Colorado's fast-moving, high-end mortgage lending market by offering software designed to quickly analyze jumbo borrowers' more complex incomes and assets.

April 9 -

Mortgage credit availability tightened during March to its lowest level in over a year, adding another headwind to a market challenged by rising interest rates and a shortage of homes for sale.

April 5 -

As policymakers take another crack at housing finance reform, federal leaders and the housing lobby are once again perpetuating the false notion that ending government guarantees would cause the 30-year, fixed-rate mortgage to vanish.

March 21 American Enterprise Institute

American Enterprise Institute -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Loan program revisions made by one large conventional mortgage investor led to a decrease in total residential home finance credit availability in February.

March 8 -

The $446 million Pearl Street Mortgage Company 2018-1 Trust is backed by 30-year, fixed-rate loans with credit characteristics in line with recent private-label prime jumbo transactions rated by Fitch Ratings.

March 5 -

Darryl White sees an opportunity for Bank of Montreal to take more market share in the United States, and he’s betting on investments in mortgage lending, commercial banking and capital markets to get there.

February 9 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

The $401.2 million COLT 2018-1 is the eighth overall securitization of non-qualified jumbo mortgages issued by the Lone Star Funds affiliate.

January 12 -

PennyMac Financial Services Inc. is setting up its new mortgage broker channel to target home-buyer and higher-balance loan segments, and eventually become one of the dominant players in the space.

January 12 -

The new cap on the mortgage interest deduction should help the first time home buyer market by forcing sellers to lower prices, at least in the near term.

January 10 -

There were fewer mortgage programs available to borrowers at the lower end of the credit spectrum in December, resulting in an overall decrease in credit availability.

January 9 -

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

A slight decrease in the number of jumbo investor offerings contributed to lower consecutive-month credit availability in October, according to the Mortgage Bankers Association.

November 8 -

Slightly looser underwriting outside the government sector is primarily responsible for the latest increase in credit availability.

October 10 -

The shift to a purchase market and an increase in wholesale mortgage originations contributed to a nearly 17% year-over-year rise in fraud risk during the second quarter, according to CoreLogic.

September 19