-

Mortgage credit availability declined in April as lenders cut back on the number of conforming products they offered.

May 4 -

Increased access to jumbo loan products brought mortgage credit availability to its highest level since the bust.

April 6 -

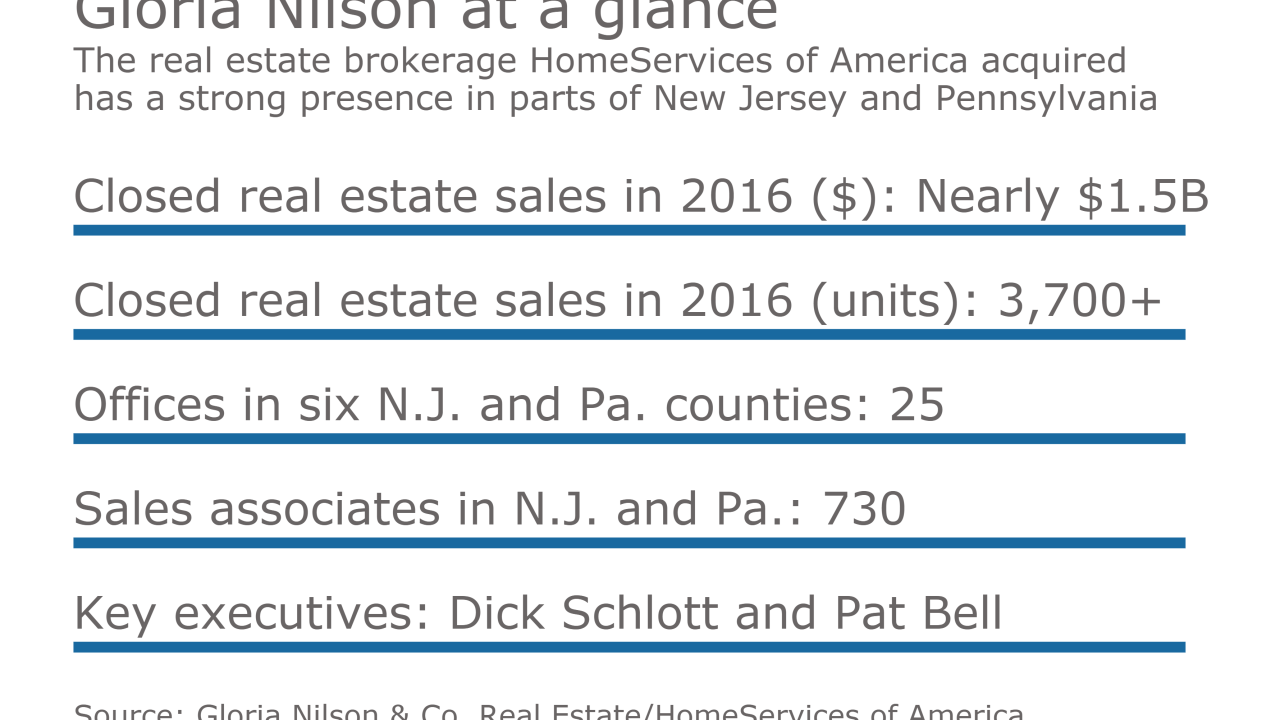

HomeServices of America has acquired regional luxury home specialist Gloria Nilson & Co. Real Estate in a deal with undisclosed terms.

April 4 -

Mortgage credit availability went up yet again in February amidst an expansion in access to government loans.

March 9 -

Application activity increased 3.3% from one week earlier, even though mortgage interest rates rose on speculation the Federal Open Market Committee could act in March.

March 8 -

Mortgage application activity increased by 5.8% during the week of Feb. 24.

March 1 -

Although issuance of residential mortgage-backed securities remains down from a year ago, the number of nontraditional deals is continuing to grow, according to Moody's Investors Service.

February 23 -

The market share of mortgage applications submitted for refinancings hit an eight-year low as total activity decreased 2% from one week earlier, according to the Mortgage Bankers Association.

February 22 -

The refinance share of mortgage activity decreased to 46.9% of total applications, its lowest level since June 2009, from 47.9% the previous week.

February 15 -

JPMorgan Chase is known to eschew selling conforming mortgage loans to Fannie Mae and Freddie Mac, preferring to securitize them in the private-label market.

February 13 -

Invictus Capital Partners, a nonprime mortgage lender based in Washington, D.C., is making its debut in the securitization market.

February 10 -

The share of refinance applications is at its lowest level in over seven and a half years, according to the Mortgage Bankers Association.

February 8 -

Mortgage credit availability increased in January amidst wider access to jumbo loans, according to the Mortgage Bankers Association.

February 7 -

The share of refinance applications fell under 50%, a sign the industry could be shifting to a predominantly purchase market.

February 1 -

Mortgage application volume increased 4% from one week earlier even as interest rates rose during the period, according to the Mortgage Bankers Association.

January 25 -

There was a slight increase in application activity driven by consumers taking advantage of a downturn in mortgage rates to refinance.

January 18 -

The Federal Housing Administration program could see a $50 billion increase in single-family loan endorsements this year if a planned 25-basis-point annual premium cut goes into effect on Jan. 27.

January 13 -

Mortgage application volume started off 2017 on a good note as activity increased 5.8% from one week earlier, according to the Mortgage Bankers Association.

January 11 -

Mortgage credit availability grew for the fourth consecutive month in December, the Mortgage Bankers Association reported.

January 5 -

JPMorgan is returning to a familiar structure as it again pools large-market prime jumbo mortgages for investors in collateralized residential mortgage loans.

December 16