-

The decision provides more clarity to noteholders in the state about when the six-year statute of limitations to bring a foreclosure action begins.

February 23 -

A federal judge denied the Office of the Comptroller of the Currency's motion to have the case thrown out, saying concerns about the agency's rulemaking process to reform the Community Reinvestment Act have merit.

February 1 -

The company also reported a large fourth-quarter loss that reflected a significant increase in its loan-loss provision.

February 1 -

The complaint unsealed Monday alleges three individuals and several companies they owned or controlled engaged in False Claims Act violations involving short sales of properties that had Federal Housing Administration-insured mortgages.

January 5 -

The CFPB issued two rulemakings in 2020 that the financial services industry and consumer advocates hoped would finally clarify key issues over how collectors contact debtors and deal with legacy debts. But both sides want the incoming Biden administration to make further changes.

January 5 -

The agency's rule outlines steps collectors must take to inform consumers about an outstanding debt, and prohibits companies from pursuing lawsuits after a statute of limitations has ended.

December 18 -

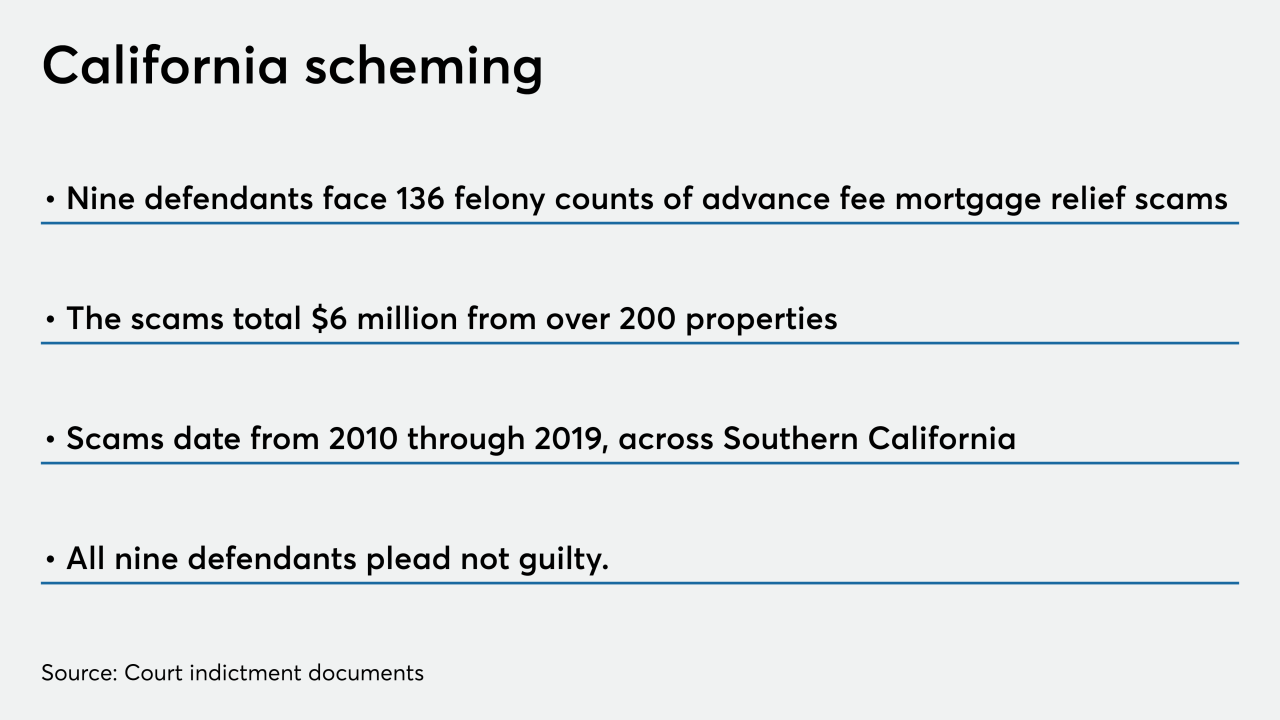

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1 -

A former home mortgage consultant with the company alleges she was subjected to a lower compensation structure, awards and benefits compared to her male counterparts.

August 12 -

The mortgage REIT's external manager responded by filing a new lawsuit against it, calling the move "baseless and retaliatory."

July 23 -

A lawsuit filed Tuesday argues that the bureau's establishment of the panel looking into regulatory changes violated the Federal Advisory Committee Act.

June 16 -

Real estate crowdfunding company Sharestates launched a program Wednesday offering liquidity to private lenders and loan aggregators contending with margin calls as a result of market volatility related to the coronavirus outbreak.

April 1 -

The company disclosed that an internal review of a now-discontinued loan program found that employees engaged in misconduct tied to income verification and requirements, among other things.

March 9 -

A dozen of the nation's largest underwriters were accused of colluding with traders to artificially set prices on the secondary market for Fannie Mae and Freddie Mac securities.

December 17 -

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns among bankers that they could become an even more inviting litigation target.

October 9 -

The two Democrats waded into a court battle over the president's ability to fire a director of the Consumer Financial Protection Bureau.

October 8 -

The agency had decided not to challenge a recent court ruling that its structure violates the separation of powers, but newly confirmed Director Mark Calabria now appears willing to the fight the case.

July 9 -

A developer behind projects in the Maine cities of Portland and Saco was sued by a business partner as properties there are scheduled to be sold at foreclosure auctions.

July 8 -

Ocwen Financial, Fidelity Information Services and Fidelity's corporate parent have agreed to settle a lawsuit over regulatory audit expenses Fidelity submitted to Ocwen for reimbursement.

May 9