-

A lawsuit filed Tuesday argues that the bureau's establishment of the panel looking into regulatory changes violated the Federal Advisory Committee Act.

June 16 -

Real estate crowdfunding company Sharestates launched a program Wednesday offering liquidity to private lenders and loan aggregators contending with margin calls as a result of market volatility related to the coronavirus outbreak.

April 1 -

The company disclosed that an internal review of a now-discontinued loan program found that employees engaged in misconduct tied to income verification and requirements, among other things.

March 9 -

A dozen of the nation's largest underwriters were accused of colluding with traders to artificially set prices on the secondary market for Fannie Mae and Freddie Mac securities.

December 17 -

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns among bankers that they could become an even more inviting litigation target.

October 9 -

The two Democrats waded into a court battle over the president's ability to fire a director of the Consumer Financial Protection Bureau.

October 8 -

The agency had decided not to challenge a recent court ruling that its structure violates the separation of powers, but newly confirmed Director Mark Calabria now appears willing to the fight the case.

July 9 -

A developer behind projects in the Maine cities of Portland and Saco was sued by a business partner as properties there are scheduled to be sold at foreclosure auctions.

July 8 -

Ocwen Financial, Fidelity Information Services and Fidelity's corporate parent have agreed to settle a lawsuit over regulatory audit expenses Fidelity submitted to Ocwen for reimbursement.

May 9 -

Ocwen Financial Corp. now alleges that Fidelity Information Services misled California officials about its ability to conduct the audit at the heart of litigation.

February 12 -

A lawsuit alleging Wells Fargo improperly compensated its California-based mortgage loan officers could have broader ramifications now that it has been granted class certification.

February 8 -

Ocwen Financial subsidiary PHH Mortgage will pay a total of $750,000 to six military members and increase employee training to settle Department of Justice allegations that it conducted foreclosures that violated the Servicemembers Civil Relief Act.

February 6 -

The U.S. Supreme Court turned away a broad challenge to the structure of the Consumer Financial Protection Bureau, the agency that Republicans say has stifled economic growth through over-regulation.

January 14 -

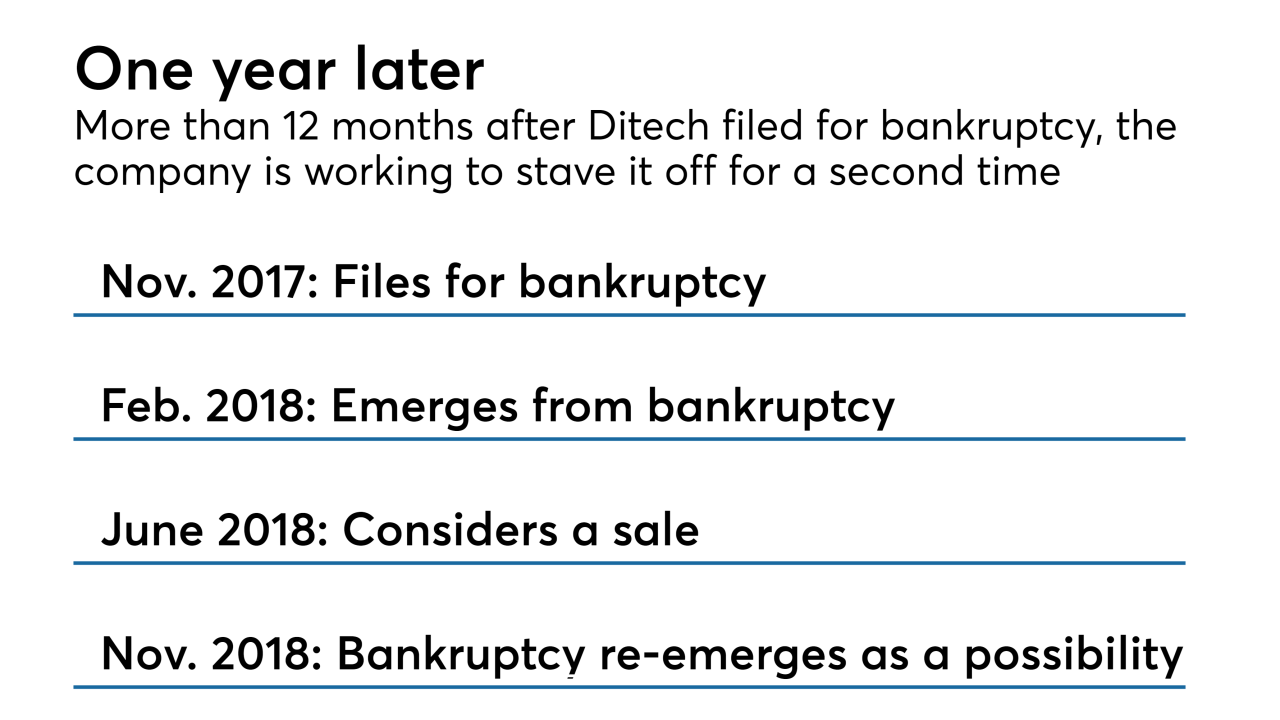

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

State officials have lost two rounds in a lawsuit that says California improperly diverted money intended for homeowners to make payments on housing bonds.

September 25 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15 -

A ruling involving a Cleveland law firm casts doubt on CFPB claims that attorneys misrepresent their role to consumers.

July 27 -

Leandra English, who sued President Trump and Mick Mulvaney last year claiming to be the rightful director of the CFPB, said Friday that she plans to resign and drop the litigation.

July 6 -

Greg Englesbe resigned as CEO of New Jersey lender E Mortgage Management after a jury awarded $3 million to a woman who accused Englesbe of injuring her when he grabbed and forcibly kissed her at a Philadelphia restaurant.

June 29