-

Compared with the week prior, approximately 83,000 more loans from all investor types became forborne.

June 26 -

A new CFPB rule will expedite the forbearance and loss-mitigation process for consumers suffering financial hardship from the pandemic.

June 23 -

The number of loans going into coronavirus-related forbearance dropped, with the growth rate falling 7 basis points between June 8 and June 14, according to the Mortgage Bankers Association.

June 22 -

Compared with the week prior, approximately 57,000 fewer loans from all investor types were forborne.

June 19 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

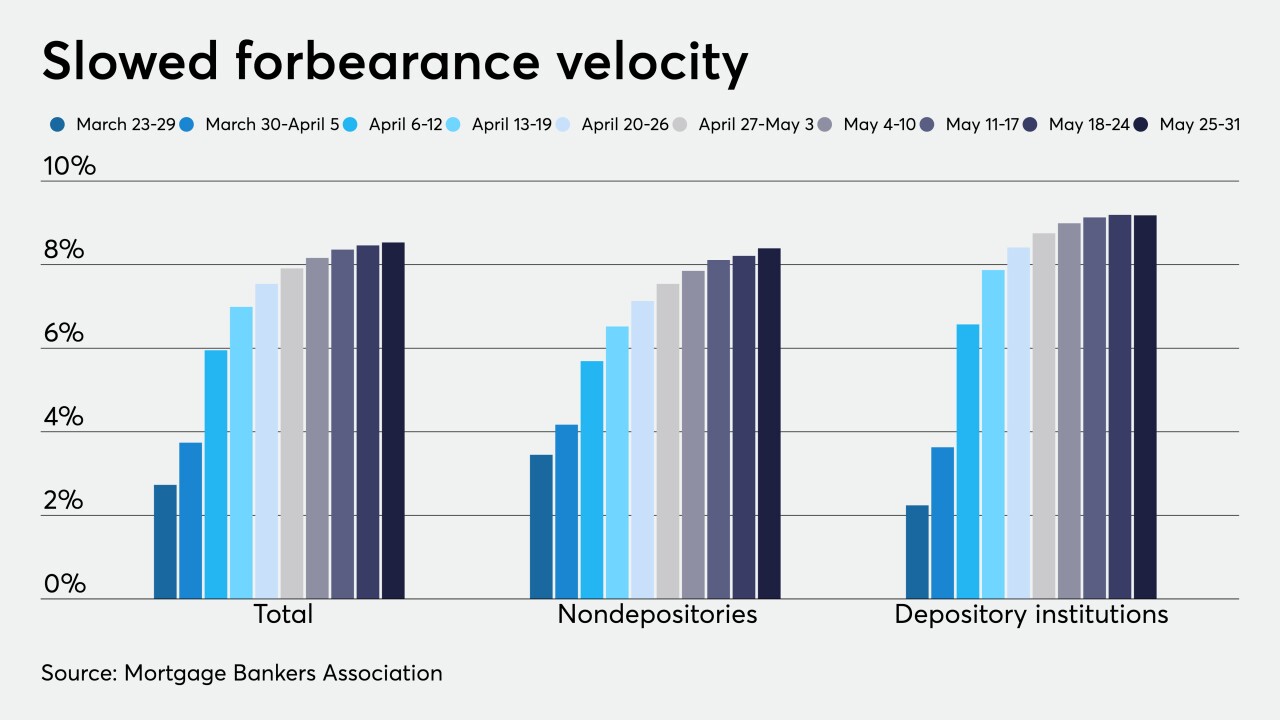

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

About 9% of government-insured loans in forbearance have low equity, which could hamper post-forbearance servicing.

June 8 -

But there was an increase in private-label mortgages in forbearance.

June 5 -

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

June 2 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

Kalahari Resorts defaulted on a $347 million mortgage originated by JPMorgan Chase

May 27 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26 -

The templates are meant to make it easier to obtain agency approval for small-dollar loan products and to accommodate mortgage servicers that want to provide online loss mitigation options.

May 22 -

As the growth rate in forbearance requests downshifts, a vast stockpile of loans await modifications.

May 22 -

To deal with the crunch, servicers should combine cloud and digital workflow automation technologies.

May 19 Clarifire

Clarifire -

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18 -

Eligible borrowers can add the forborne payments to the end of their loan term.

May 13 -

The joint site describes potential strategies for both homeowners and renters economically affected by COVID-19.

May 12 -

Specialized Loan Servicing will pay more than $1 million to settle Consumer Financial Protection Bureau allegations that it foreclosed on protected consumers and failed to send required evaluation notices in 2014.

May 12 -

The number of mortgages in coronavirus-related forbearance rose by 37 basis points as the unemployment rate soared, according to the Mortgage Bankers Association.

May 11

![“A growing concern for many [homeowners] is the notion that they would have to make a balloon payment at the end of the mortgage forbearance,” said CFPB Director Kathy Kraninger.](https://arizent.brightspotcdn.com/dims4/default/21bc754/2147483647/strip/true/crop/5000x2813+0+260/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F1e%2F1a%2Fa2ee24e14f76810e720c3b08aee8%2Fkraninger-kathy-bl-031020.jpg)