M&A

M&A

-

Bed Bath & Beyond purchased Tokens.com, a blockchain platform utilizing services from Figure, tZERO and ShyftLabs.

February 3 -

How the message from Sierra Pacific Mortgage could have been delivered in a better, more empathetic fashion rather than leaving affected workers embittered.

February 2 -

After the announcement last fall, Embrace added local staff and increased marketing nad outreach in New Jersey to assist potential Oceanfirst borrowers.

January 23 -

Executives surveyed by American Banker said companies vying to wrestle market share from banks are a major threat to operations in the coming year.

January 21 -

The real estate data firm said the merger will support efforts to scale and plans to ramp up development of enterprise technology products.

January 20 -

The latest Lower acquisition comes after several previous mergers with lenders as well as two last year that incorporated technology and real estate platforms.

January 14 -

The deal which brings hundreds of thousands of agents under one roof also combines retail lender Guaranteed Rate's separate joint ventures with each brokerage.

January 9 -

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

The deal still faces a lawsuit from activist investor HoldCo Asset Management, which contends that Comerica didn't properly shop itself before agreeing to sell to Fifth Third.

January 6 -

First Federal Bank stretched its retail mortgage operations into Louisiana and Mississippi, following its expansion into the Midwest and Arizona in 2023.

January 5 -

The merger of equals, which received a chilly reception from investors when it was announced in July, closed faster than analysts had expected.

January 2 -

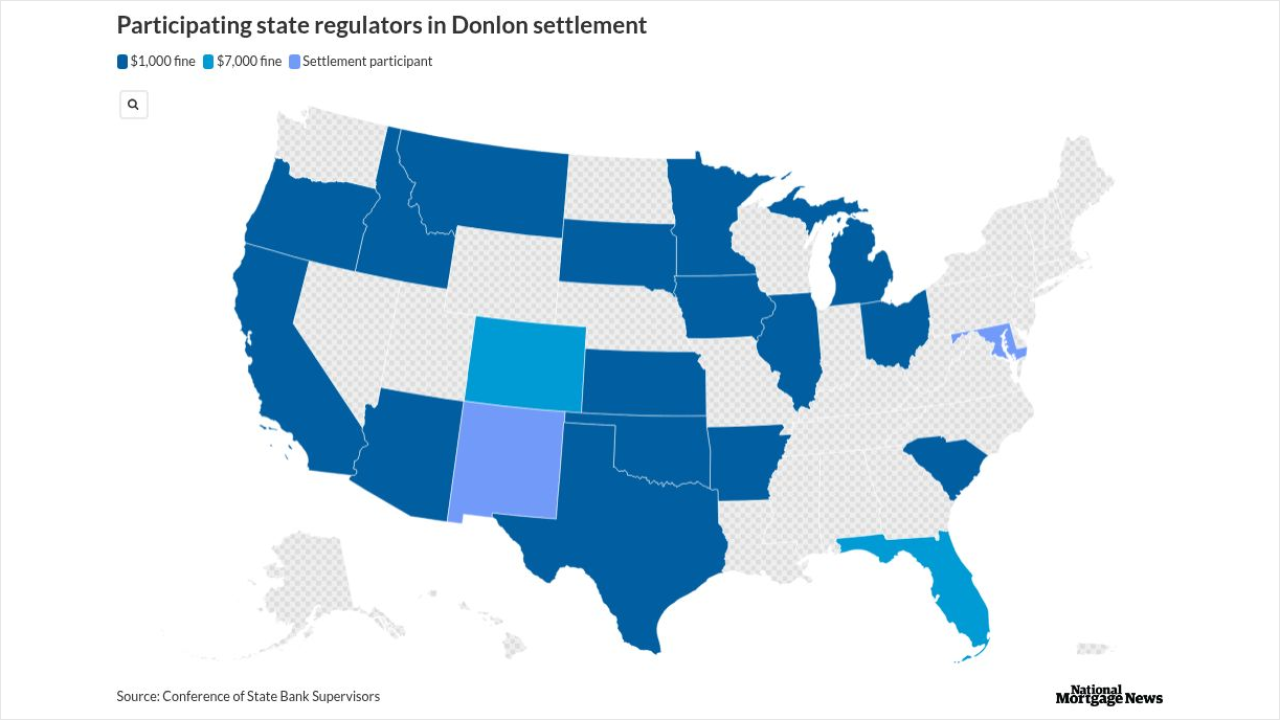

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

The latest announcement comes two months after an initial round of staff reductions following approval of Rocket's acquisition of the company.

December 29 -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

Proxy advisory firm Institutional Shareholder Services recommended approval of Fifth Third's $10.9 billion proposed acquisition of Comerica.

December 22 -

The Dallas bank turned down another offer because it thought it could get a higher price from Fifth Third, and also could ink an agreement faster, according to Comerica's latest regulatory filing.

December 18 -

The deal significantly grows United Wholesale Mortgage's servicing portfolio, and it will increase the float on its common stock, making it more investable.

December 17 -

The provider of actuarial-related services is bringing a company that provides mortgage servicing rights analytics and risk management into the fold.

December 8