-

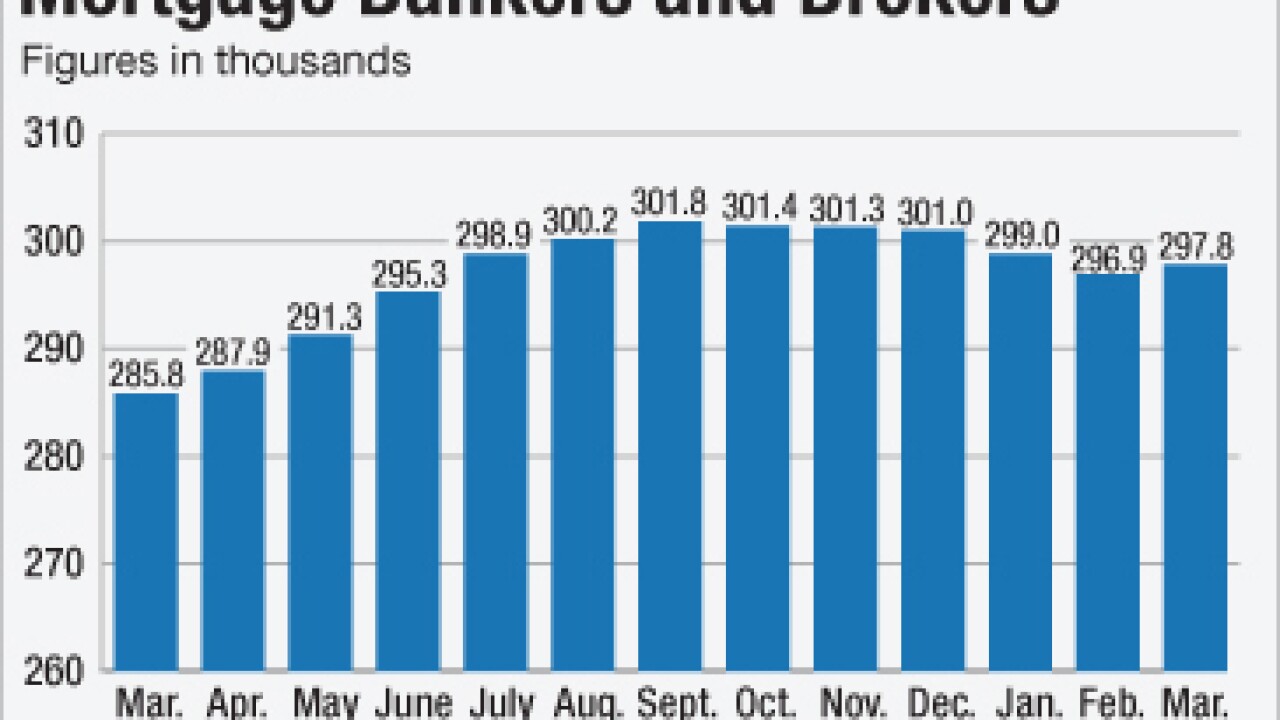

Hiring by independent mortgage firms accelerated in September after a slowdown in the prior month.

November 4 -

Mortgage brokers were among the companies that received the regulator's warning letters, but brokers are not required to report HMDA data leading many to suspect mini-correspondents, which straddle the line between broker and lender, were the recipients.

October 28 -

The CFPB sent letters Thursday to 44 mortgage lenders and brokers warning them of potential reporting violations related to their mortgage lending activities infractions the bureau is increasingly pushing lenders to take seriously.

October 27 -

To successfully respond to the most pressing challenges facing the mortgage industry right now, lenders and servicers must navigate issues of competition, governance, affordability and margins.

October 18 -

A desire to own their own businesses led many loan officers to become mortgage brokers during the industry's growth period. As brokering regains its footing, that entrepreneurial spirit is making a comeback.

October 18 -

Nonbank lenders and brokers added 900 employees to their payrolls in August as home sales slowed.

October 7 -

United Wholesale Mortgage has rolled out a new tool that allows mortgage brokers to receive automated income verification.

October 4 -

The National Association of Mortgage Brokers has created a new grant program that is designed to expand the mortgage broker channel by helping mortgage professionals open their own wholesale shops.

September 26 -

Industry veteran A.W. Pickel III is heading to AmCap Mortgage to become president of the lender's newly formed Midwestern division.

September 14 -

It's no secret that subprime lending played a heavy role in the demise of the mortgage broker. But to truly understand how brokers rose to prominence, it is helpful to look back to the channel's beginnings. Here's a look at three data points that sum up the rise and fall of the mortgage broker.

September 6 -

Depositories still dominate home lending, but nondepositories' market share is the highest it has been in at least two decades. Here's why.

September 6 -

If the past 40 years has revealed anything about the mortgage industry, it's that change is constant, and inevitable. From the future of Fannie and Freddie to the role technology will play in underwriting, here's a look at 10 bold predictions that will shake up the mortgage industry.

September 6 -

A surge in new and existing home sales is prompting lenders to increase their payrolls.

September 2 -

Donald Trump had heard all the chatter, the idle talk about how the U.S. housing market was overheating and trouble was looming. He was unfazed. It was the spring of 2006 and he was pushing a new mortgage business, Trump Mortgage LLC.

August 22 -

United Wholesale Mortgage has begun offering a conventional 1% down payment program to mortgage brokers.

July 13 -

Carrington Mortgage Services has added conventional loans to the portfolio of products offered by its wholesale lending division.

June 22 -

Brokers remain perplexed over how to strike a balance between helping borrowers shop for the best deal and maintaining compliance with the TILA-RESPA integrated disclosures. Specifically, how do brokers and wholesalers meet TRID's delivery deadline and accuracy requirements when a loan is resubmitted to a new lender?

June 21 -

TRID wasn't as hard on the wholesale channel as was once feared, but some parties involved in the process still either do not fully understand the rule or haven't perfected their operations to handle it.

June 8 -

Increased loan production during the spring home buying season has nonbank mortgage lenders stepping up their hiring.

June 3 -

Forecasters expect stronger originations in the second quarter as home buying outpaces refinancings.

May 6