-

Mortgage activity plunged before the start of the year, but subprime originations dropped the least, according to TransUnion. Despite dwindling volume, borrower delinquency rates hit historic lows in the first quarter.

May 16 -

Americans continued to take on debt in the first quarter, though new mortgage borrowing slowed to the weakest level since late 2014, according to a Federal Reserve Bank of New York report.

May 14 -

Strong levels of employment and continued economic expansion drove February's mortgage delinquencies and foreclosures to 20-year lows, according to CoreLogic.

May 14 -

Even though mortgage delinquencies increased on a quarter-to-quarter basis, strong overall metrics mitigate any concerns regarding future loan performance, according to the Mortgage Bankers Association.

May 14 -

As home price appreciation levels off, the amount of underwater loans rose in the first quarter while equity-rich properties continued adding value, according to Attom Data Solutions.

May 9 -

Payoffs of maturing office loans in securitizations may be delayed more often in the next few years if increasing inventory constrains occupancy and rent growth, according to Morningstar.

May 8 -

Mortgage application fraud risk came in hot at the start of the year, but two housing market conditions worked against each other to bring growth to a halt, according to First American Financial Corp.

May 3 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29 -

Plenty of homeowners succumbed to foreclosure when the housing bubble burst, but the effects on Hispanic and black communities in particular were heightened, with many still suffering, according to Zillow.

April 25 -

Mortgage prepayments came gushing in at the start of the spring home buying season as delinquencies also improved, according to Black Knight.

April 23 -

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Destiny USA, one of the largest malls in the nation, is struggling to pay its mortgage, according to a published report.

April 17 -

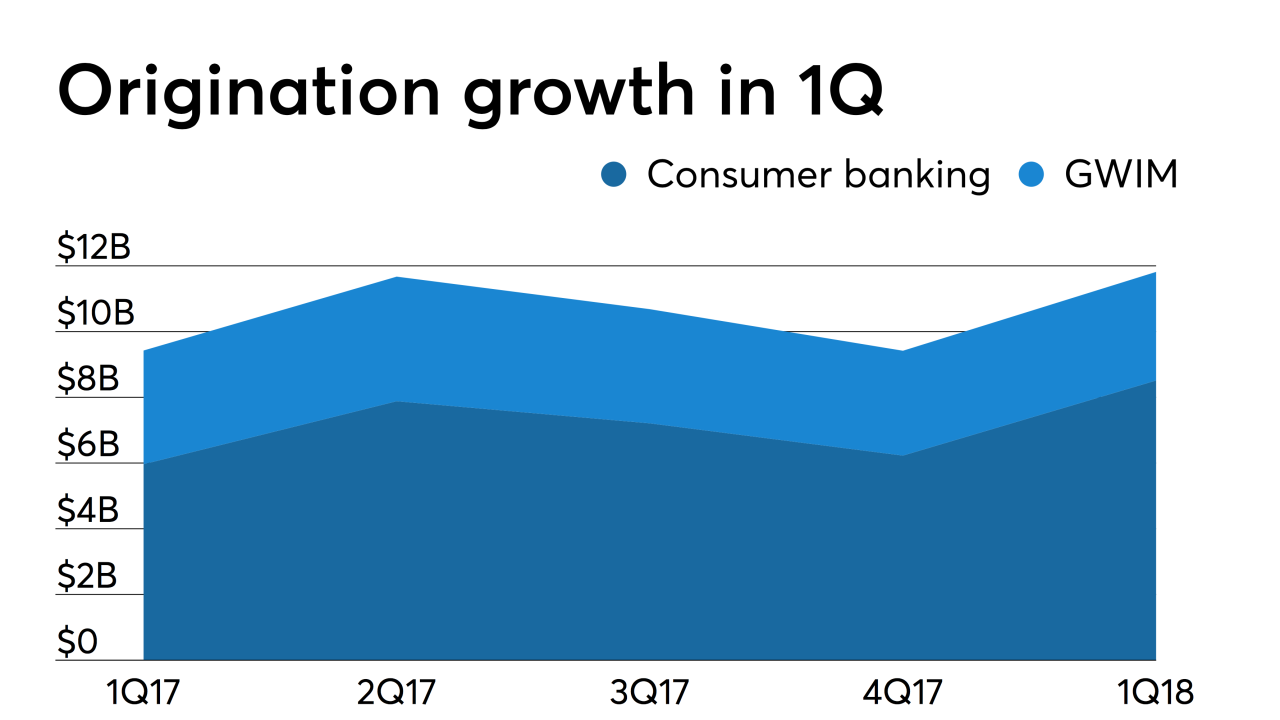

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

As the dangers of global warming lead to heightened natural disasters, those disasters result, at least temporarily, in a higher amount of mortgage defaults. From Texas to the nation's capital, these are the 12 most hazard-prone housing markets, according to Redfin.

April 15 -

Citigroup's first quarter mortgage-related revenue increased compared with the fourth quarter — although down slightly from the same period last year — as its lending operations continued to contract.

April 15 -

The number of properties with foreclosure filings dropped to the lowest quarterly amount since the Great Recession, according to Attom Data Solutions.

April 11 -

An uncertain future confronts the development, which is located in the North San Pedro Square area of San Jose and was proposed by Z & L Properties.

April 10 -

With a strong job market and low interest rates, the mortgage delinquency rate fell to its lowest January level in at least 20 years.

April 9 -

The commercial mortgage-backed securities delinquency rate increased for the first time since October lead by a 31-basis-point rise in late payments for loans secured by retail properties, Fitch Ratings said.

April 8