-

An AI-powered virtual assistant could be used in a variety of ways, including helping customers to prequalify for mortgages, easing compliance and detecting problems.

September 18 -

While the severity of Florence was reduced prior to Friday morning's landfall, mortgage servicers are taking proactive steps in addressing the emergency situation.

September 14 -

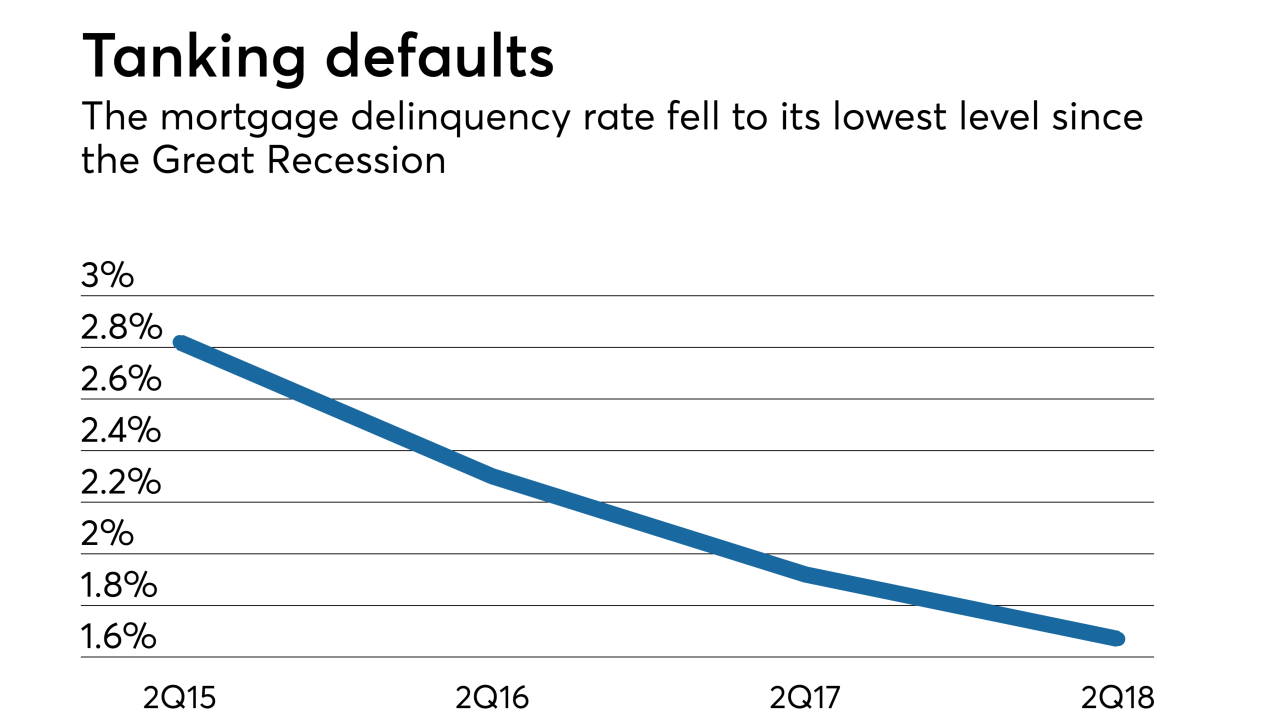

The number of Americans who are behind on their mortgage payments is the lowest in more than a decade.

September 12 -

The serious mortgage delinquency rate sank to its lowest June reading in 11 years, though recent natural disasters pose risk to loan performance in affected areas, according to CoreLogic.

September 11 -

The mortgage delinquency rate dropped to its lowest level in 12 years despite foreclosure starts and active foreclosures both increasing in July, according to Black Knight.

September 10 -

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22 -

July's year-over-year increase in foreclosure starts for 44% of the nation's metro areas is a result of looser underwriting standards and a sign of future growth in defaults, said Attom Data Solutions.

August 21 -

Mortgage delinquency rates dropped on an annual basis, a sign of a strengthening economy, but could soon see a spike due to this year's wildfires, according to CoreLogic.

August 14 -

The risk of mortgage defaults reached its highest point since the second quarter of 2015 as lenders loosen credit, according to VantageScore.

August 10 -

The gap between equity-rich homeowners and mortgage borrowers who are seriously underwater narrowed in the second quarter, highlighting the uneven nature of the housing market's recovery since the Great Recession.

August 9 -

The priciest house for sale in the Tampa Bay, Fla., area could soon become its biggest foreclosure.

August 7 -

Arch MI U.S. returned to having the No. 1 market share among private mortgage insurers as it increased its new insurance written 15% over the previous year.

August 1 -

Radian Group's second-quarter earnings beat consensus estimates because of lower loan loss provisions than forecast, along with record new mortgage insurance written.

July 26 -

Nonbank mortgage-backed securities servicers increase their exposure to agency loans as the housing market distances itself from last decade's crash, according to Fitch Ratings.

July 24 -

Mortgage foreclosure starts and active foreclosures were at their lowest level in over a decade although there was an increase in new delinquencies in June, according to Black Knight.

July 24 -

Debates on the issue often focus on how lending decisions affect certain demographic groups, but those analyses tend to ignore an important factor: default rates.

July 23

-

Continued favorable loss development trends allowed MGIC Investment Corp. to beat analyst estimates for the second-quarter earnings report.

July 18 -

Fewer Dallas-area homeowners are behind in their mortgage payments than at any time since the Great Recession.

July 16 -

Fannie Mae and Freddie Mac may need to tap into U.S. Treasury funds when they adopt CECL, a new accounting rule that makes companies set aside money upfront for expected loan losses.

July 12 -

Foreclosure filings plummeted in the first half of the year, but 40% of local markets saw foreclosure starts increase, with the last housing bubble no longer to blame for the growth, according to Attom Data Solutions.

July 12