-

Though early-stage mortgage delinquencies inched up in December 2017, the serious mortgage delinquency rate hit its lowest point for the month of December since 2006.

March 13 -

With the exception of the troubled retail sector, delinquency rates across property types supporting commercial mortgage-backed securities were flat to declining in February compared with January.

March 12 -

The Federal Agricultural Mortgage Corp. reported significant gains in new business volume, but also realized a big jump in 90-day delinquencies.

March 9 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

Lonnie Brantley Jr. avoided prison by striking a plea deal for lying to federal housing regulators during an investigation into his troubled mortgage lending business.

March 2 -

Mortgage borrowers 60 days or more late with their payments declined both quarter-to-quarter and year-over-year, as recession-era defaults work their way out of the system.

February 20 -

Freddie Mac is now accepting bids on $420 million in nonperforming loans, its first NPL sale of 2018.

February 16 -

National MI set a record for new insurance written in the fourth quarter, but its parent company reported a net loss for the period due to tax reform.

February 16 -

Serious delinquency rates were up sharply in November in both Texas and Florida compared to a year ago, while lower in all other states but Alaska, according to CoreLogic.

February 13 -

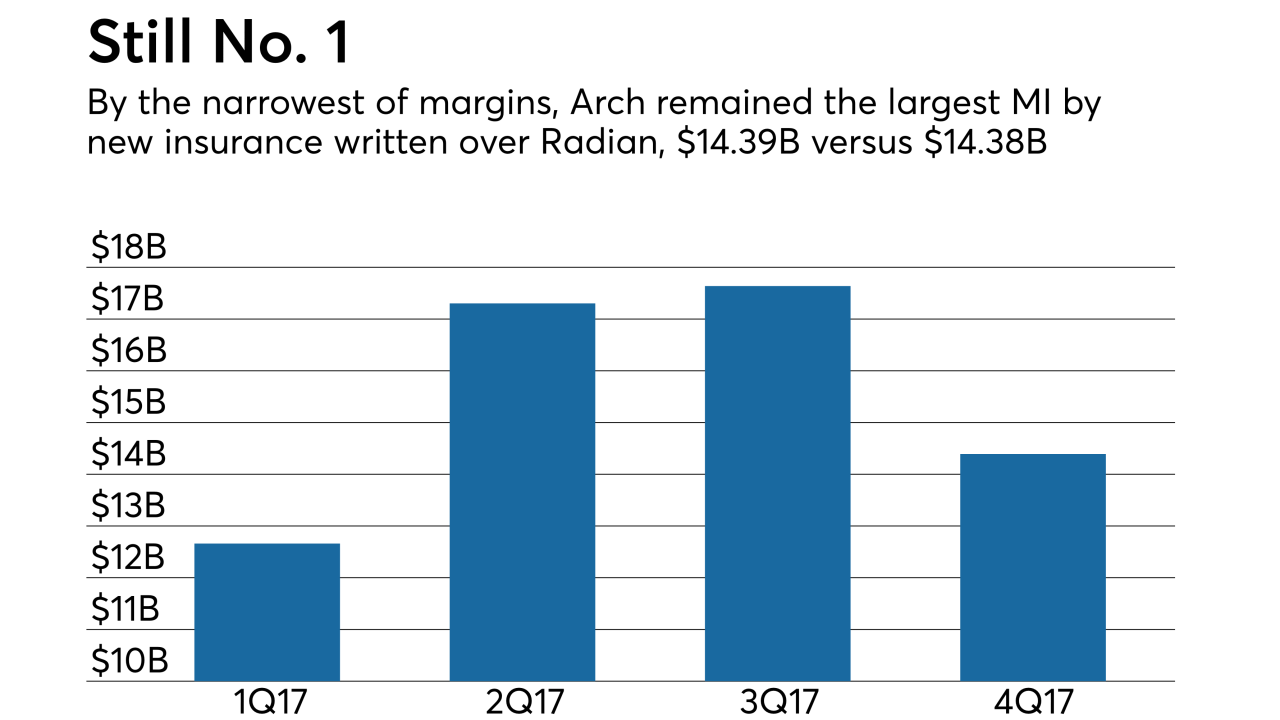

Arch Capital Group's mortgage insurance subsidiary increased its cushion under the secondary market capital standards in the fourth quarter even as its delinquent inventory grew.

February 13 -

A new due diligence firm created by a trio of former Clayton Holdings executives wants to shake up a static business model.

February 12 -

There was an increase in total mortgage defaults during the fourth quarter but that rise has to be measured in context of what had been a favorable environment prior to the third-quarter storms.

February 8 -

Communication between all parties in the chain, from borrower through guarantor, is the best way to minimize mortgage losses after events like last year’s hurricanes and wildfires, according to servicers and federal officials.

February 8 -

Mortgage servicers should approach efforts to overhaul their compensated structure with caution, as changes to the status quo "could have ripple effects across the entire real estate finance industry," warned Mortgage Bankers Association Chairman David Motley.

February 7 -

It was a record-setting year in terms of the low number of foreclosure starts, partially helped by the various post-storm moratoria, according to Black Knight.

February 5 -

From responding to natural disasters to emerging technology strategies, here's a look at six top trends on the agenda for the 2018 MBA Servicing Conference.

February 2 -

The strong housing economy in 2017 led to an increase in premiums earned and lower claims costs for Old Republic International's title insurance business.

January 25 -

Frost Bank announced in October that it would be vacating the high-rise building bearing its name on North Carancahua Street in Corpus Christi.

January 24 -

Loans late by 90 days or more are increasingly concentrated in parts of Florida, Georgia and southeast Texas as fallout from the storms continues to weigh on the market.

January 23 -

Foreclosure filings were reported on 676,535 properties nationwide in 2017, marking the lowest level of foreclosure activity since 2005.

January 18