-

A new due diligence firm created by a trio of former Clayton Holdings executives wants to shake up a static business model.

February 12 -

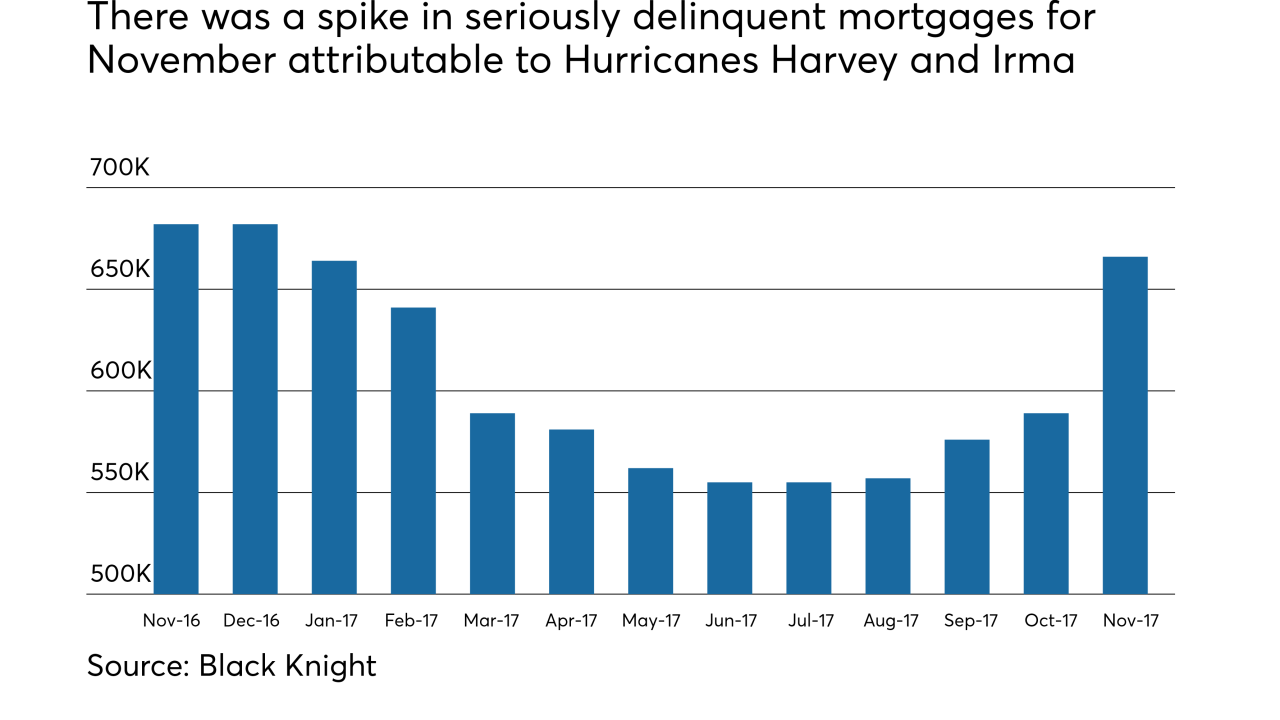

There was an increase in total mortgage defaults during the fourth quarter but that rise has to be measured in context of what had been a favorable environment prior to the third-quarter storms.

February 8 -

Communication between all parties in the chain, from borrower through guarantor, is the best way to minimize mortgage losses after events like last year’s hurricanes and wildfires, according to servicers and federal officials.

February 8 -

Mortgage servicers should approach efforts to overhaul their compensated structure with caution, as changes to the status quo "could have ripple effects across the entire real estate finance industry," warned Mortgage Bankers Association Chairman David Motley.

February 7 -

It was a record-setting year in terms of the low number of foreclosure starts, partially helped by the various post-storm moratoria, according to Black Knight.

February 5 -

From responding to natural disasters to emerging technology strategies, here's a look at six top trends on the agenda for the 2018 MBA Servicing Conference.

February 2 -

The strong housing economy in 2017 led to an increase in premiums earned and lower claims costs for Old Republic International's title insurance business.

January 25 -

Frost Bank announced in October that it would be vacating the high-rise building bearing its name on North Carancahua Street in Corpus Christi.

January 24 -

Loans late by 90 days or more are increasingly concentrated in parts of Florida, Georgia and southeast Texas as fallout from the storms continues to weigh on the market.

January 23 -

Foreclosure filings were reported on 676,535 properties nationwide in 2017, marking the lowest level of foreclosure activity since 2005.

January 18 -

Radian Group has improved the capital cushion at its mortgage insurance subsidiary through enhanced reinsurance arrangements and providing cash and marketable securities.

January 18 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

Default rates in second mortgages and bank cards rose notably in December, suggesting consumers are having trouble managing increased spending.

January 17 -

Despite the overall mortgage delinquency rate being down in October, early-stage mortgage delinquencies increased following an active hurricane season, according to CoreLogic.

January 9 -

Genworth Financial's acquisition by a Chinese insurance company, which has already been delayed several times, might be in peril following the failure of another cross-border merger to gain approval.

January 4 -

PHH Corp. agreed to a $45 million settlement to resolve allegations from 49 states and the District of Columbia that it engaged in "foreclosure process abuses" involving "inconsistent signatures" in its servicing business from 2009 to 2012. The settlement comes as the nonbank mortgage company continues its legal challenge to a separate regulatory action by the CFPB.

January 3 -

The largest residential mortgage servicers will get even larger in 2018, benefiting from consolidation and the outsourcing of servicing rights acquired by companies without their own platforms.

December 26 -

Development company NRP Group has sued the owner of the Lone Star Brewery for not refunding a $550,000 deposit after a deal to buy land for an apartment complex at the site fell through.

December 26 -

The seven largest national banks held less than 5% of loans that were delinquent at the end of the third quarter, the Office of the Comptroller of the Currency said Friday.

December 22 -

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22