-

The rush to refinance led to more errors in January and the shift to more-risky purchase apps will add to lenders' fraud concerns going forward.

March 2 -

With extreme winter weather about to give way to ballooning insurance and mortgage forbearance claims in Texas, servicers will need to get through their pipelines with urgency while weeding out fraud.

February 25 -

The former executive at Lend America, who has remained out of prison since his 2011 guilty plea, will not be incarcerated for his acts.

January 20 -

The complaint unsealed Monday alleges three individuals and several companies they owned or controlled engaged in False Claims Act violations involving short sales of properties that had Federal Housing Administration-insured mortgages.

January 5 -

The accused, who also faces vehicle title and investment fraud charges, allegedly submitted falsified statements related to the payoff of an earlier mortgage when applying for a new one.

December 18 -

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

December 16 -

Tough competition for home listings makes consumers more likely to misrepresent themselves on loan applications.

December 1 -

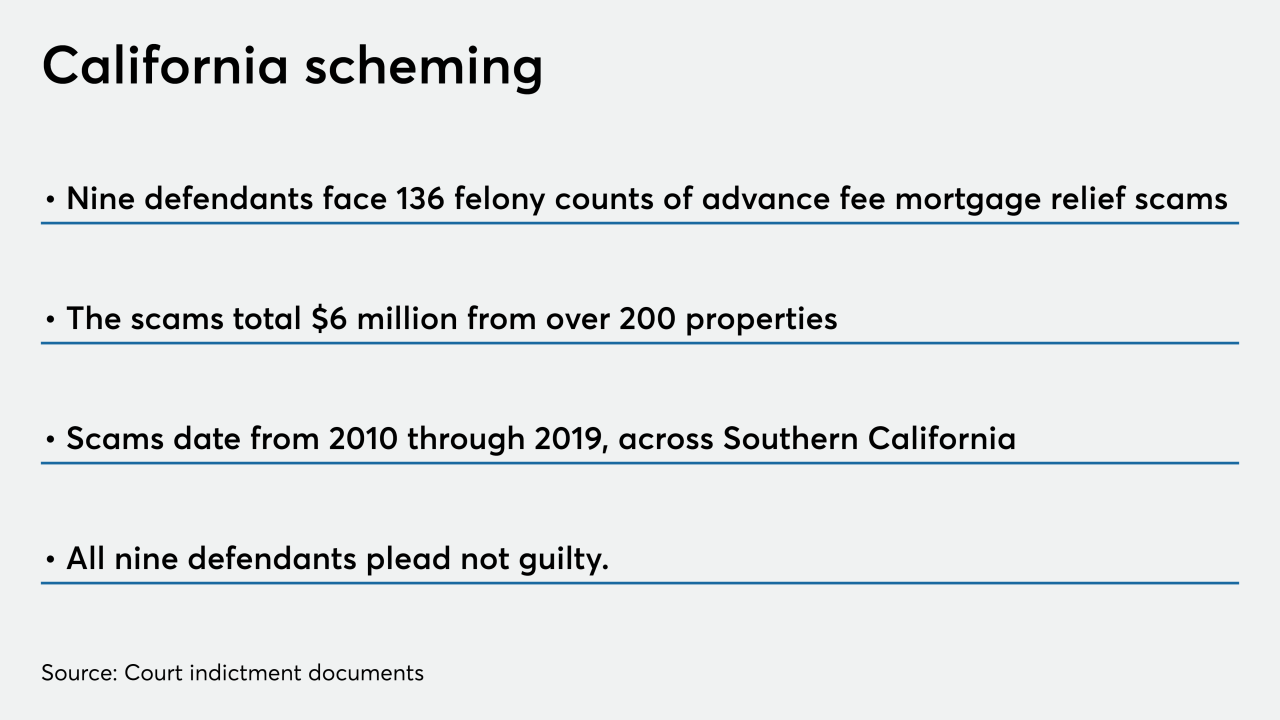

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

The third quarter’s higher share of purchase applications, which followed the refinance wave that crested in the second, caused a rise in mortgage application fraud risk, according to CoreLogic.

November 12 -

More than six months after the CARES Act became law, the two entities joined a host of industry organizations in launching the COVID Help for Home campaign to educate borrowers on the next steps in forbearance.

November 11