-

Non-banks tracked by Morningstar DBRS reported combined net income of $367 million for the third quarter, down from $807 million three months prior.

November 26 -

The Mortgage Bankers Association's index of home-purchase applications jumped 7.6% to 181.6 in the week ended Nov. 21, data from the group showed Wednesday.

November 26 -

An expanded data set based on the third quarter annual price changes is what the Federal Housing Finance Agency uses to calculate next year's conforming loan limits.

November 25 -

The government-sponsored enterprise took its first look at what new loan volume might be like in two years and found it could rise closer to pandemic levels.

November 24 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

Luxury home prices rose 5.5% year over year in October to a median $1.28 million, far outgaining the 1.8% increase of nonluxury homes.

November 24 -

While some international purchasers are reluctant to buy in the U.S. right now, interest in investment properties still abounds, the CEO of Waltz said.

November 21 -

Frank Cassidy, who is currently principal deputy assistant secretary at the Department of Housing and Urban Development, will soon face a full Senate vote.

November 20 -

Even with this week's increase, mortgage rates have remained within a 13 basis point band since mid-September, with industry pundits saying that's where they will stay.

November 20 -

The national median payment applied for by purchase applicants fell to $2,039 in October from September, the Mortgage Bankers Association said.

November 20 -

Sales of previously owned homes in the US rose in October to the fastest pace in eight months, as buyers took advantage of lower mortgage rates and gained the upper hand over sellers in some markets.

November 20 -

Trump's remarks — made in a joking tone — come amid increased pressure on the administration from voters to lower the cost of living.

November 20 -

Even to the detriment of greater profits, the sector is offering ultra-low terms via temporary buydowns combined with larger forward commitments.

November 20 -

Rocket enters the crowded DSCR market with a product for experienced investors, joining rivals as non-QM lending grows and demand for single-family rentals stays strong.

November 19 -

Consecutive weeks of mortgage rate increases resulted in a 5.2% decrease in mortgage loan application volume, according to the Mortgage Bankers Association.

November 19 -

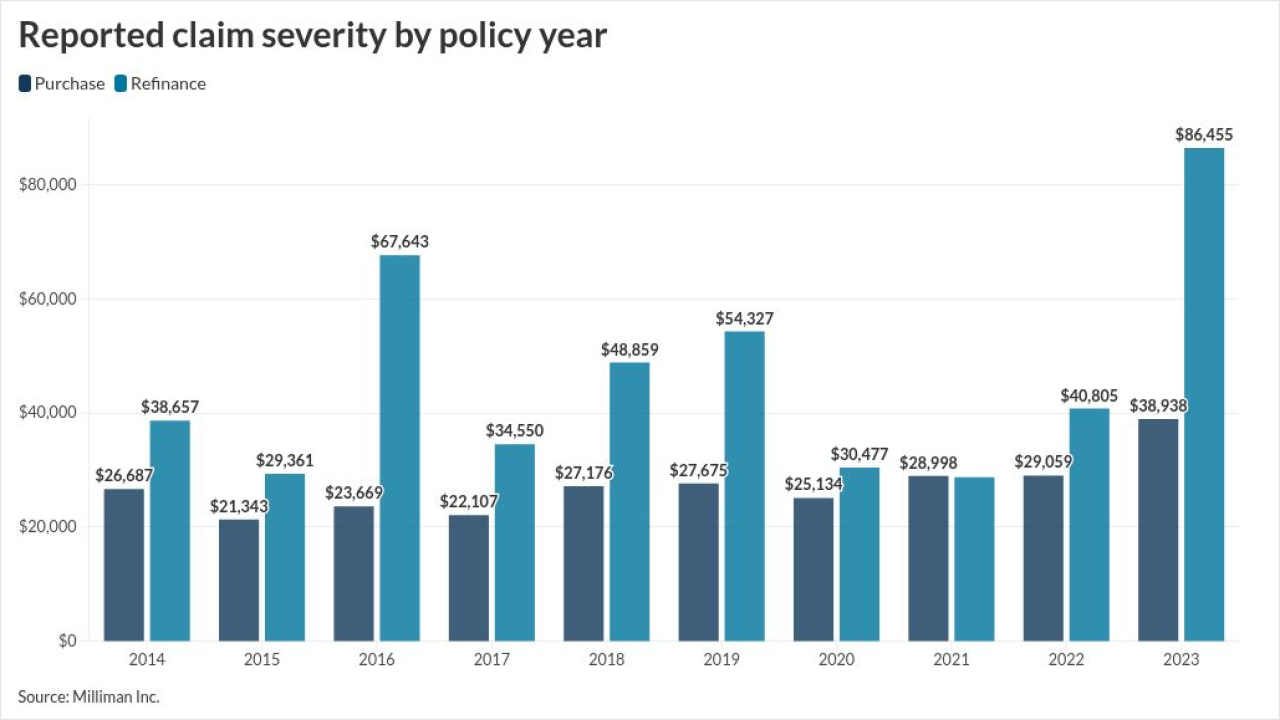

The average loss from the two categories is almost seven times higher than the mean amount for all other types, according to research from ALTA and Milliman.

November 18 -

Independent mortgage bankers were in the black for each loan originated during the third quarter, as low rates brought an application surge in September.

November 18 -

Two heavyweights in the US residential real estate market, Compass Inc. and Zillow Inc., will face off in a New York courtroom this week in a legal battle that could reshape the future of how homes are marketed and sold in the country.

November 18 -

Home Depot's bleak forecast provides another warning about the strength of US consumers in the absence of official economic data during the US government shutdown.

November 18