-

The national median payment applied for by purchase applicants fell to $2,039 in October from September, the Mortgage Bankers Association said.

November 20 -

Sales of previously owned homes in the US rose in October to the fastest pace in eight months, as buyers took advantage of lower mortgage rates and gained the upper hand over sellers in some markets.

November 20 -

Trump's remarks — made in a joking tone — come amid increased pressure on the administration from voters to lower the cost of living.

November 20 -

Even to the detriment of greater profits, the sector is offering ultra-low terms via temporary buydowns combined with larger forward commitments.

November 20 -

Rocket enters the crowded DSCR market with a product for experienced investors, joining rivals as non-QM lending grows and demand for single-family rentals stays strong.

November 19 -

Consecutive weeks of mortgage rate increases resulted in a 5.2% decrease in mortgage loan application volume, according to the Mortgage Bankers Association.

November 19 -

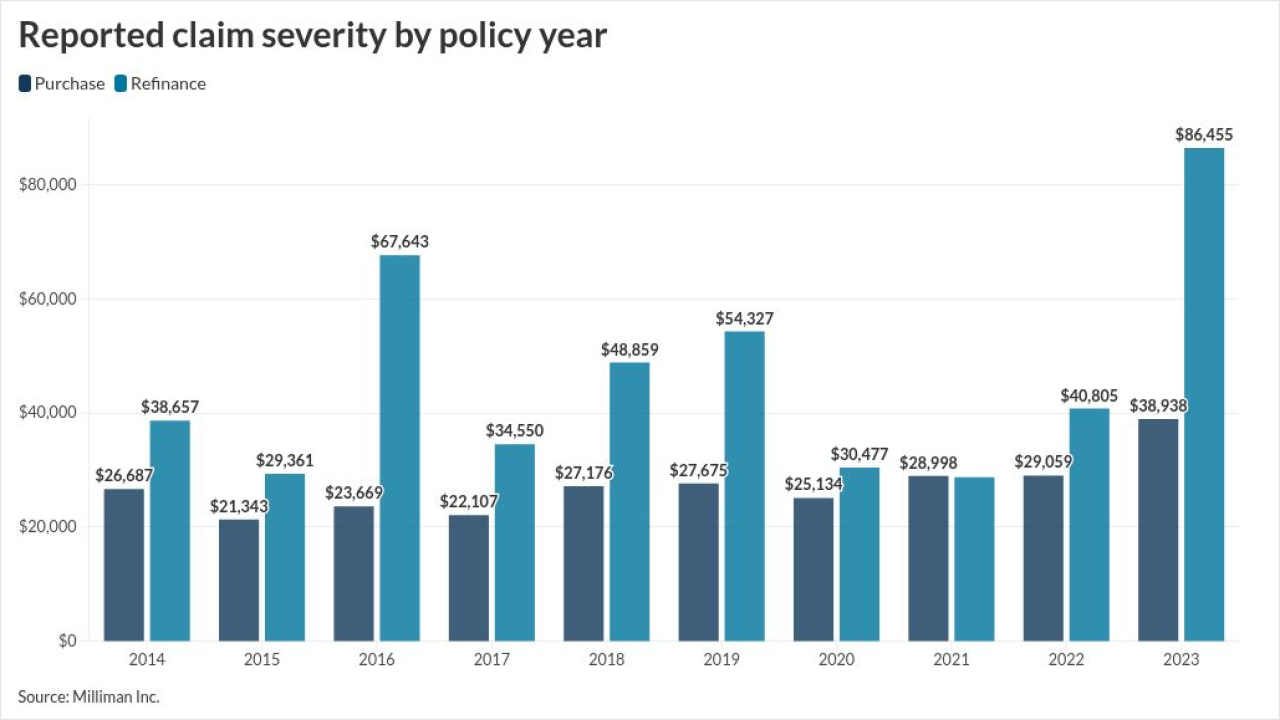

The average loss from the two categories is almost seven times higher than the mean amount for all other types, according to research from ALTA and Milliman.

November 18 -

Independent mortgage bankers were in the black for each loan originated during the third quarter, as low rates brought an application surge in September.

November 18 -

Two heavyweights in the US residential real estate market, Compass Inc. and Zillow Inc., will face off in a New York courtroom this week in a legal battle that could reshape the future of how homes are marketed and sold in the country.

November 18 -

Home Depot's bleak forecast provides another warning about the strength of US consumers in the absence of official economic data during the US government shutdown.

November 18 -

Application error findings rose over 15%, the second quarter in a row they have moved higher, the post-closing file review from Aces Quality Management found.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

New-home mortgage applications dropped, but the annual sales pace was the strongest in over a year, the Mortgage Bankers Association said.

November 17 -

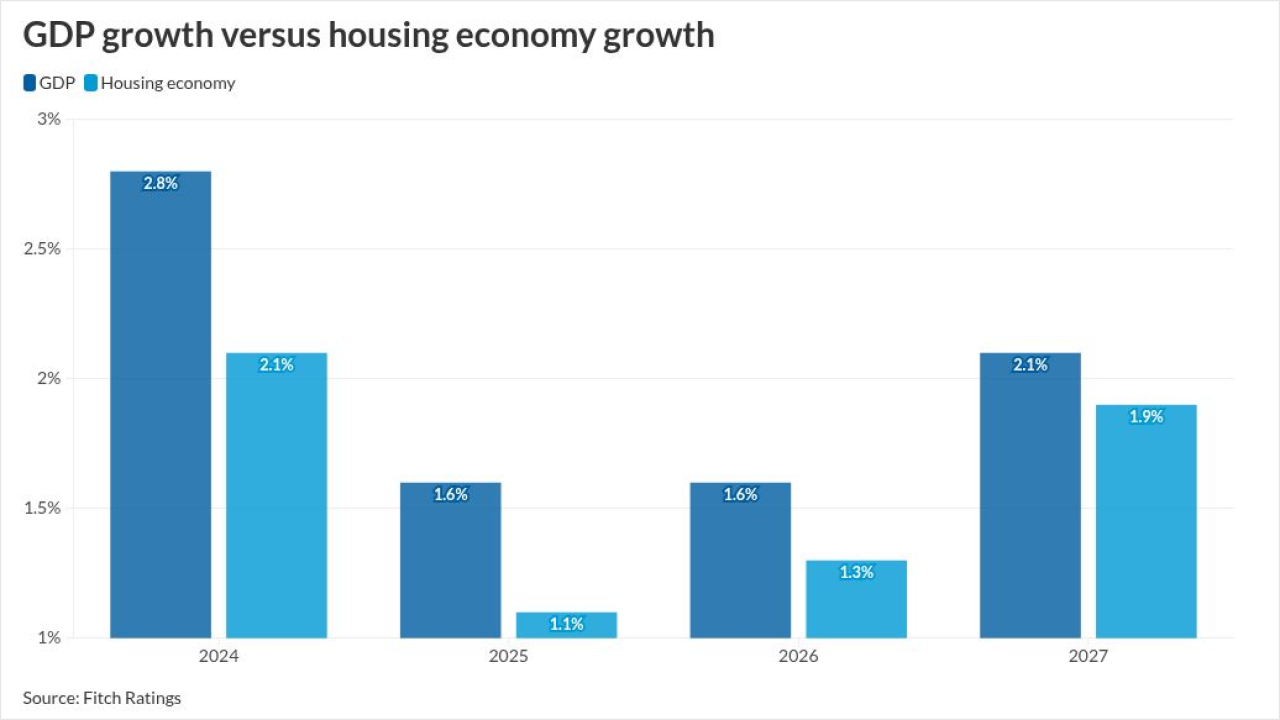

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

The fintech had over $2 billion in home equity line of credit volume in the third quarter and reported growing production in its crypto and non-QM offerings.

November 14 -

With the increase in investor-owned properties, the risk of undisclosed real estate fraud, including occupancy misrepresentation, rose 9% in the third quarter.

November 14 -

The hidden costs of homeownership total nearly $16,000, rising 4.7% in the past year.

November 13 -

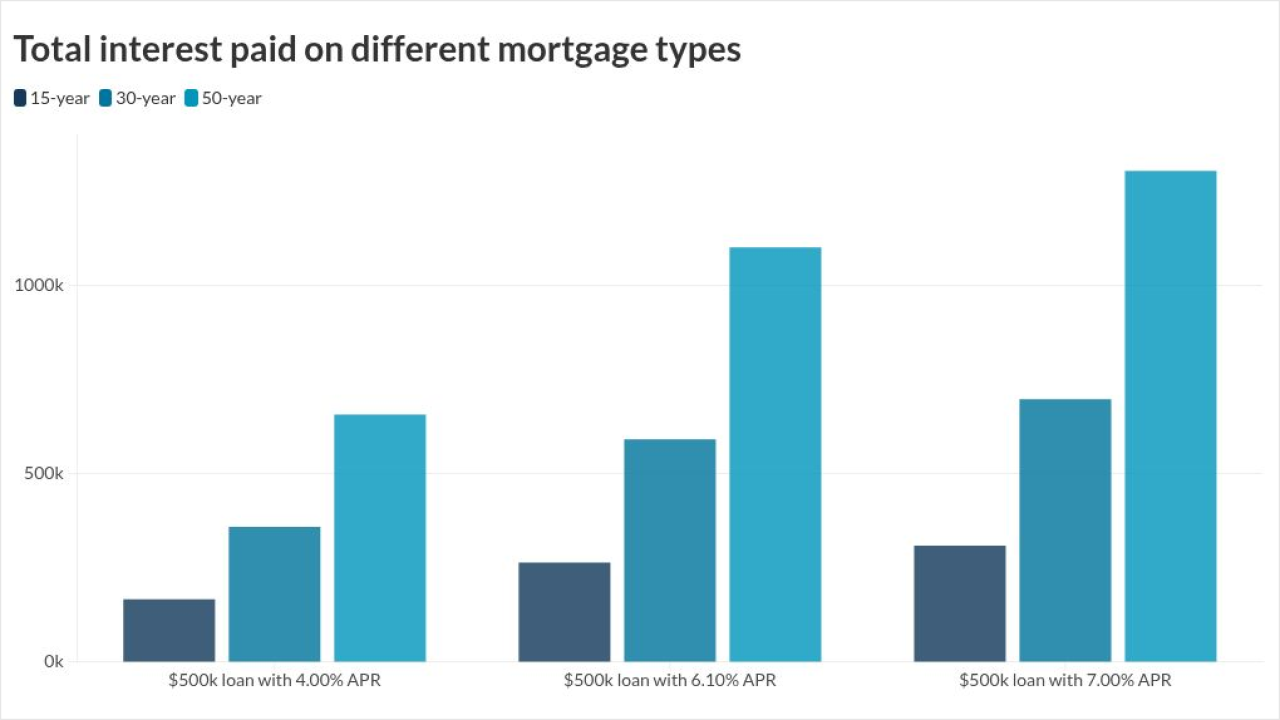

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

For the second consecutive week, the 30-year fixed rate mortgage increased as investors were still sorting through the lack of information due to the shutdown.

November 13 -

The mortgage company, even though it is owned by a bank, has been profitable for the last two years, when considering its originations operations, as it does.

November 13