-

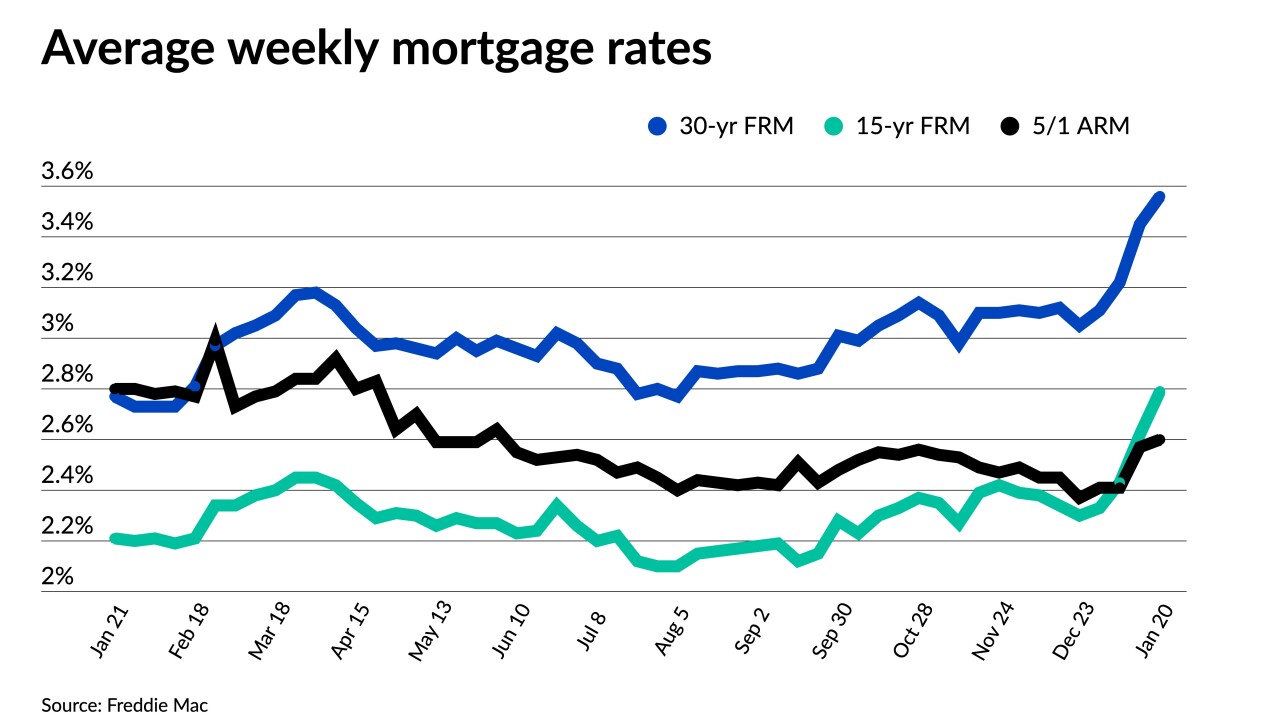

All major averages have risen to start 2022, with the 15-year surpassing the ARM.

January 20 -

December's average balance for a mortgage to purchase a newly constructed property set an all-time high, the Mortgage Bankers Association's Builder Application Survey found.

January 20 -

Influencer loan officers are aiming to reach the largest emerging group of homebuyers, one super-short video at a time.

January 20 -

Home valuation professionals have had mixed feelings about automation out of concern that some forms could result in less accurate assessments.

January 19 -

The new offering’s loan structure is designed to hedge against digital currency's price volatility.

January 19 -

Modest reductions were made to the 2021 and 2022 outlooks, although the government-sponsored enterprise did boost purchase expectations for this year.

January 19 -

But a surge in purchases led overall mortgage volumes to a weekly gain and pushed average loan size to a new record.

January 19 -

The settlement is a reminder that officials who oversee the loan officer licensing system do actively police the fulfillment of professional requirements by loan officers.

January 18 -

While the normal holiday season pattern contributed to the December drop-off, potential buyers also need to make offers on multiple properties before winning a home, Redfin said.

January 18 -

Average prices were up 15% compared to the same month in 2020.

January 14 -

President Biden’s aspirations for aggressive forgiveness haven’t been fulfilled to date, but steps taken so far have lowered a key hurdle to entry-level homeownership.

January 14 -

The mortgage broker business was never a driving force for the Chicago-based firm's purchase of Stearns Lending, so dropping it wasn't totally unexpected.

January 14 -

The latest jobs and economic numbers pave the way for additional upward movement throughout 2022, analysts said.

January 13 -

The ruling overturns a summary judgment in a class action lawsuit filed by refinance customers between 2004 and 2009 in West Virginia over alleged inflated property values.

January 12 -

But the online real estate company is eliminating nearly half of the positions in its existing mortgage business as a result of the deal.

January 12 -

Increasing rates contributed to a sluggish pace for refinances, but the purchase market showed sustained strength.

January 12 -

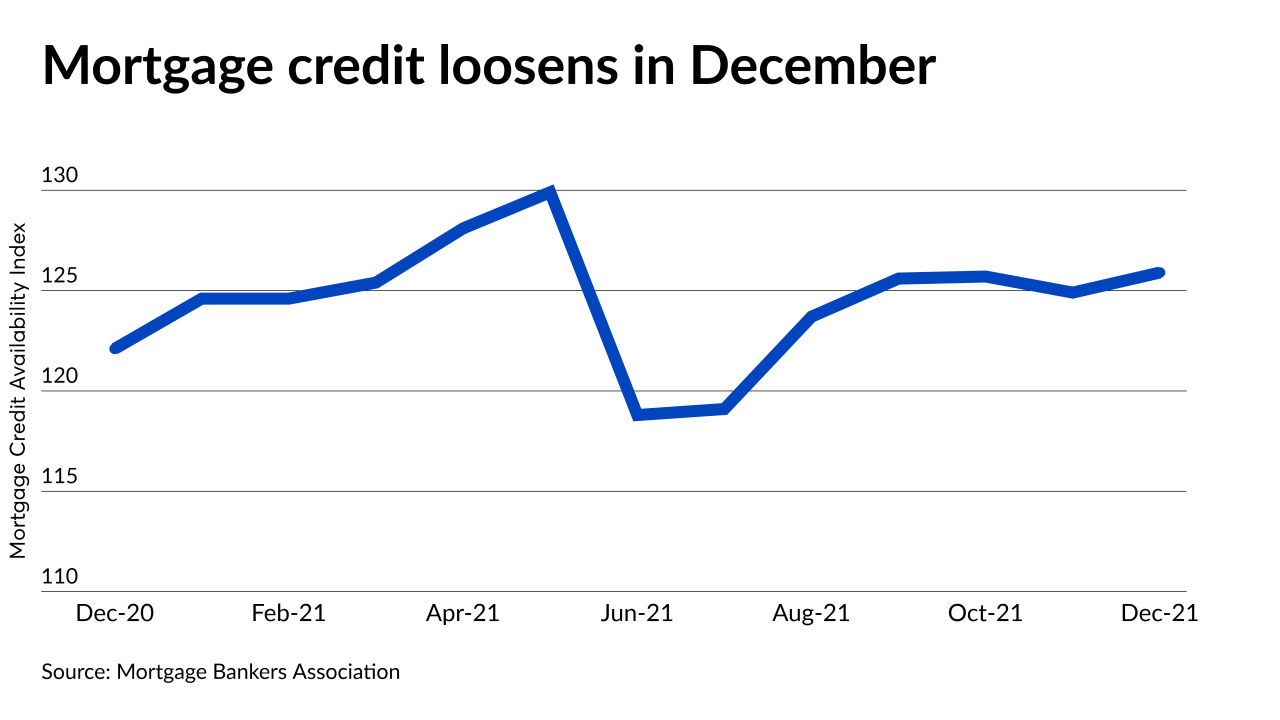

December was the fifth month out of the last six in which credit conditions loosened, the Mortgage Bankers Association reported.

January 11 -

December's activity was down 18% from November, led by a 23% drop in purchase volume and a 17% decline in rate-and-term refinancings, Black Knight said.

January 10 -

Nearly half of likely buyers said they feel more urgency to act if the 30-year FRM reached 3.5%, a Redfin survey found.

January 7 -

Total U.S. jobs came in below consensus estimates in December, according to the Bureau of Labor Statistics.

January 7