-

While qualifying got a little tougher for entry-level buyers with lower incomes in November, some other prospective borrowers had an easier time of it.

December 10 -

Now that the Department of Housing and Urban Development clarified that participating in these programs does not create a fair lending violation, lenders and fair housing advocates wonder whether more mortgage lenders will actually participate.

December 10 -

This group of homeowners has greater financial obligations than any generation before them and largely aren’t aware of how they can make use of their home as an asset, a survey from Hometap found.

December 8 -

The three leaders left voluntarily, sources confirmed.

December 8 -

An upturn in government-backed applications also led average loan sizes to decrease for the first time in over a month.

December 8 -

The monthly pace of increases have moderated since the spring, with CoreLogic expecting annual growth to decline to 2.5% by this time next year.

December 7 -

As the real estate finance industry transitions from the highs and lows of the COVID era into the new normal of 2022, industry standards will continue to play a key role in helping us solve ongoing business challenges, regardless of the market environment, writes the president of MISMO.

December 7

-

But rising rates and tightening affordability are slowing appreciation rates, Black Knight found in its latest Mortgage Monitor report.

December 6 -

But the latest employment report also reveals that if construction hiring remains sufficiently strong, home purchase originations are on track to grow to $1.7 trillion from $1.6 trillion next year.

December 3 -

Besides making the deduction permanent, the bill doubles the income threshold for those eligible to claim it.

December 2 -

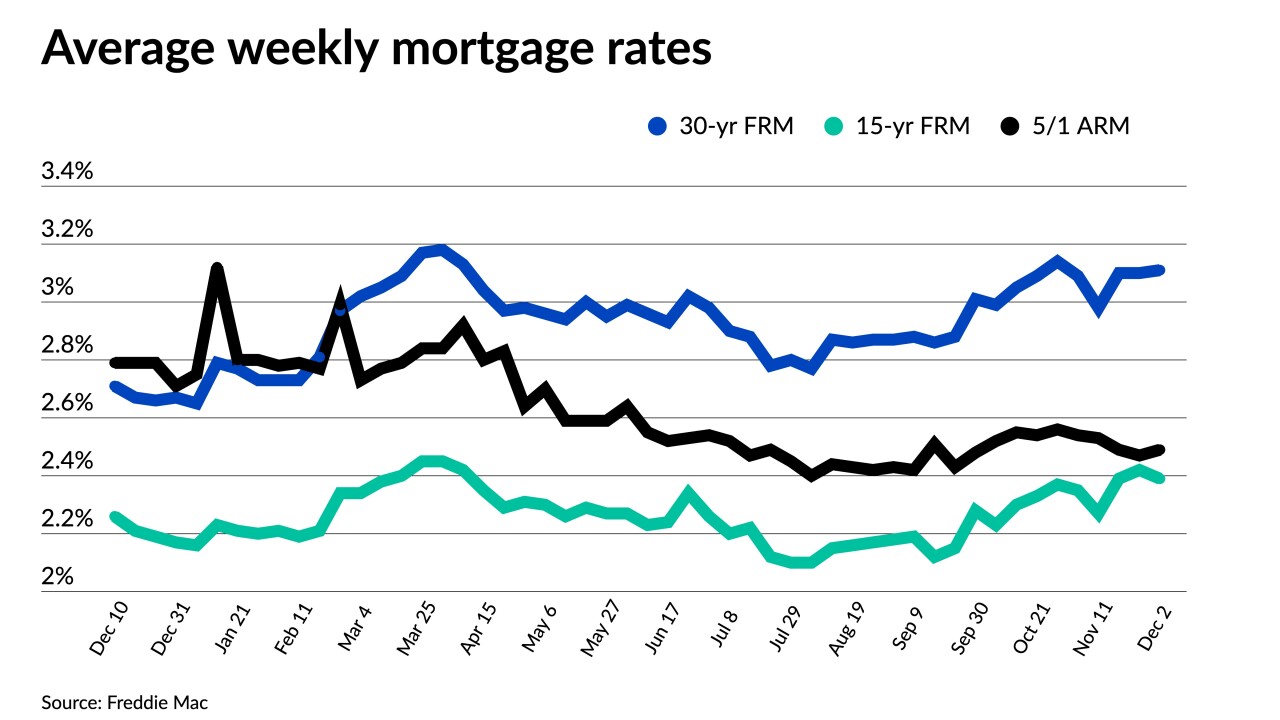

Treasuries plunged following news of the omicron variant, but subsequently reversed course.

December 2 -

The news comes just a day after the company restructured its merger with Aurora Acquisition to put $750 million in cash on its balance sheet right away.

December 1 -

The agency must raise its upper and lower levels in tandem with the new conforming loan limits by law.

December 1 -

The new terms, which still value the New York-based mortgage lender at $6.9 billion, include a $750 billion convertible bridge note.

December 1 -

Purchase applications increased for the fourth consecutive week, with the average loan amount at its highest since February.

December 1 -

The increase that followed in the pandemic’s wake is subsiding, and migration patterns are shifting, according to Redfin.

November 30 -

Higher sales commissions helped to drive production costs to their second-highest level since the Mortgage Bankers Association started its survey in 2008.

November 30 -

Though unlikely to derail a hot housing market, another surge in COVID-19 cases could cloud the outlook for economic growth, analysts said.

November 29 -

With home improvement spending up, more mortgage bankers are building out teams to capture the market.

November 26 -

While most agree texting is essential, are more traditional methods, like direct mail, still necessary post-COVID?

November 24