-

Refinance numbers declined for the seventh time in eight weeks, leading to an overall weekly decrease.

November 17 -

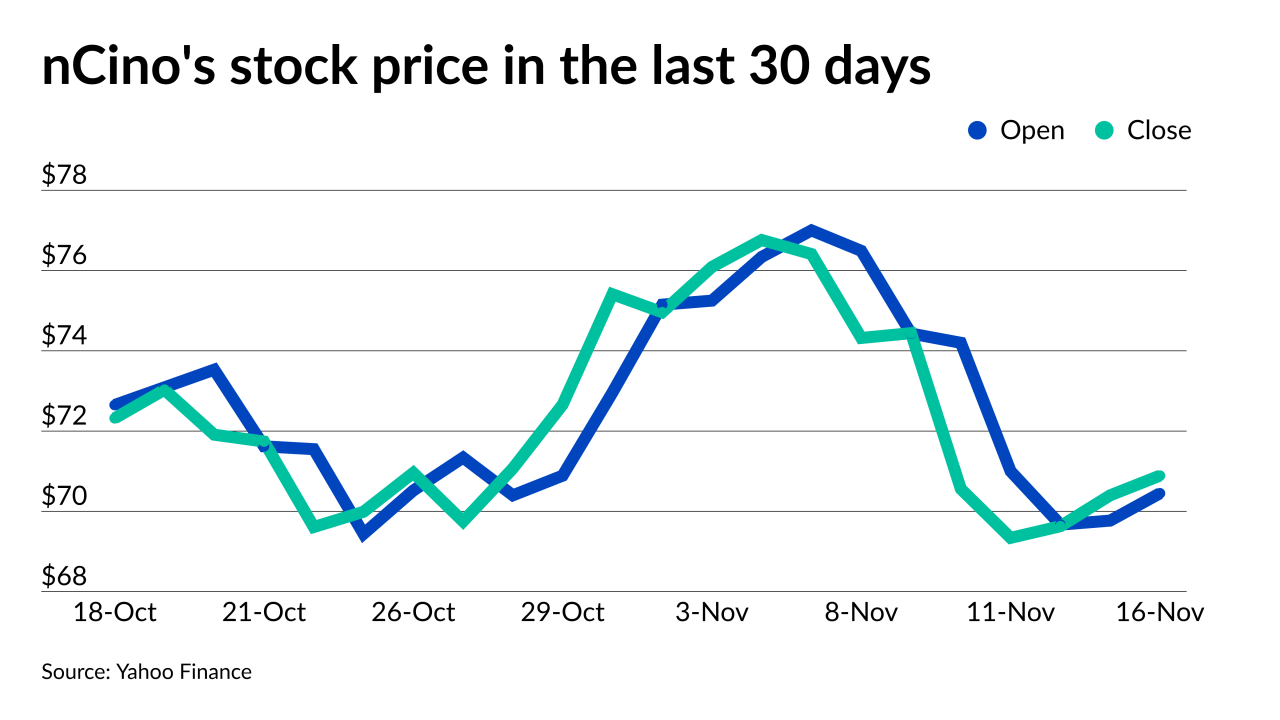

The transaction takes depository-focused nCino into the independent mortgage banking side of the lending business.

November 16 -

Despite elevated prices and supply-chain bottlenecks, October application activity was up for the second time in three months and pushed the average loan size to a record high.

November 16 -

A pilot conducted with a handful of independent financial advisors has transitioned to a full roll-out, with the lender offering a discount of up to $5,000 to potential borrowers through the broker-dealer.

November 15 -

The company was able to generate a relatively higher margin than the previous quarter, in contrast to broader industry trends, bringing its bottom line back into the black.

November 12 -

Even though one aspect of these lending standards is becoming more flexible, some say they still don’t always meet the needs of borrowers like delivery workers employed on a contract basis.

November 12 -

The company’s servicing operations also reported a quarterly profit, with its portfolio increasing by 20% annually.

November 11 -

The weekly gain was the largest since July, but overall activity still remains close to early 2020 lows.

November 10 -

Nearly half of the company’s revenue comes from sources outside of the traditional home lending market, CEO Patricia Cook told analysts during the company’s earnings call.

November 10 -

The Federal Housing Administration’s changes seek to bring guidelines for specialized Title I programs in line with current borrower and market needs.

November 9 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

The wholesale lender's net income of nearly $330 million factored in a $170.5 million hit from a reduction in its mortgage servicing rights fair value.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

The two fintechs look to streamline document capture and credit decisioning for lenders.

November 8 -

More aggressive pursuit of government-related agencies’ affordable housing mission is expanding product availability, but government intervention can be a double-edged sword.

November 8 -

All six companies, however, remained highly profitable, as the delinquency and forbearance outlook is favorable for the possibility of rising claims payments.

November 5 -

Sue Barber takes over the position after leading its Northeast division.

November 5 -

Plans to taper rate stimulus could further dampen industry employment, depending on the extent to which decreased volume is offset by staffing needs driven by the shift to work-intensive purchase loans.

November 5 -

While the company produced $88 billion during the period, it had a major margin squeeze in its TPO Pro channel.

November 5 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

November 5