-

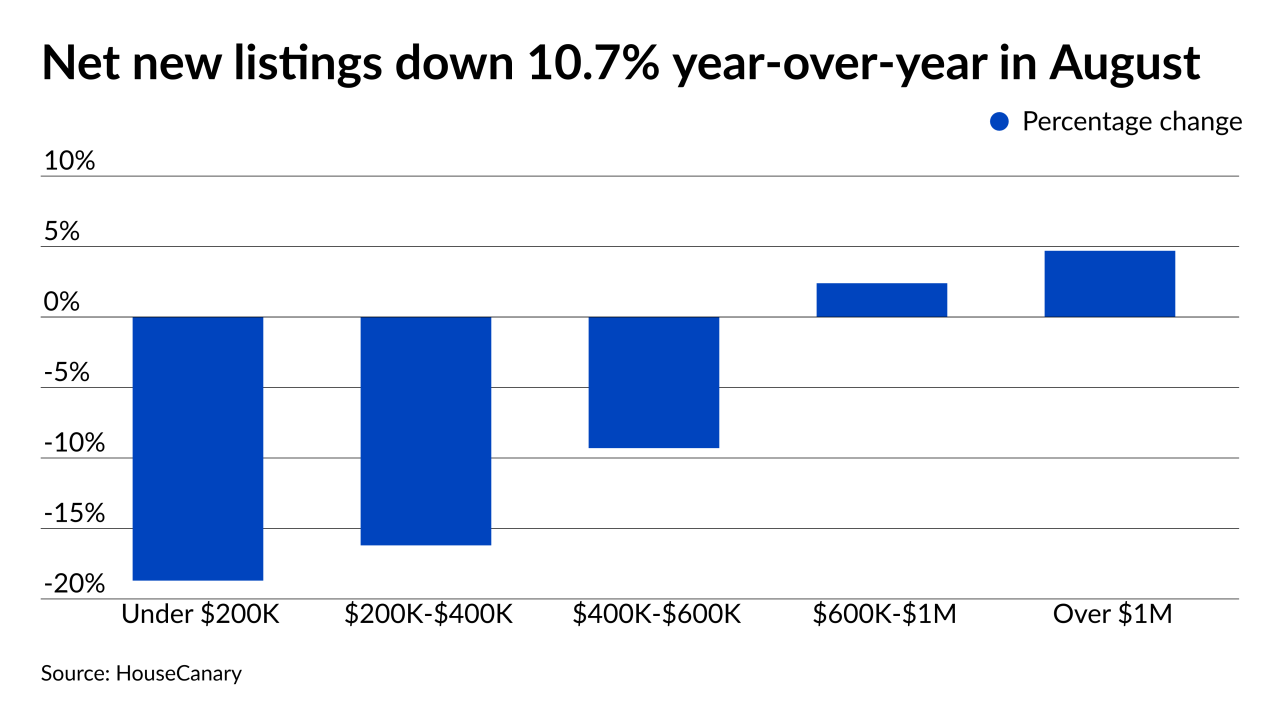

What that means for the industry outlook depends in part on how well the imbalance between supply and demand for homes sustains wavering gains in the housing market.

September 3 -

Price growth is moderating and properties are taking longer to sell — albeit by a modest three days.

September 2 -

The 30-year average has remained below 3% for two months.

September 2 -

The company's new name helps reflect the business lines it expanded into outside of fix-and-flip during the last few years.

September 1 -

Average loan sizes also grew, as continued demand for homes still outpaces inventory.

September 1 -

None of the leading areas ranked by investor share of sales were in the Golden State during 2020, in contrast to the state’s dominance on the list in the wake of the Great Recession.

August 30 -

Payments from PayPal, Venmo and Zelle add an extra wrinkle when dealing with bank statement loans.

August 30 -

Increasing COVID-19 numbers offset promising economic figures, resulting in minimal changes.

August 26 -

Purchases and refinance activity both edged higher, as loan sizes decreased, signaling opportunities may exist for first-time buyers.

August 25 -

Even as lenders increased purchase share, higher expenses and margin compression related to pricing competition led to smaller quarterly net gains.

August 24 -

Purchases of new single-family homes increased 1% to a 708,000 annualized pace following an upwardly revised 701,000 in June, government data showed Tuesday.

August 24 -

The company is divesting itself of another piece of Xome after previously peddling Title365 to Blend Labs.

August 23 -

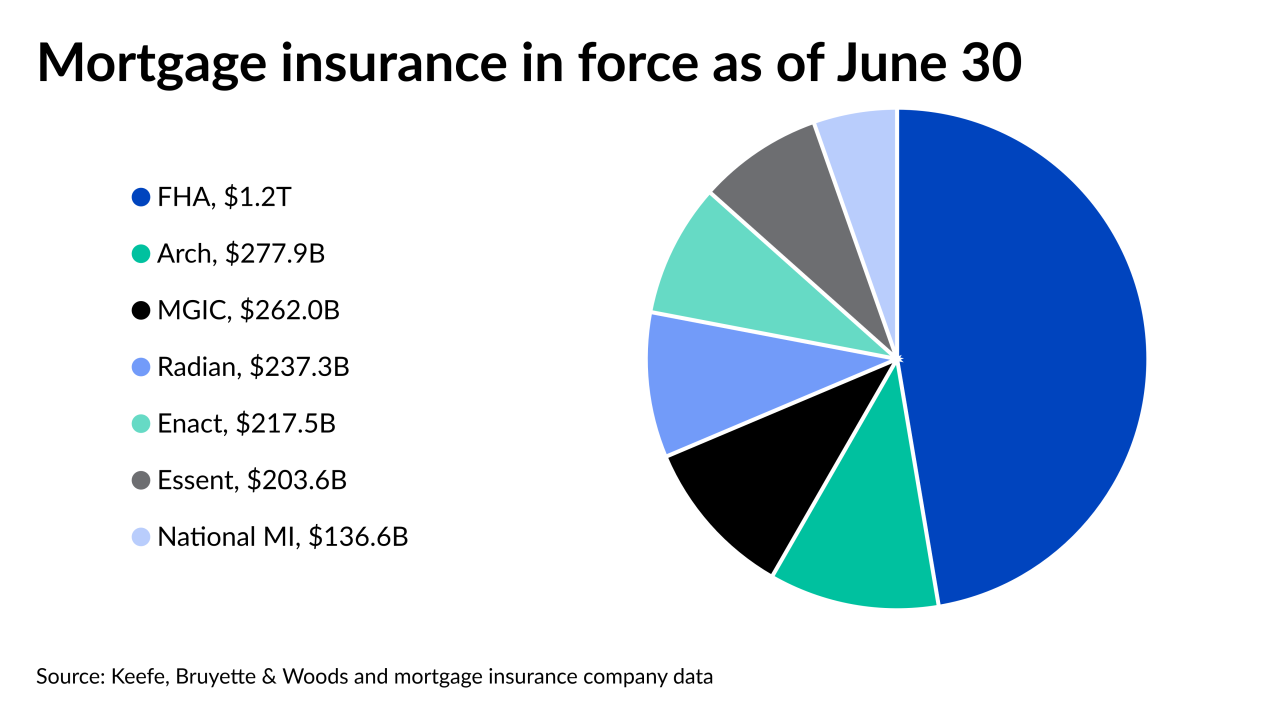

However, the pace of growth at the six active underwriters should moderate over the next two years, Keefe, Bruyette & Woods said.

August 23 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

Meanwhile, investors await word from the central bank regarding monetary policy, as limited housing supply continues to drive prices upward.

August 19 -

Lower rates and higher home prices will boost dollar volume although few home sales will cut into purchase volume growth.

August 19 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18 -

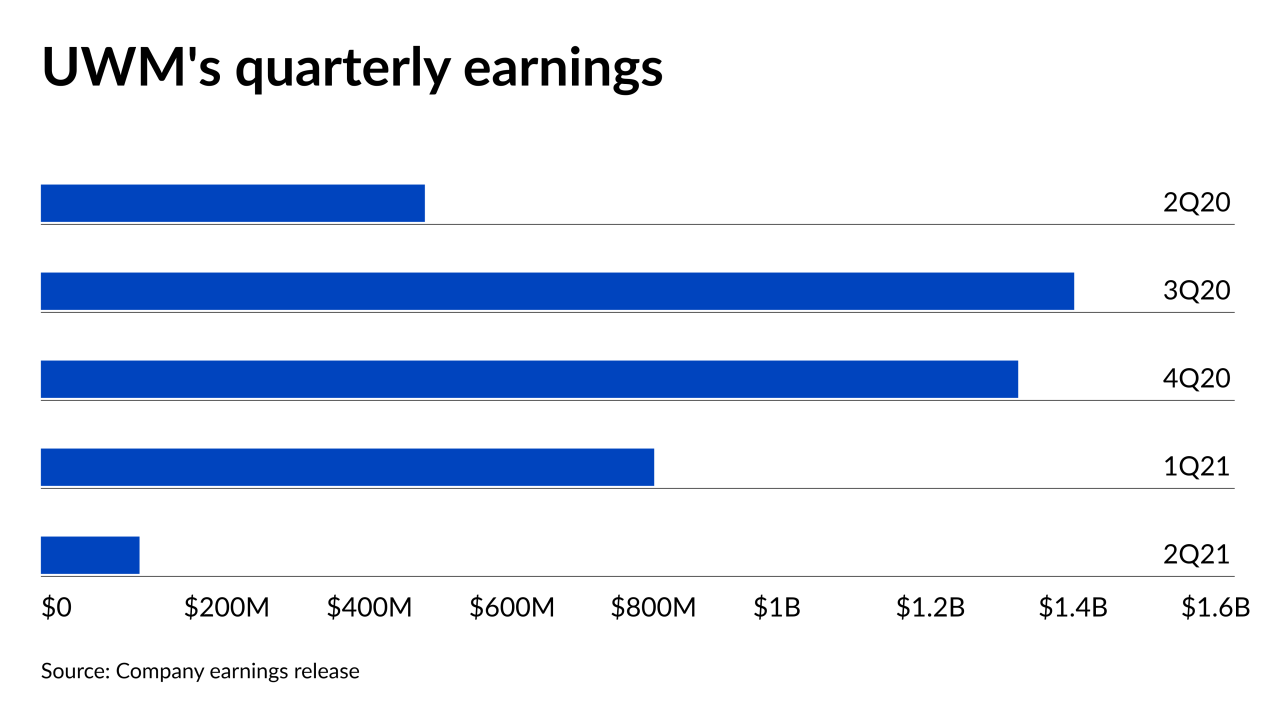

The wholesale lender has a cost structure aimed at beating the competition in a rising rate environment, Chairman and CEO Mat Ishbia said on the second quarter earnings call.

August 17 -

The share of home sales that were competitive remained above year-ago levels in July, but only by a few percentage points.

August 16 -

Depressed margins and a $219 million hit to its servicing rights fair value translated to a lower bottom line at the wholesaler.

August 16