-

From FICOs to purchase volume, here's a look at seven mortgage lending trends that will shape the housing market this year.

February 20 -

New Residential priced its second stock offering in four months, looking for gross proceeds of nearly $665 million.

February 20 -

Mortgage applications rose for the first time in five weeks as key interest rates held steady, according to the Mortgage Bankers Association.

February 20 -

HomeStreet Bank will attempt to sell its stand-alone mortgage business and portfolio of servicing rights, a move that comes amid growing pressure from an activist investor to exit home lending and concerns about declining demand and regulatory challenges.

February 15 -

Mortgage industry hiring and new job appointments for the week ending Feb. 15.

February 15 -

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

Mortgage applications decreased 3.7% from one week earlier, because of consumer concerns over the direction of the economy outweighed lower interest rates, according to the Mortgage Bankers Association.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12 -

Stable equity and debt availability should keep multifamily and commercial real estate originations in line with 2017's peak, according to the Mortgage Bankers Association.

February 11 -

A lawsuit alleging Wells Fargo improperly compensated its California-based mortgage loan officers could have broader ramifications now that it has been granted class certification.

February 8 -

Mortgage industry hiring and new job appointments for the week ending Feb. 8.

February 8 -

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

Fourth-quarter increases in Fannie Mae and Freddie Mac mortgage origination volume helped Walker & Dunlop reach a new quarterly high in revenue of $215 million.

February 6 -

Mortgage applications decreased 2.5% from one week earlier, even as interest rates fell to their lowest levels in 10 months, according to the Mortgage Bankers Association.

February 6 -

Popular TV shows about house fixers and flippers have sparked consumer interest in remodeling, creating an opportunity for lenders to build a specialty in renovation loans while traditional mortgage lending is weak.

February 4 -

The Consumer Financial Protection Bureau has published a new "frequently asked questions" tool to help mortgage lenders with TILA-RESPA integrated disclosures compliance.

February 1 -

Mortgage industry hiring and new job appointments for the week ending Feb. 1.

February 1 -

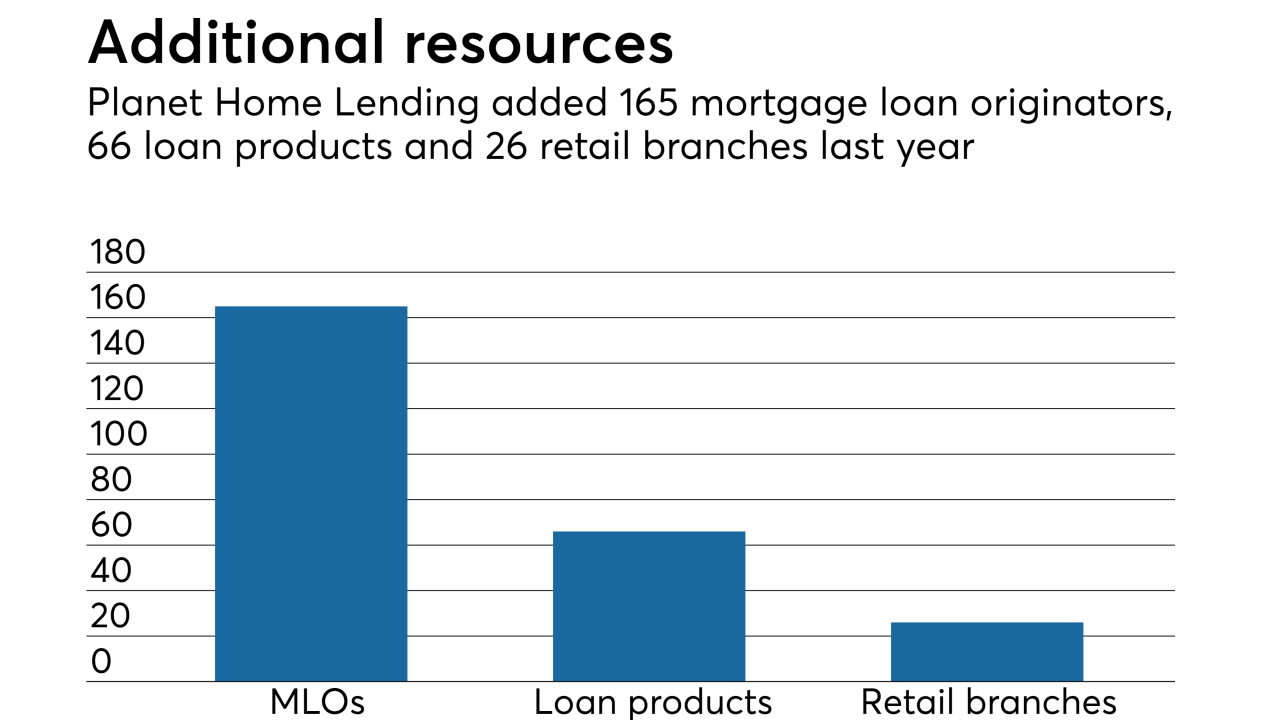

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

Mortgage application activity decreased 3% from one week earlier as rates for conventional loans continued to move higher, according to the Mortgage Bankers Association.

January 30