-

The J.G. Wentworth Co.'s financial results improved in the third quarter, due in part to an increase in mortgage originations, but it continued to operate at a loss.

November 14 -

Lenders holding a majority share in The J.G. Wentworth Co. agreed late last week to restructure and deleverage the embattled company as its operations stabilize and its mortgage unit grows.

November 13 -

Mortgage industry hiring and new job appointments for the week ending Nov. 10.

November 10 -

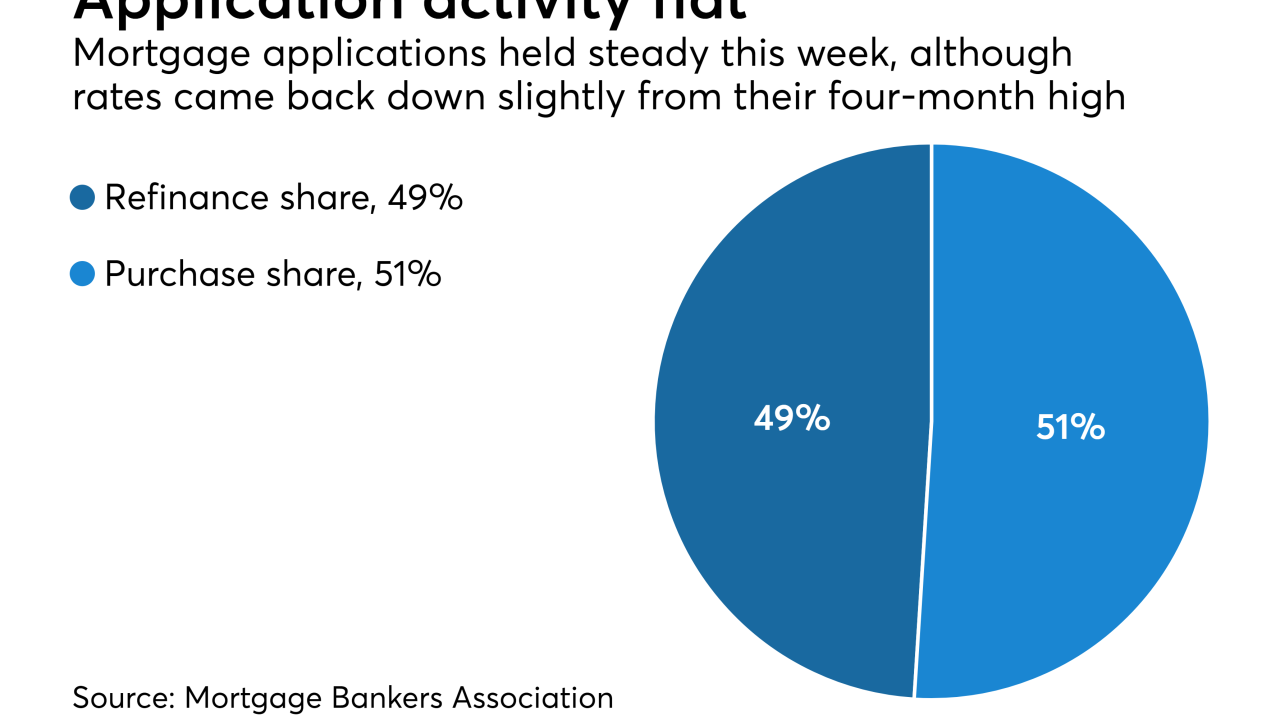

Mortgage application activity was unchanged from one week earlier although rates came back down slightly from their four-month high, according to the Mortgage Bankers Association.

November 8 -

Mortgage industry hiring and new job appointments for the week ending Nov. 3.

November 3 -

Nationstar Mortgage Holdings posted net income of $7 million for the third quarter, its first under the new Mr. Cooper consumer-facing brand.

November 2 -

Connecticut was the lone state in the nation in September to see a decline in borrowers misrepresenting facts on mortgage loan applications.

November 2 -

Mortgage rates rose to their highest level since July, leading to a 2.6% decrease in loan applications from one week earlier, according to the Mortgage Bankers Association.

November 1 -

TCF is looking to diversify its streams of revenue as it dials back auto lending amid concerns about weakening credit quality.

October 30 -

Commercial and multifamily originations are projected to surpass the 2007 market peak this year, according to the Mortgage Bankers Association.

October 27 -

Third-quarter net income at mortgage technology provider Ellie Mae was higher year-over-year but came in below the previous quarter's number as the company worked to produce gains despite falling originations.

October 27 -

Mortgage industry hiring and new job appointments for the week ending Oct. 27.

October 27 -

CoreLogic's net income dropped to $31 million in the third quarter from $36 million a year ago due to a settlement and an estimated 25% decline in origination units.

October 26 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

Federal Housing Finance Agency Director Mel Watt said the agency is poised to examine alternatives to how a Fannie Mae and Freddie Mac assess creditworthiness of home buyers, including seeking public comment on the issue later this fall.

October 23 -

Ben Carson doesn't want big banks to worry so much about being penalized from mortgage lending errors.

October 23 -

Gain important insights from experts in the field on key trends and advancements in digital mortgage.

October 23 -

Hawaii's booming economy contributed to the Honolulu bank's 10% increase in loans and 9% increase in deposits in the third quarter.

October 23 -

To protect veterans from predatory lending practices, Ginnie Mae and the Department of Veterans Affairs should remove lenders' financial incentive for originating Interest Rate Reduction Refinance Loans.

October 20 Chrysalis Holdings

Chrysalis Holdings -

Mortgage industry hiring and new job appointments for the week ending Oct. 20.

October 20