-

Americans' desire to be homebuyers decreased for the fifth consecutive month in December as interest rates continued their post-election climb, according to Fannie Mae.

January 9 -

New approaches to credit scoring lower the standard of the criteria required to receive a mortgage loan, at greater risk to the industry.

January 9 FICO

FICO -

Some single-family lenders are ideally trying to move purchase loans from application to funding within 21 days at a time when average timeline is twice as long. Here's why.

January 9 -

The Federal Housing Administration is cutting its annual mortgage insurance premium by 25 basis points, lowering it to 60 basis points starting Jan. 27, the agency said Monday.

January 9 -

The Department of Housing and Urban Development has charged Bank of America with discriminating against prospective Hispanic mortgage borrowers at a branch in Charleston, S.C.

January 6 -

The House Financial Services Committee will see a shuffling of deck chairs among the leadership of its subcommittees in the new Congress as it also welcomes 10 new Republican members.

January 6 -

Nashville, Tenn., tops the list of the hottest housing markets in the country for 2017, according to Zillow.

January 6 -

Quicken Loans parent company Rock Holdings has agreed to buy two online marketing service providers, marking the Dan Gilbert-owned conglomerate's entrance into the lead acquisition space.

January 6 -

Independent mortgage banking and brokerage firms added 4,000 employees in November, even as rising interest rates took its toll on loan application volume.

January 6 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Mortgage industry hiring and new job appointments for the week ending Jan. 6.

January 6 -

The Senate Banking Committee is scheduled to hold a hearing Jan. 12 on the nomination of Dr. Ben Carson as Secretary of the Department of Housing and Urban Development.

January 5 -

The lending arm of U.S. Department of Agriculture guaranteed 3,439 single-family construction loans in the first quarter of fiscal year 2017, which ended Dec. 31, but just nine of those loans involved its new single-close construction-to-permanent financing option.

January 5 -

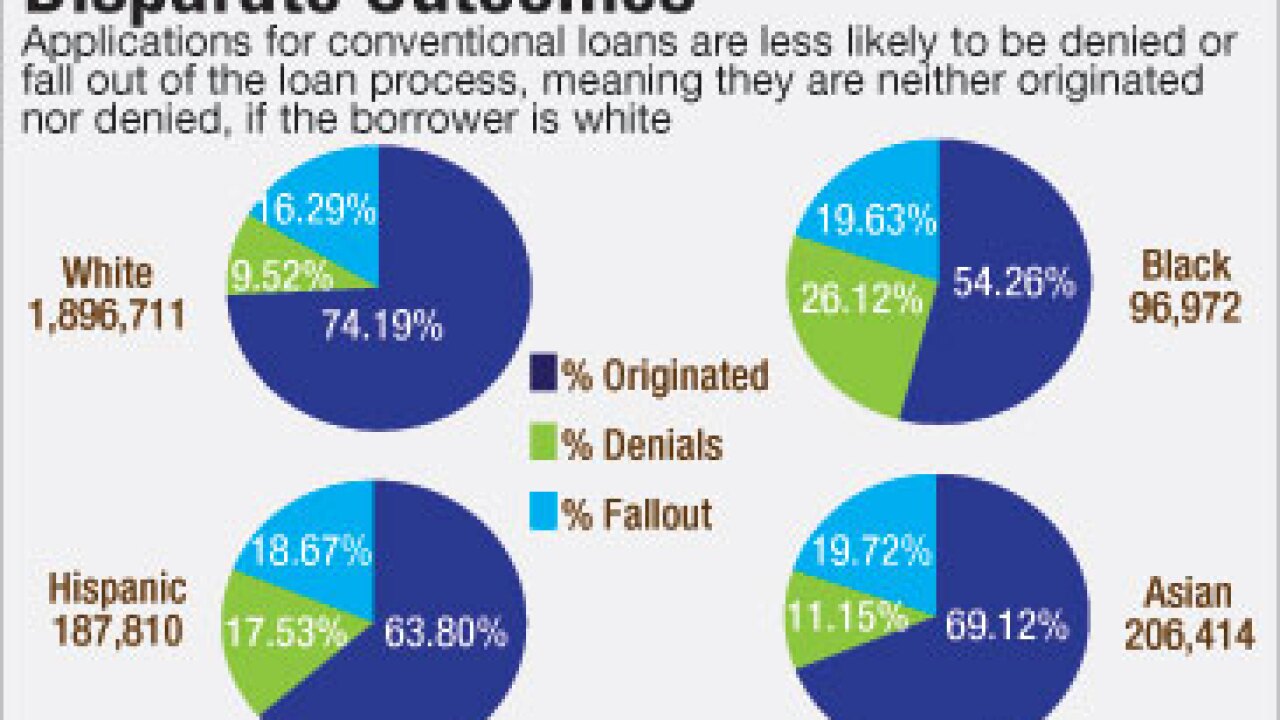

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Mortgage credit availability grew for the fourth consecutive month in December, the Mortgage Bankers Association reported.

January 5 -

Mortgage interest rates dropped for the first time since the presidential election in the first week of the new year, Freddie Mac reported.

January 5 -

Now that it has completed the purchase of its rival private mortgage insurer United Guaranty from AIG, Arch Capital Group plans to trim the sales force while avoiding service disruptions.

January 4 -

Donald Trump's election sent interest rates higher, and the mortgage industry is waiting to see what other effects he will have. Here's a look at how the housing market performed during the first years of recent presidencies.

January 4 -

Origin Bank in Addison, Texas, has begun offering warehouse financing for electronic mortgages.

January 4 -

President-elect Donald Trump's choice of well-known Wall Street lawyer Jay Clayton to head the Securities and Exchange Commission was a relatively safe move that suggests his other financial appointments may be equally conservative, industry observers said.

January 4