-

Lenders will get a reprieve from the threat of some mortgage-related penalties under a new program announced by housing-finance giant Fannie Mae on Monday.

October 24 -

Altisource Origination Services, which provides outsourced loan fulfillment services, is rebranding as Trelix.

October 24 -

Bank of Hawaii expanded lending for residential mortgages and commercial real estate, boosting its third-quarter profit.

October 24 -

The U.S. housing market is about 10 times larger than Canada's, but we can learn a few lessons from the country's cautious approach to its housing policy.

October 24 Steel Curtain Capital Group LLC

Steel Curtain Capital Group LLC -

As Rodrigo Lopez begins his term as chairman of the Mortgage Bankers Association, the Nebraska multifamily lender seeks to use the platform to embrace the challenges of improving diversity and technology throughout the industry, while remaining vigilant about the ever-changing regulatory landscape.

October 23 -

Fannie Mae has started a pilot program that transfers 265 basis points of default risk on $3.7 billion of loans delivered over a six-month period to private mortgage insurers.

October 21 -

The Consumer Financial Protection Bureau's proposed changes to new mortgage disclosure requirements do not go far enough, according to many in the industry.

October 21 -

WestStar Bank in El Paso, Texas, has acquired assets from Cimarron Mortgage Capital.

October 21 -

Roostify plans to connect its automated mortgage decisioning platform with employment and income data from Equifax.

October 21 -

Home BancShares in Arkansas would rather buy banks that meet its financial parameters than do one large deal to catapult over $10 billion in assets. The bank also spent most of this year idling with M&A so it could prepare for stress testing.

October 21 -

Moody's Corp. said federal officials are planning a lawsuit over its ratings of residential mortgage securities that critics contend were inflated to win business in the years leading up to the 2008 financial crisis.

October 21 -

Mortgage industry hiring and new job appointments for the week ending Oct. 21.

October 21 -

Binh Dang has resigned as president of LendingQB, the company confirmed Thursday.

October 21 -

A federal court appeals decision could theoretically mean that Comptroller of the Currency Thomas Curry now answers directly to Treasury Secretary Jack Lew, a significant break from the agency's history of independence.

October 21 -

Profit fell at SunTrust Banks during the third quarter because of higher costs for technology and deposit insurance premiums, as well as an unfavorable yearly comparison.

October 21 -

A simple rhyme reminds one loan officer in a bustling California housing market to stay focused, committed and to treat every loan equally.

October 21 -

Associated Banc-Corp in Green Bay, Wis., reported higher quarterly profit on the strength of tight expense control and strong mortgage banking revenue.

October 21 -

In an election year dominated by controversy and big personalities, political contributions from the mortgage industry have remained muted, reflecting apathy and uncertainty toward Hillary Clinton and Donald Trump.

October 21 -

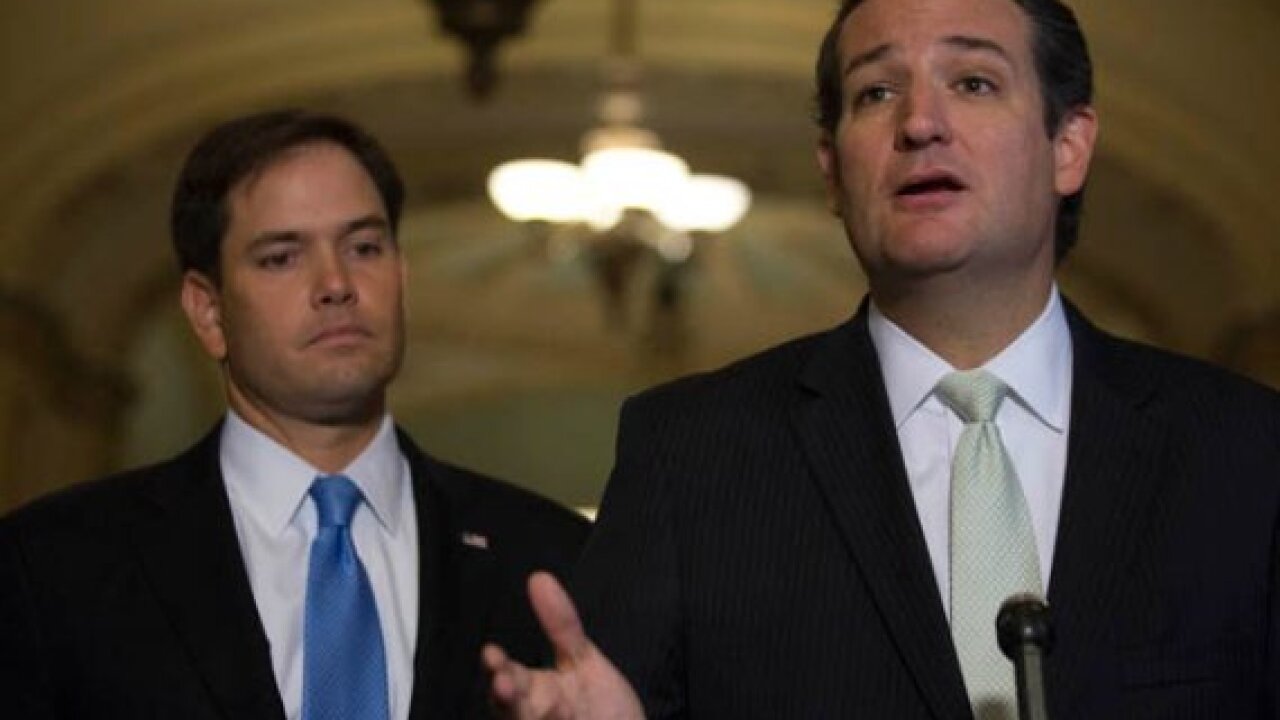

From the future of Dodd-Frank to GSE reform, the next Congress will make major decisions that will shape the mortgage industry's future. Here's a look at the Senate candidates who have received the most money in political donations from the mortgage industry.

October 21 -

With the election just weeks away, here's a look at the mortgage industry firms whose employees have made the largest political contributions during the 2016 election cycle.

October 21