-

Moody's Corp. said federal officials are planning a lawsuit over its ratings of residential mortgage securities that critics contend were inflated to win business in the years leading up to the 2008 financial crisis.

October 21 -

Mortgage industry hiring and new job appointments for the week ending Oct. 21.

October 21 -

Binh Dang has resigned as president of LendingQB, the company confirmed Thursday.

October 21 -

A federal court appeals decision could theoretically mean that Comptroller of the Currency Thomas Curry now answers directly to Treasury Secretary Jack Lew, a significant break from the agency's history of independence.

October 21 -

Profit fell at SunTrust Banks during the third quarter because of higher costs for technology and deposit insurance premiums, as well as an unfavorable yearly comparison.

October 21 -

A simple rhyme reminds one loan officer in a bustling California housing market to stay focused, committed and to treat every loan equally.

October 21 -

Associated Banc-Corp in Green Bay, Wis., reported higher quarterly profit on the strength of tight expense control and strong mortgage banking revenue.

October 21 -

In an election year dominated by controversy and big personalities, political contributions from the mortgage industry have remained muted, reflecting apathy and uncertainty toward Hillary Clinton and Donald Trump.

October 21 -

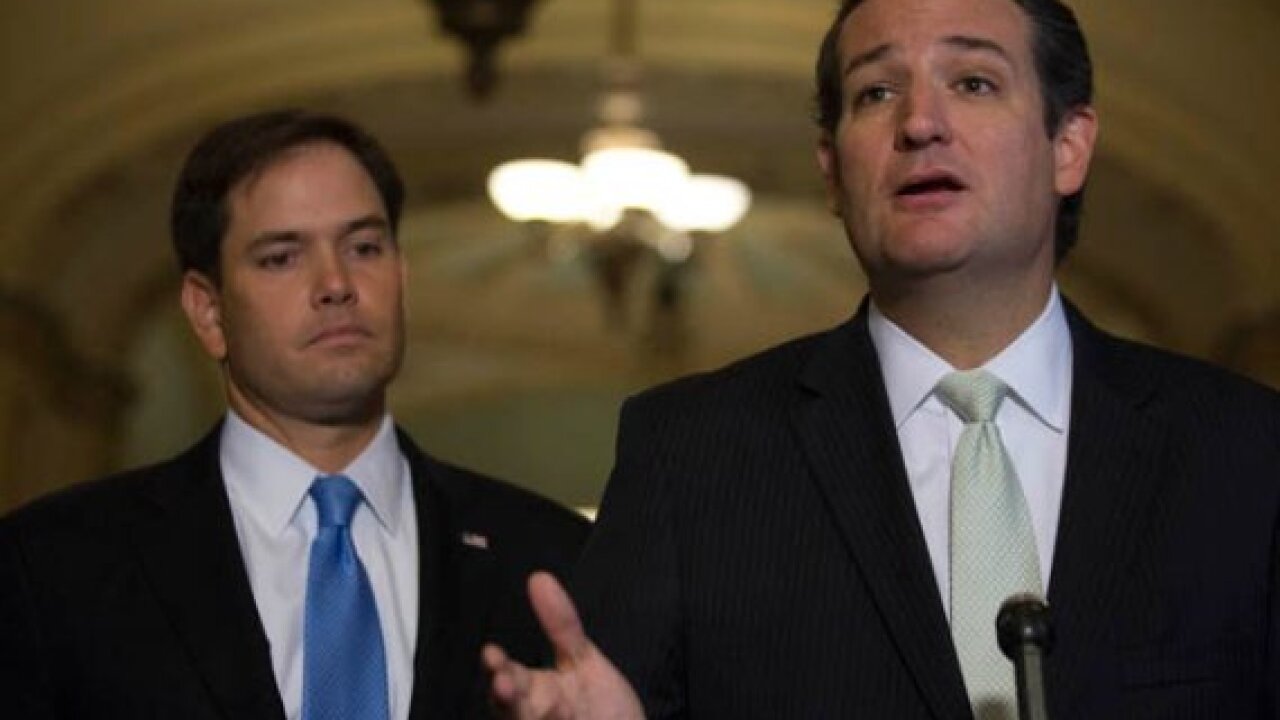

From the future of Dodd-Frank to GSE reform, the next Congress will make major decisions that will shape the mortgage industry's future. Here's a look at the Senate candidates who have received the most money in political donations from the mortgage industry.

October 21 -

With the election just weeks away, here's a look at the mortgage industry firms whose employees have made the largest political contributions during the 2016 election cycle.

October 21 -

From House Speaker Paul Ryan to Financial Services Committee Chairman Jeb Hensarling, these 10 candidates for the House of Representatives attracted the most in campaign donations from the mortgage industry.

October 21 -

Greg Carmichael, who has been on the job nearly a year as Fifth Third's CEO, has started putting his stamp on the company by aggressively trimming branches in favor of mobile, seeking to build up its consumer credit business and retooling the balance sheet.

October 20 -

The mortgage industry remains deeply uneasy with efforts by Fannie Mae, Freddie Mac and their regulator to experiment with front-end credit risk transfers, with some arguing it helps borrowers and lenders, while others fear it will cut out small institutions.

October 20 -

Bank of America is expanding a program that provides 3% down payment home loans through a partnership with Freddie Mac and a North Carolina credit union.

October 20 -

In a move designed to help further calm lender fears about mortgage repurchase liability, Fannie Mae is preparing to offer immediate representation and warranty relief to lenders that use its suite of automated quality assurance technology.

October 20 -

A new Rural Housing Service construction-to-permanent loan program is garnering strong interest from lenders and builders who see it as a much-needed opportunity.

October 20 -

ClosingCorp has rebranded its Loan Estimate and Good Faith Estimate products as a single service, SmartFees.

October 20 -

Heather Russell, who was fired earlier this year as Fifth Third Bancorp's chief legal officer, has re-emerged in a new role.

October 20 -

SunTrust Banks in Atlanta has agreed to buy the multifamily lending business of Pillar Financial in New York.

October 20 -

Rates for the 30-year conforming fixed-rate mortgage rose above 3.5% for the first-time since before the Brexit vote, according to Freddie Mac.

October 20