-

Housing starts in the US fell in October to the lowest level since the onset of the pandemic as data delayed by last fall's government shutdown showed builders continued to cut back amid still-high prices and mortgage rates.

January 9 -

The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

January 8 -

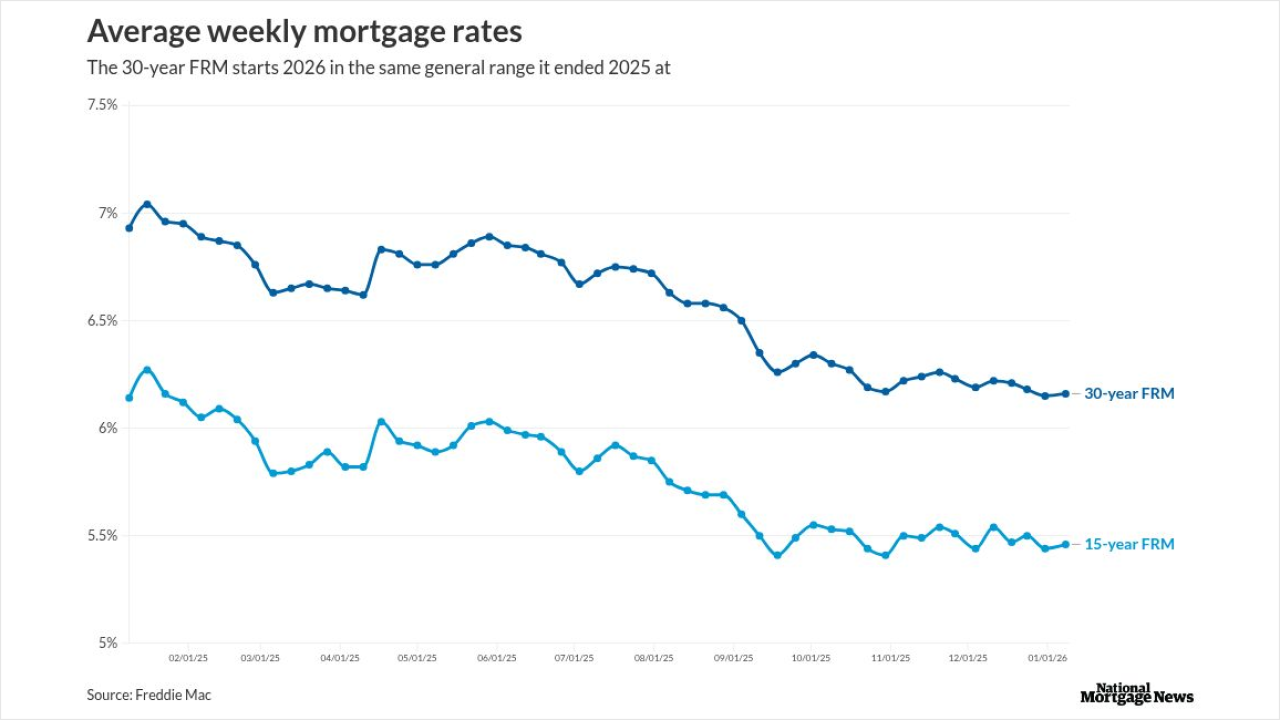

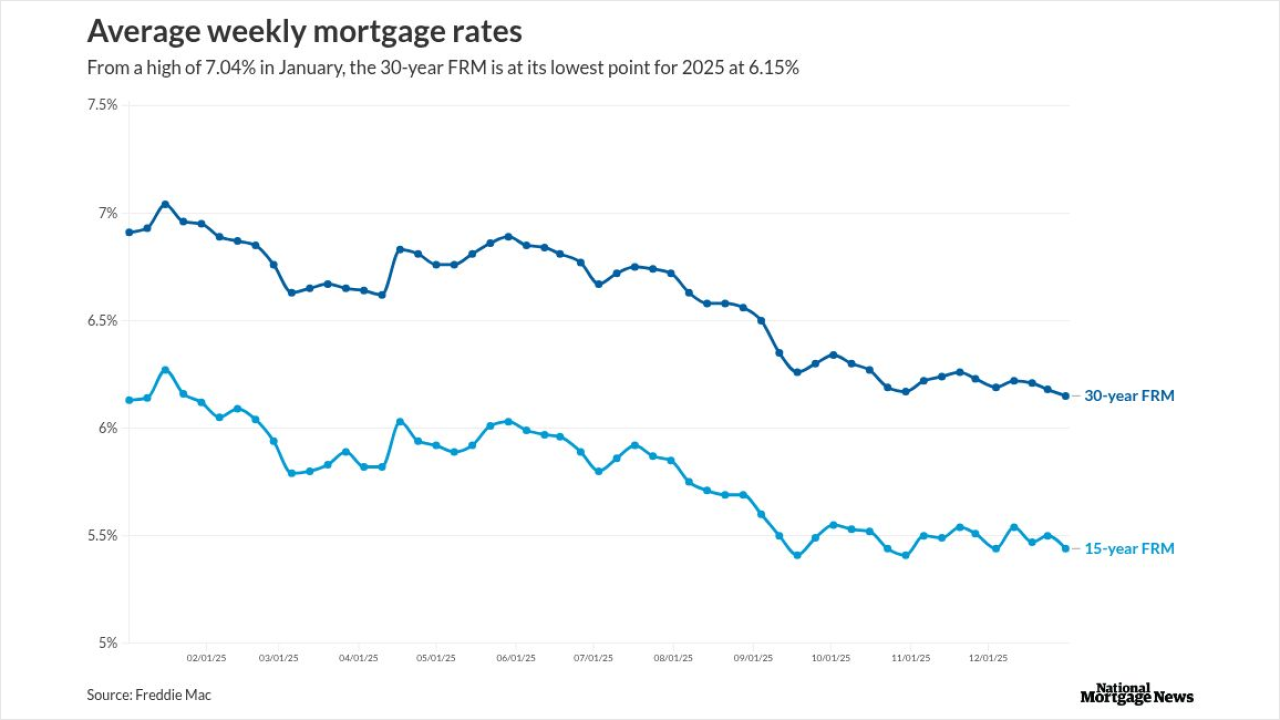

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

Loanlogics rolled out the LoanBeam NQM income analyzer in October and has four users for the non-qualified mortgage underwriting technology, including Pennymac.

January 7 -

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

Walker & Dunlop Affordable Bridge Capital will originate flexible, short-term first-mortgage bridge loans for properties designated for government programs.

January 7 -

A shared client base helped lead to introduction of the new integration, with implementation scheduled to come later this year, the companies said.

January 7 -

The deal comes as technology experts see likely 2026 artificial intelligence breakthroughs in mortgage to come through improved underwriting.

January 7 -

US mortgage rates fell last week to the lowest level since September 2024, a hopeful sign for the sluggish housing market to start the new year.

January 7 -

Although some of the cohort surveyed were flush with savings, others admitted having precarious debt situations and steadfast attitudes toward luxury purchases.

January 6 -

Annual home-price appreciation ended last year at 0.7%, the smallest calendar-year increase since 2011, when prices dropped 2.9%, according to ICE.

January 6 -

The accusations, relating to the lender's marketing programs, including trips for brokers as things of value, stem from a larger racketeering complaint.

January 5 -

First Federal Bank stretched its retail mortgage operations into Louisiana and Mississippi, following its expansion into the Midwest and Arizona in 2023.

January 5 -

The number of remodeling establishments hit at a record high earlier this decade and now accounts for over 60% of home construction-related businesses.

January 2 -

The Federal Home Loan Bank of Chicago will be offering more funding and higher per-member limits as part of its 2026 Community Advance program.

January 2 -

A majority of recent sellers said they offered to cover closing costs, with many also buying down mortgage rates, according to a new report from Zillow.

December 31 -

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

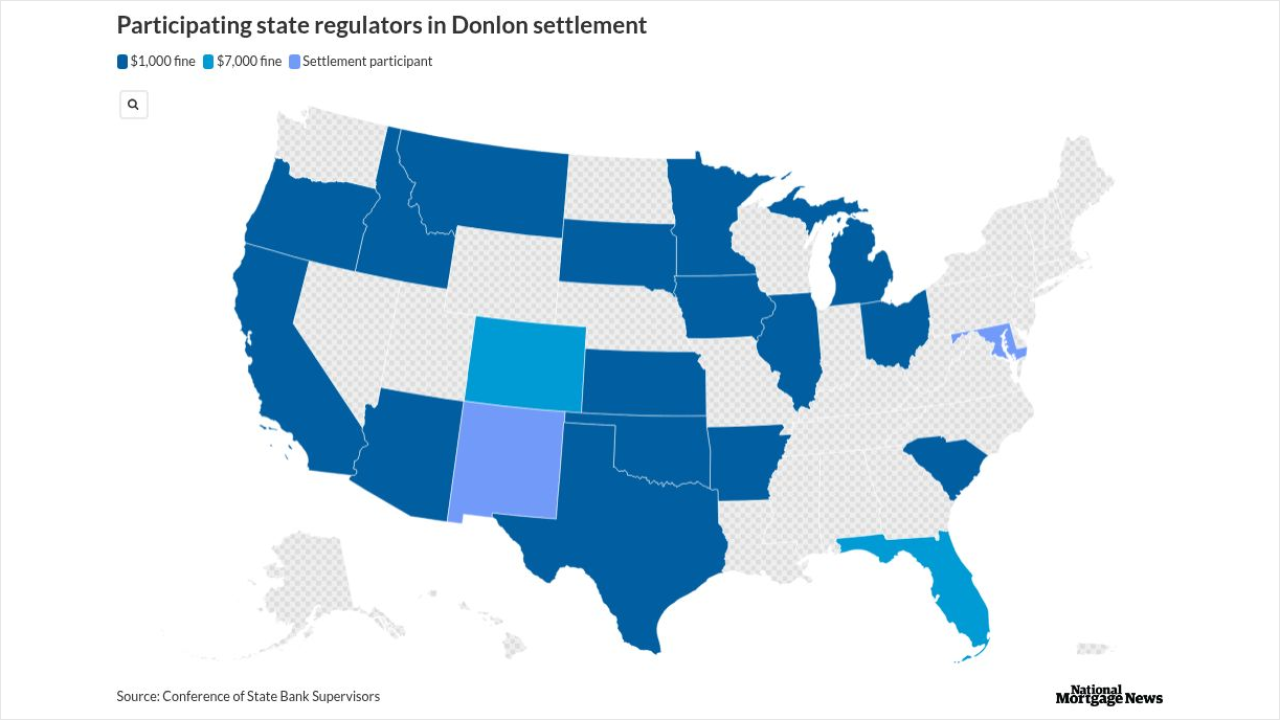

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

AI's capabilities far exceed how the technology is being used in mortgage, but an all-in strategy will quickly put companies ahead of the pack, leaders say.

December 31