-

The Office of the Comptroller of the Currency could make the Community Reinvestment Acts spirit relevant in a digital age so long as it builds the right framework for chartered fintech companies.

January 18

-

While precise definitions vary, the term generally describes a smooth customer experience that may not even require a phone call or branch visit.

January 18 -

Just days before President Obama will leave office, the White House released a white paper advocating for the U.S. government to engage in efforts to promote the fintech industry.

January 17 -

The startup, known for refinancing millennials' student loans, is now writing more than $100 million of home mortgages a month, and expects this to be its fastest-growing product. Here's why.

January 17 -

Black Knight Financial Services has integrated its Lien Alert portfolio monitoring tool with its LoanSphere MSP servicing system.

January 11 -

Mortgage brokers and their wholesale partners have seen a slow increase in their market share since the start of the housing recovery. Remax's Motto Mortgage franchise business could accelerate growth faster than the channel's advocates hope for.

January 10 -

American Mortgage Consultants has acquired a business unit that handles due diligence and quality control for residential mortgages from Stewart Lender Services.

January 10 -

Ellie Mae has rolled out an extension to its Encompass Lending Platform to allow loan officers to originate loans in a mobile environment.

January 9 -

Some single-family lenders are ideally trying to move purchase loans from application to funding within 21 days at a time when average timeline is twice as long. Here's why.

January 9 -

Quicken Loans parent company Rock Holdings has agreed to buy two online marketing service providers, marking the Dan Gilbert-owned conglomerate's entrance into the lead acquisition space.

January 6 -

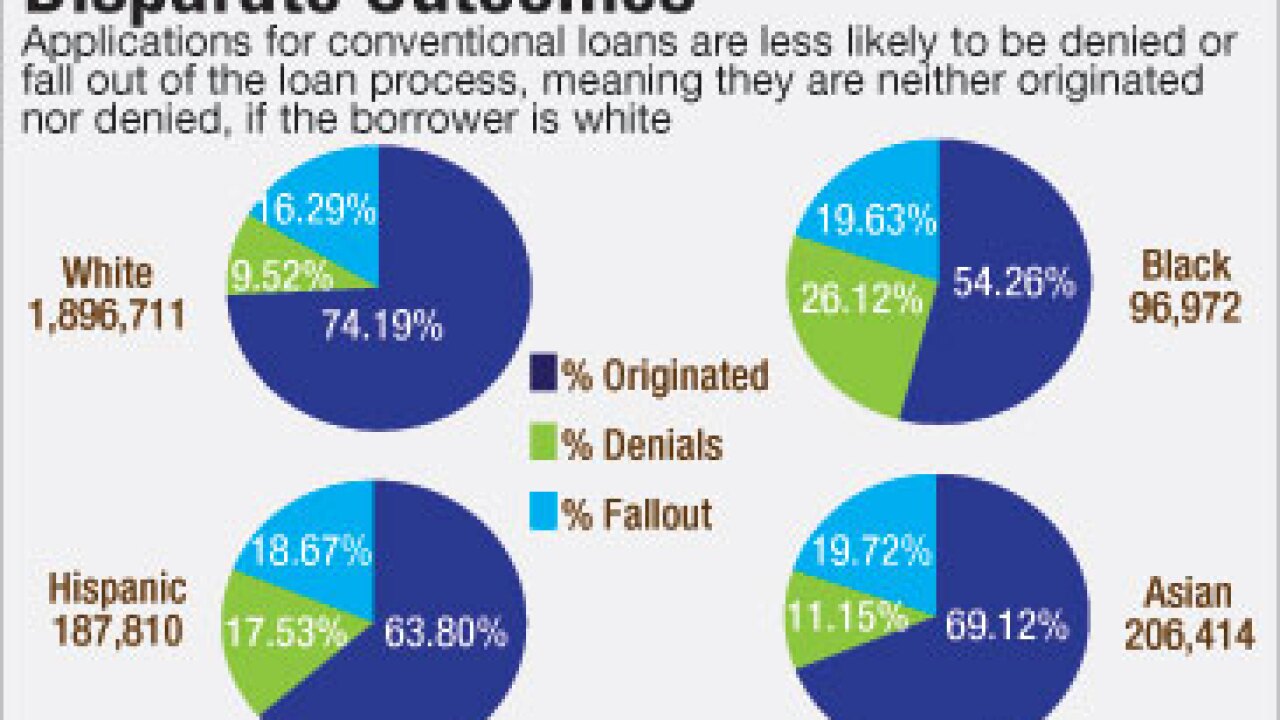

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Origin Bank in Addison, Texas, has begun offering warehouse financing for electronic mortgages.

January 4 -

Some of the most popular contributors to National Mortgage News' Voices community weigh in on what they see coming in the next year for origination, servicing, technology and regulation.

December 29 -

Fannie Mae's Day 1 Certainty initiative and automated verification tools at Freddie Mac are set to improve mortgage loan application defect and misrepresentation risk in 2017, according to a report from First American Financial Corp.

December 28 -

It's unclear how the new political environment will affect the platform's viability or how investors will view the securities issued on it. The next year could determine the project's success and role reshaping the secondary mortgage market.

December 27 -

Opes Advisors shows would-be borrowers how purchasing a house fits into their total financial picture, now and years into the future. Many of its loan officers are licensed investment advisors.

December 20 -

Radius Financial Group worked for years to achieve an end-to-end digital closing process, finally doing so this fall. Here's how the Massachusetts lender got it done.

December 19 -

While depository mortgage lenders should exercise some caution before welcoming trended data and alternative credit scoring into their process, they must become inclusive or face losing market share to newer industry players like SoFi.

December 16 Sapient Global Markets

Sapient Global Markets -

Nationstar Mortgage Holdings has unveiled a new website and mobile application, which will include educational content, interactive data tools and modules regarding mortgage payments.

December 15