-

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

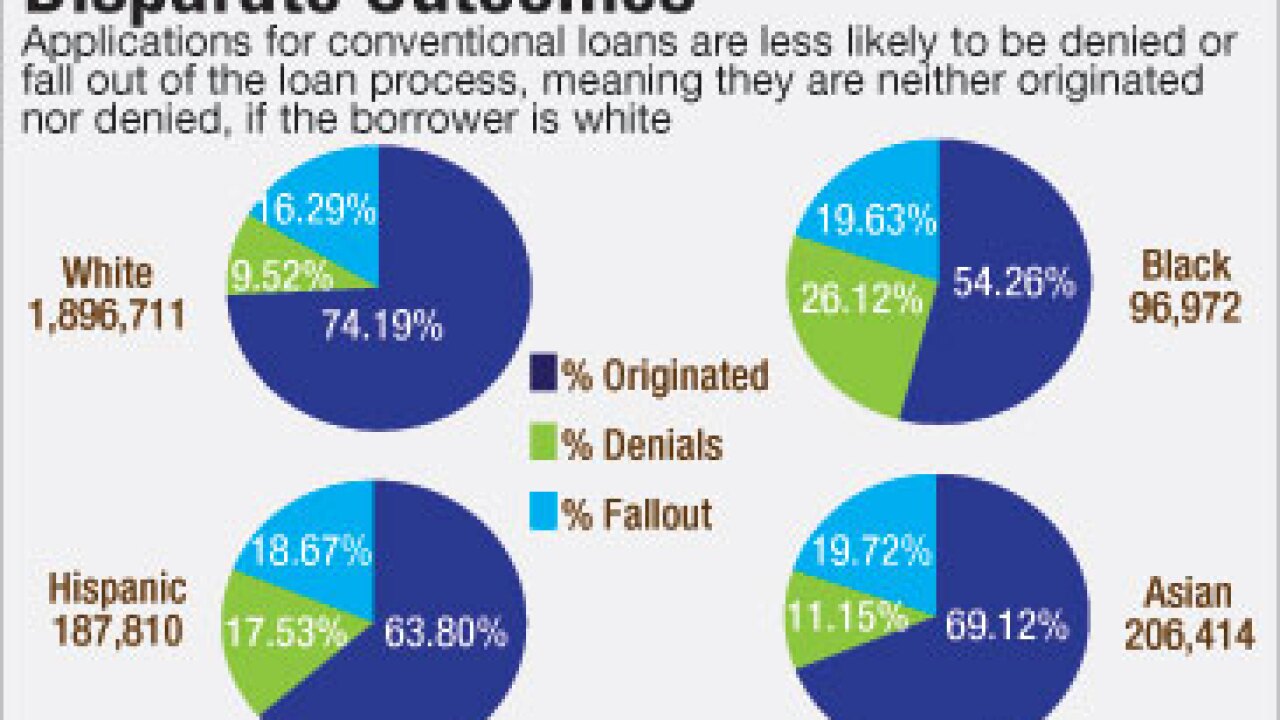

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Origin Bank in Addison, Texas, has begun offering warehouse financing for electronic mortgages.

January 4 -

Some of the most popular contributors to National Mortgage News' Voices community weigh in on what they see coming in the next year for origination, servicing, technology and regulation.

December 29 -

Fannie Mae's Day 1 Certainty initiative and automated verification tools at Freddie Mac are set to improve mortgage loan application defect and misrepresentation risk in 2017, according to a report from First American Financial Corp.

December 28 -

It's unclear how the new political environment will affect the platform's viability or how investors will view the securities issued on it. The next year could determine the project's success and role reshaping the secondary mortgage market.

December 27 -

Opes Advisors shows would-be borrowers how purchasing a house fits into their total financial picture, now and years into the future. Many of its loan officers are licensed investment advisors.

December 20 -

Radius Financial Group worked for years to achieve an end-to-end digital closing process, finally doing so this fall. Here's how the Massachusetts lender got it done.

December 19 -

While depository mortgage lenders should exercise some caution before welcoming trended data and alternative credit scoring into their process, they must become inclusive or face losing market share to newer industry players like SoFi.

December 16 Sapient Global Markets

Sapient Global Markets -

Nationstar Mortgage Holdings has unveiled a new website and mobile application, which will include educational content, interactive data tools and modules regarding mortgage payments.

December 15 -

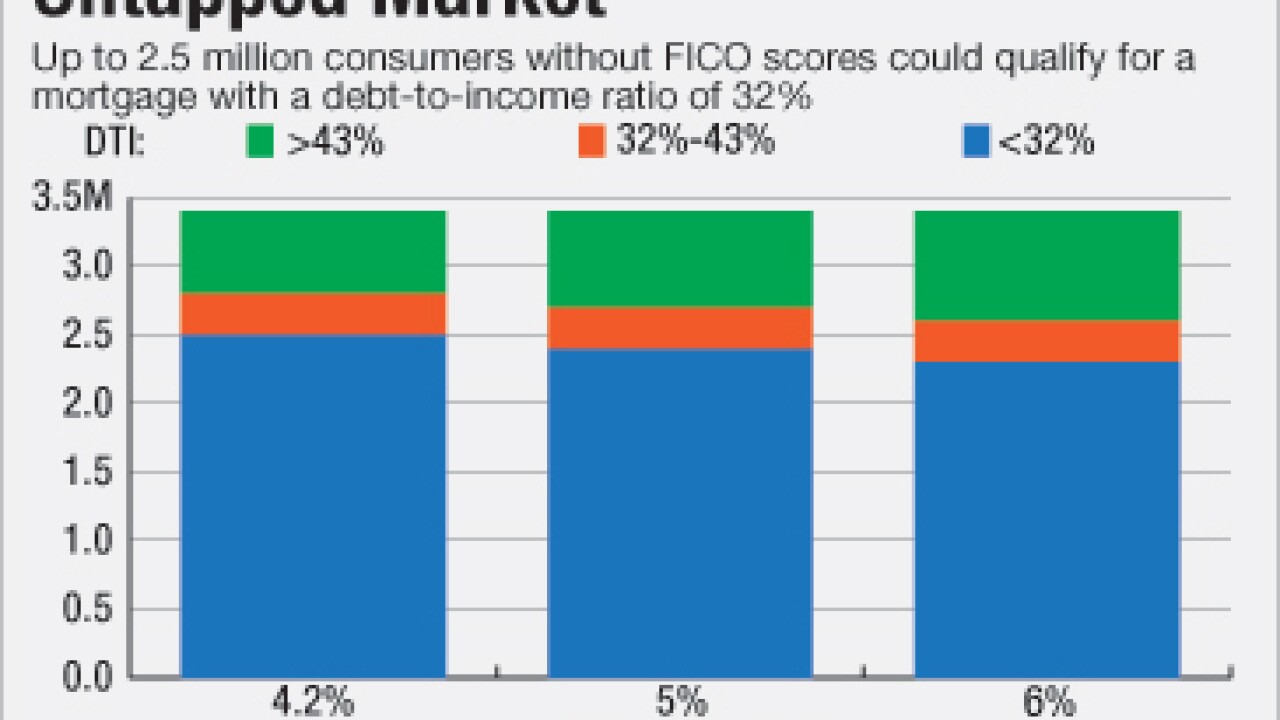

Many consumers without traditional credit scores have nearly identical risk profiles to those who can be assessed the conventional way, representing an untapped market, according to a report by VantageScore.

December 12 -

Fairway Independent Mortgage Corp. is rolling out a new mobile application that allows consumers to apply for a loan, scan documents and get updates on their loan status through real-time push notifications.

December 12 -

Ally Financial is now making home loans.

December 12 -

Data aggregation and analytics platform provider Envestnet-Yodlee has created a new automated mortgage asset verification product.

December 9 -

The Mortgage Industry Standards Maintenance Organization is proposing a standard for the maintenance and sharing of commercial and multifamily real estate rent-roll information.

December 9 -

Moves by lenders to adapt their processes with the TILA-RESPA integrated disclosure rule in mind appear to have staunched the increase in loan application defects, according to ACES Risk Management.

December 9 -

A flood of fintech companies are promising to create a better experience for mortgage borrowers, forcing lenders to contemplate buying a vendor's software, building applications in-house or even outright acquiring a company with digital expertise.

December 9 -

SAN FRANCISCO Want to improve the customer experience? Start by making the employees' tools better.

December 8 -

Fidelity National Financial plans to distribute the stock it owns in Black Knight Financial Services to its shareholders as part of a plan to simplify the corporate structure of the two companies and increase Black Knight's liquidity.

December 8 -

Digital mortgages are not an idea for the future; they are here to stay, and the mortgage industry must put aside its misplaced fear of technology and change and embrace them.

December 8 Pavaso

Pavaso