-

Price growth is moderating and properties are taking longer to sell — albeit by a modest three days.

September 2 -

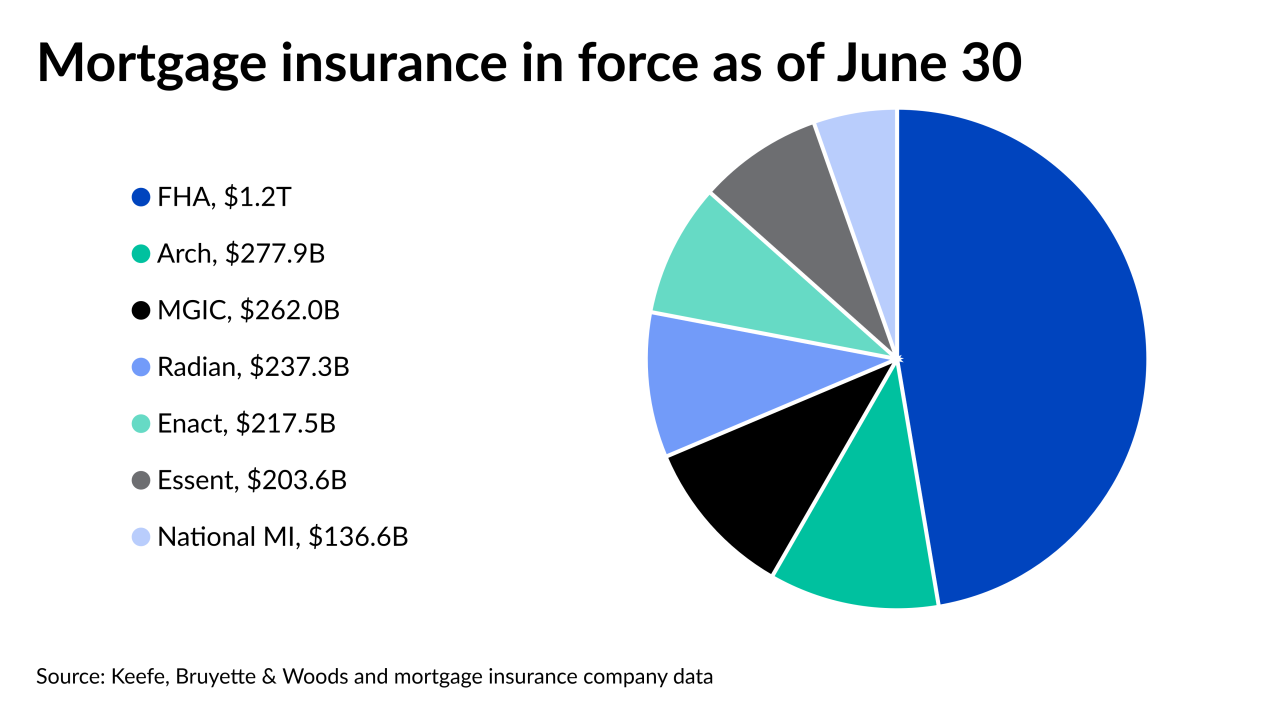

The deal comes with a 10-year agreement for Arch to serve as the exclusive mortgage insurance provider for Westpac LMI’s former parent financial institution in Australia.

August 31 -

Payments from PayPal, Venmo and Zelle add an extra wrinkle when dealing with bank statement loans.

August 30 -

Despite “color blind” underwriting algorithms, loan denial rates on mortgages that were not backed by the Federal Housing Administration and the VA skewed heavily toward minority groups, according to a study by The Markup.

August 27 -

However, the pace of growth at the six active underwriters should moderate over the next two years, Keefe, Bruyette & Woods said.

August 23 -

The lending technology provider currently has 37,741 decisioning steps or pivot points on its platform.

August 18 -

Protecting consumers from cyberthreats and monetary loss should be paramount for every lender and title company. Here's how to get there with minimal fuss.

August 17 FundingShield

FundingShield -

Second quarter open orders were 37% higher than one year prior, while closed orders grew by 43%.

August 13 -

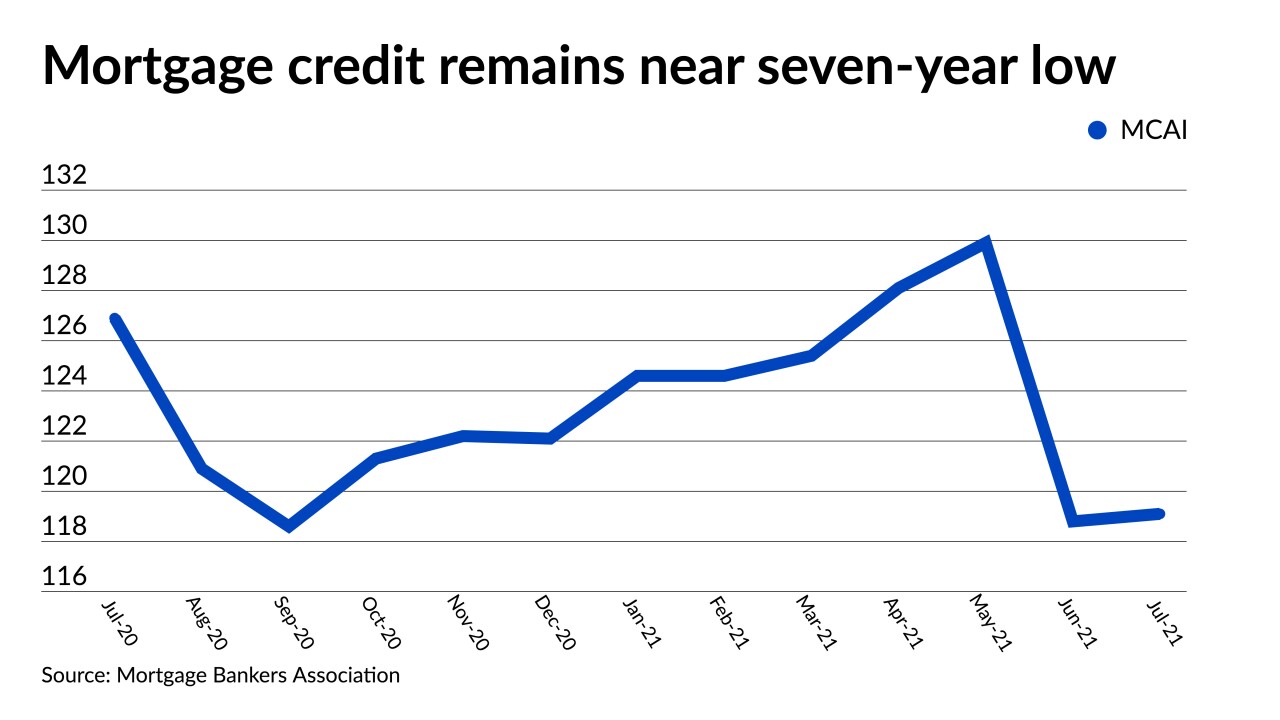

A jump in jumbo loan programs was countered by lenders dropping high loan-to-value conforming products.

August 12 -

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11 -

Delinquency concerns continue to wane as the end of forbearances is not expected to lead to a massive wave of foreclosure activity.

August 6 -

The tool is designed to help lenders adjust their underwriting to address the growing faction of non-W2 employees, which is expected to make up half of the workforce by 2027.

July 29 -

The company's Series A funding round, led by Sequoia Capital, added $165 million in capital, which will allow it to expand its home buying operations into more states.

July 27 -

Less than a year after a Series C capital raise, the title insurer formerly known as States Title is about to complete a merger with a special purpose acquisition company.

July 27 -

The shift to higher-margin home purchase policies helped to boost results at First American, Old Republic and Stewart.

July 22 -

The cloud IT provider for settlement services companies has no timeline on when services will be restored following its shutdown Friday.

July 20 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

This is the second acquisition in the private equity firm’s newly established technology vertical.

July 7 -

Premiums written increased 45%, while net operating income was up over 65%, the American Land Title Association said.

June 28 -

Errors created in the loan manufacturing process were partly responsible for the increase in 2020, according to an analysis by Aces Quality Management.

June 22