-

May’s overall delinquency rate was up over 100% from the prior year.

August 11 -

Scheduling the meeting will remove uncertainty for CoreLogic shareholders over the hostile bid, its board said.

August 10 -

Conditions have improved for the first time since November.

August 6 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

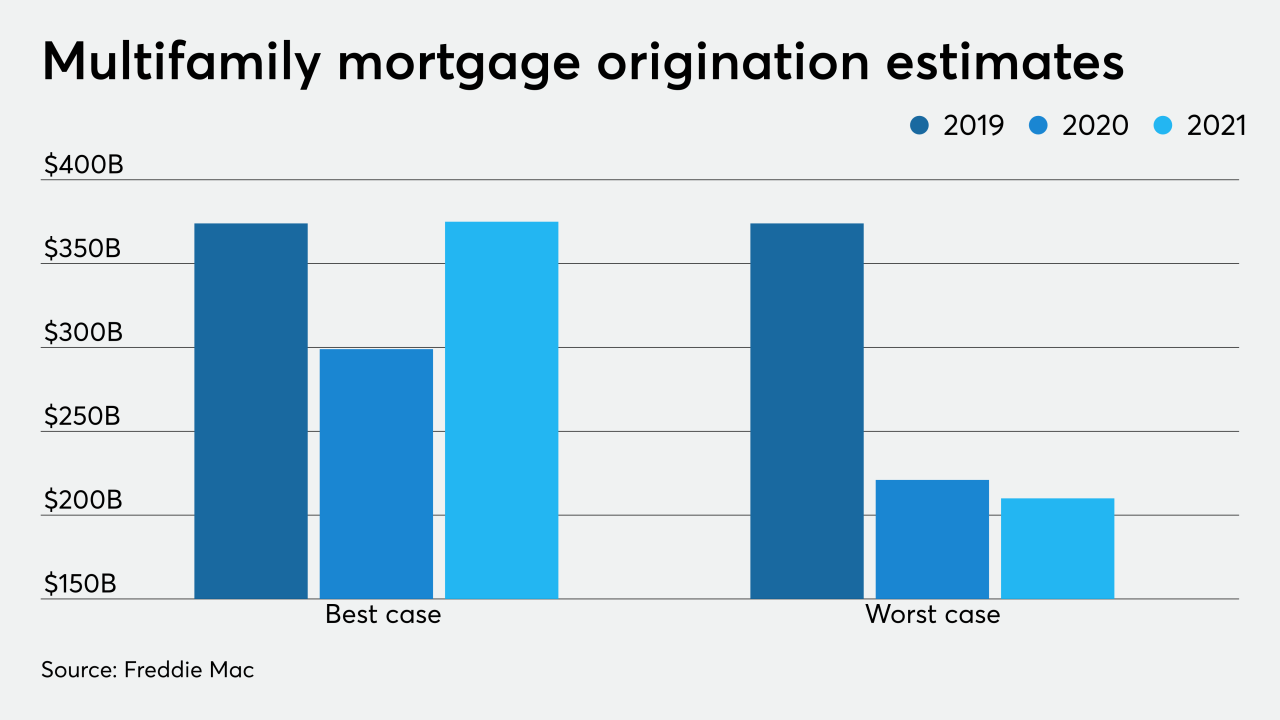

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

The investors seeking to take over CoreLogic plan to solicit support from fellow shareholders to replace nine directors, after the company refused to engage in talks over their $7 billion proposal to take it private.

July 29 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 28 ACES Risk Management Corp.

ACES Risk Management Corp. -

Optimal Blue is being combined with Compass Analytics.

July 27 -

Citing possible exploitation, Bank of America instituted a policy that put limits on loans to persons in guardianship. It later ended the policy.

July 24 -

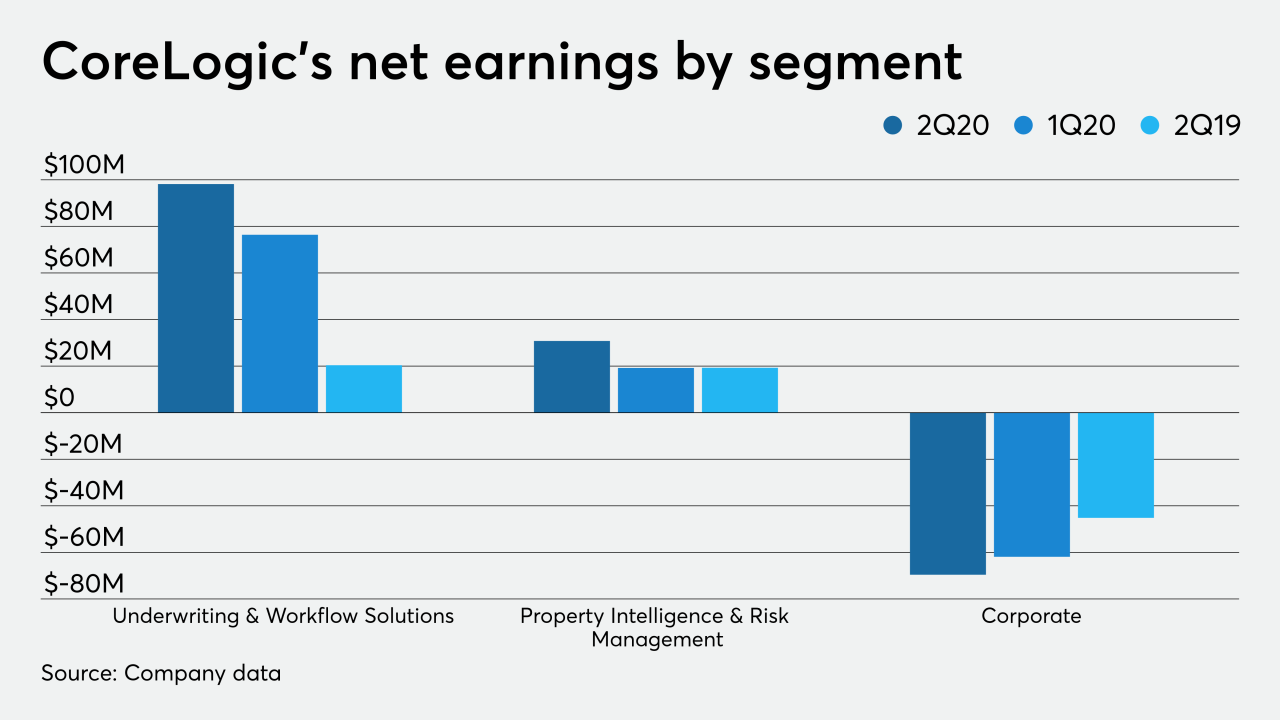

Other moves it is undertaking include business divestitures and increased dividends while defending against a takeover attempt.

July 23 -

Almost six in 10 completely agreed that company-provided technology met or exceeded their expectations.

July 23 -

It starts with understanding investor, insurer and regulatory requirements and how they're interpreted and applied.

July 20 Simplifile

Simplifile -

As the coronavirus created uncertainty for the housing market, underwriting standards tightened further in June.

July 9 -

As the country wrestles economic volatility, millennial homeownership demand rises, fueled by historically low mortgage rates.

July 1 -

Video conferencing might replace some in-person meetings even after people can go back out on the road again.

June 24 -

Government-sponsored enterprise reform could be one hurdle to future innovation.

June 23 -

Buying power for many consumers is hampered and some originators said that affects their ability to serve consumers.

June 19 -

The availability of some loans used to build homes dried up due to the coronavirus. Opening up the economy may help if it doesn't lead to a spike in infections, and if consumer demand persists.

June 16 -

The measures extended by the Federal Housing Finance Agency include alternative methods used for certain appraisals and for verification of employment.

June 11