-

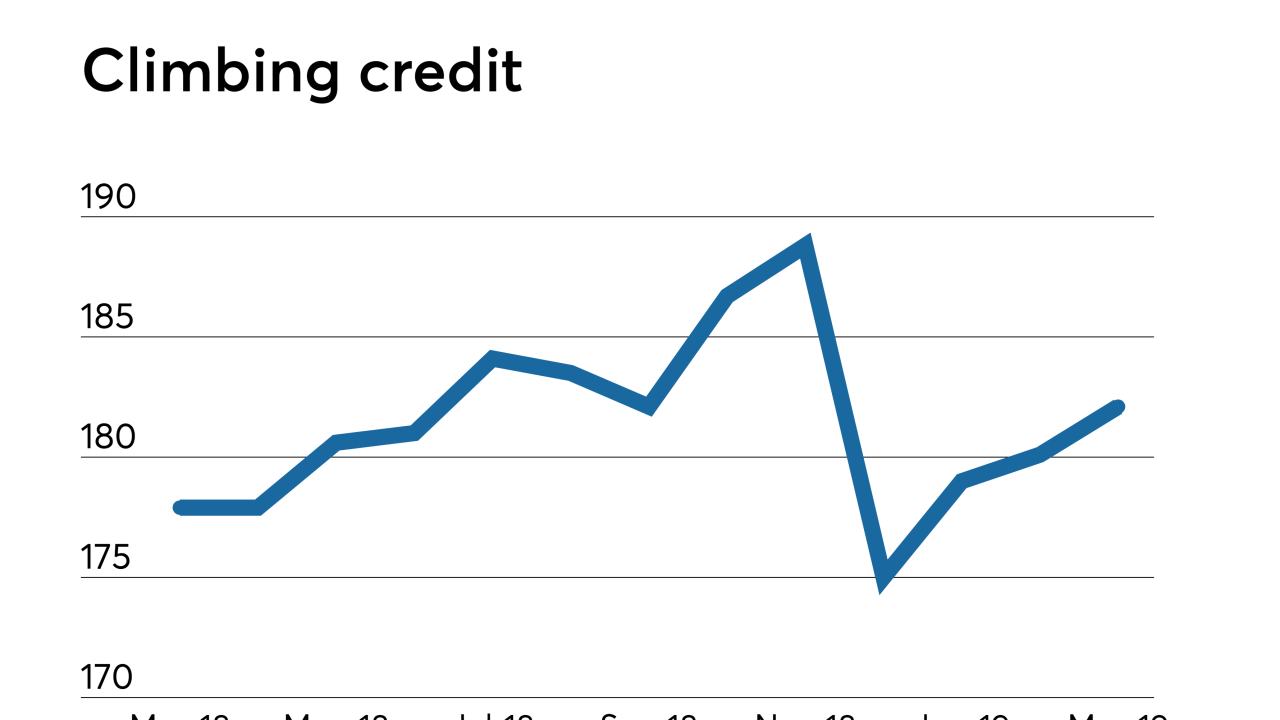

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

Mortgage borrowers don't know about the logistics of applying for a loan, which is the basis for their erroneous ideas about the process, the respondents to the 2019 Top Producers Survey said.

April 2 -

Plaza Home Mortgage's wholesale division has rolled out a one-time close, construction-to-permanent loan that meets Fannie Mae underwriting guidelines.

April 1 -

Technology, staffing, reform: Here's a look at 12 key insights from the 2019 Top Producers, from what they considered critical to success to stances they have on industry initiatives going forward.

April 1 -

Income-related mortgage application fraud risk has the potential to increase as competition rises among buyers during the peak spring season, First American said.

March 29 -

The digital lender rebranded its mortgage business as SoFi Home Loans about four months after it took a step back from real estate finance to redesign its processes.

March 29 -

With the launch of its Medical Professional Mortgage Product, TD Bank is leveraging an opportunity to attract new customers and to address what it says is a knowledge gap among this group of professionals.

March 22 -

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

Freddie Mac is broadly offering instant representation and warranty relief for automatically validated self-employment income following a test of the concept last year.

March 6