-

Ellie Mae's first-quarter net income of a little over $2 million was lower than last year's due to some one-time expenses, but continuing operations numbers exceeded analysts' expectations.

April 27 -

The Federal Housing Finance Agency's plan to combine Fannie Mae and Freddie Mac mortgages into a single security starting in June 2019 promises to bring both benefits and challenges to the mortgage sector.

April 27 -

The CFPB finalized an amendment to its "know before you owe" mortgage disclosure rule that gives lenders more flexibility to adjust closing cost estimates and pass those increases on to borrowers.

April 26 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

The program is aimed at increasing homeownership in neighborhoods where soaring rents have left tens of thousands of low- and moderate-income tenants trying to live in Baltimore without being one of the nearly 7,500 tenants who get evicted each year.

April 26 -

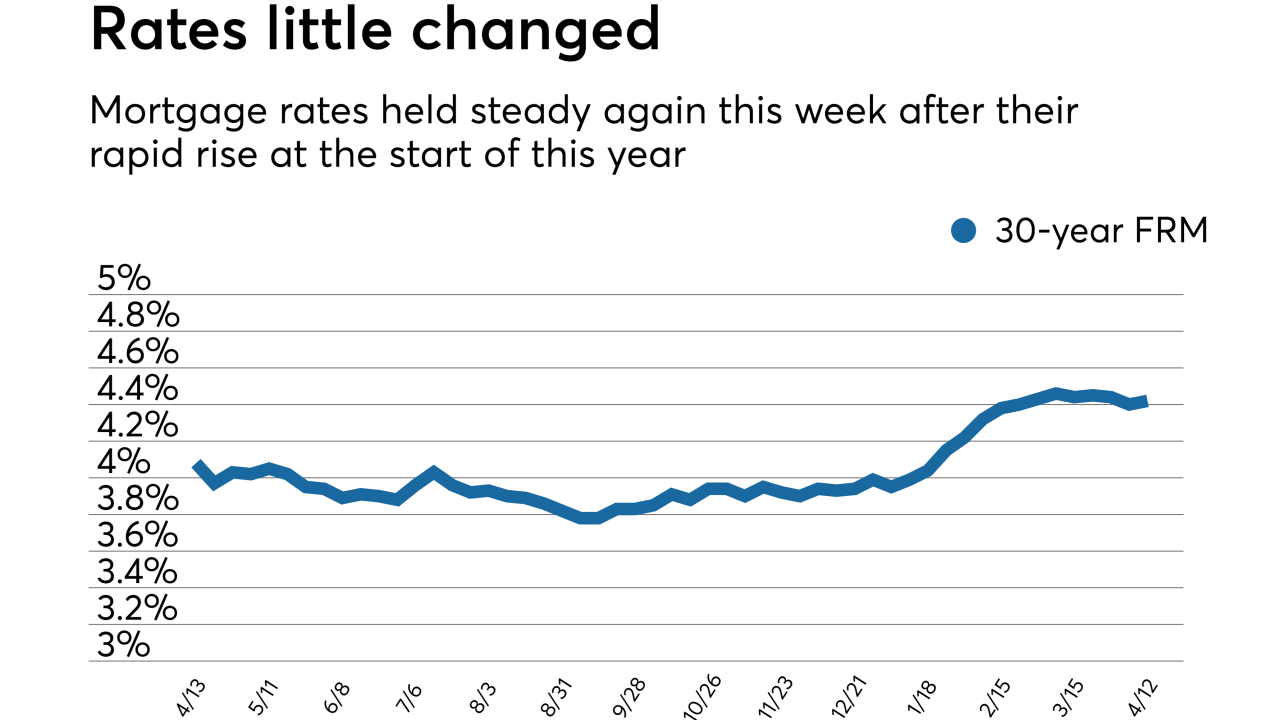

Mortgage rates rose to their highest level in over four years, as 10-year Treasury yields broke the 3% ceiling this past week.

April 26 -

WEI Mortgage discovered a data breach from an email phishing scam last fall that may have exposed loan package information and identifying data such as Social Security numbers.

April 24 -

No individuals have been named in connection with the bank’s recent misdeeds, which resulted in a $1 billion fine, even as some senior leaders stand to gain from the government’s tax cut.

April 24 Public Citizen

Public Citizen -

FHA mortgage denials are higher now than they were 20 years ago. Here's a look at the 12 housing markets with the largest combined denial rates for black, Asian and Hispanic applicants.

April 23 -

A data validation integration Freddie Mac is adding to its technology platform could also deliver representation and warranty relief to lenders when it verifies self-employed borrowers' incomes.

April 20 -

Mortgage rates jumped across the board to their highest point this year as 10-year Treasury yields rose in the past week over economic headlines, according to Freddie Mac.

April 19 -

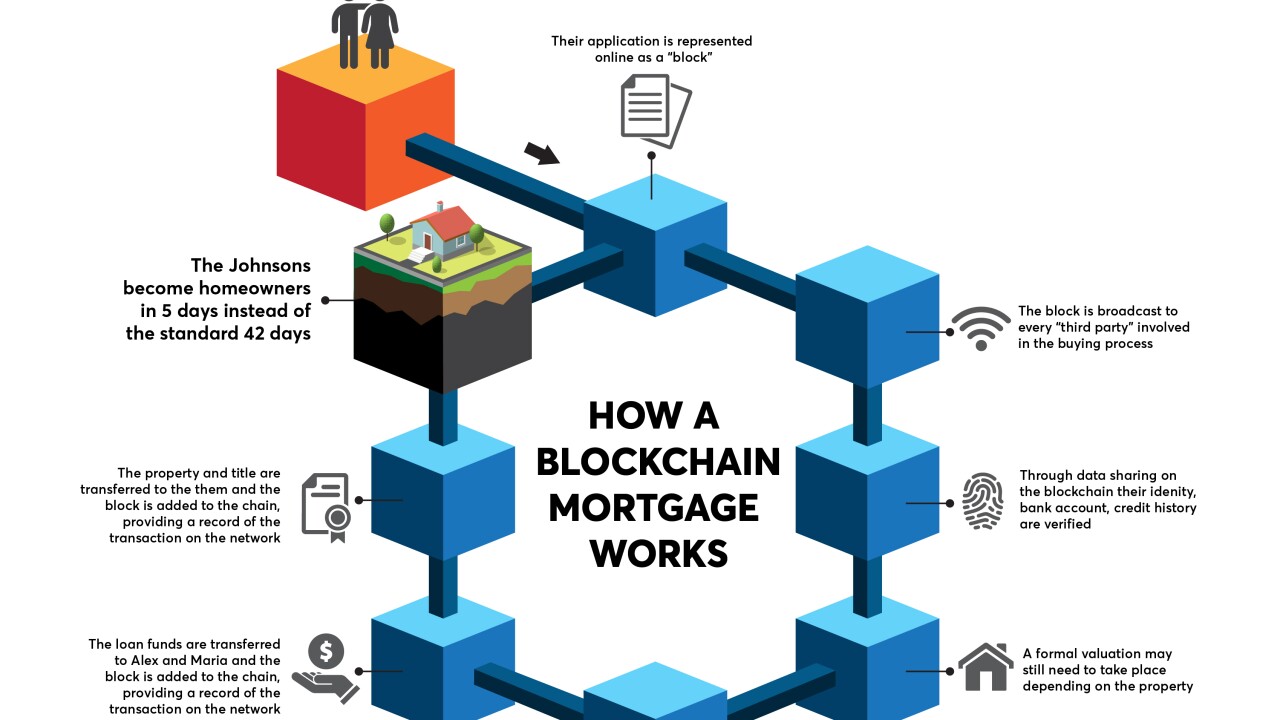

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

The Mortgage Bankers Association is calling for Ginnie Mae, states, the Internal Revenue Service and other government agencies to overcome remaining digital mortgage challenges.

April 16 -

Cloudvirga, in collaboration with Freddie Mac, has created the capability for loan officers to submit mortgage loan data to both government-sponsored enterprises' automated underwriting systems simultaneously with a single click.

April 12 -

Mortgage rates increased a scant two basis points this past week, holding steady recently after their rapid rise at the start of this year, according to Freddie Mac.

April 12 -

The use of appraisal management companies does not result in higher quality property valuation reports, according to a working paper published by the Federal Housing Finance Agency.

April 11 -

Lennar Corp.'s home finance subsidiary with the help of Blend rolled out its own digital mortgage platform, as another small lender tries to keep up with Rocket Mortgage.

April 9 -

Technology startup Eave is making a foray into Colorado's fast-moving, high-end mortgage lending market by offering software designed to quickly analyze jumbo borrowers' more complex incomes and assets.

April 9 -

Mortgage rates dropped as the stock market downturn at the start of the week drove yields on the 10-year Treasury lower.

April 5