-

Retiring Ellie Mae CEO Jonathan Corr and new ICE Mortgage Technologies President Joe Tyrrell discuss how the two companies will be merged.

September 25 -

Twelve people were charged in a scheme regarding the creation of 100 fraudulent mortgages in Georgia, according to the HUD inspector general.

September 24 -

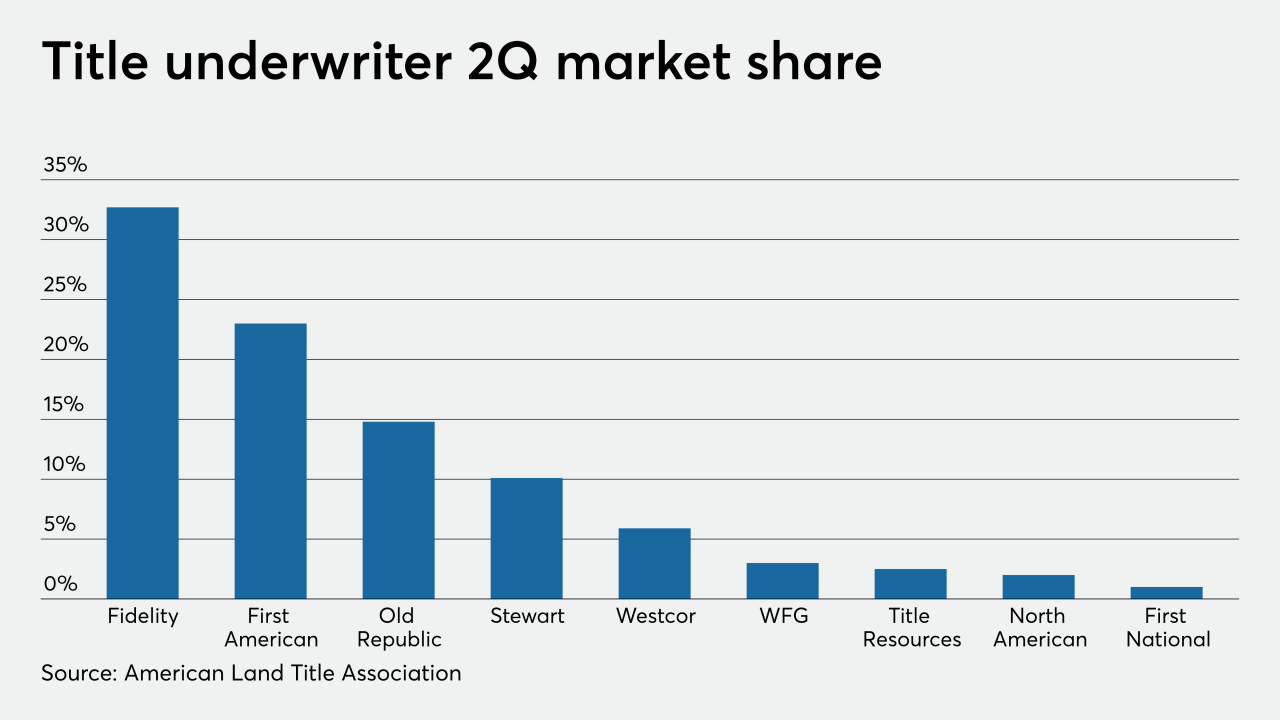

Westcor has been gaining market share, growing to 5.9% of premiums written in 2Q 2020, versus 3.4% in the first quarter of 2019.

September 21 -

Lenders and vendors are starting to realize that there are both areas in which artificial intelligence can be used more broadly, and areas in which technology’s role should be limited.

September 16 -

A deep understanding of the history of racial discrimination in both lending and technology is a prerequisite to the development of new technologies, panelists said.

September 16 -

The deal brings yet another mortgage origination component under the same roof.

September 16 -

Any roadmaps for client service that existed before the pandemic have changed, according speakers at DigMo2020.

September 15 -

The proposals offer lenders both cause for celebration and for concern.

September 15 Promontory MortgagePath

Promontory MortgagePath -

Even though second-quarter originations were nearly double the same period in 2019, most were refinancings, which generate less revenue for title companies.

September 11 -

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

Uncertainties in the job market drove mortgage credit availability down again, falling to the lowest point since March 2014, according to the Mortgage Bankers Association.

September 10 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

Mr. Cooper plans to hire an additional 2,000 employees by the end of this year as record low interest rates spur home purchases and mortgage refinancings.

September 2 -

Inconsistent loan processing was a pain point for Remax's Motto Mortgage franchisees and the acquisition should solve that, executives said.

September 2 -

-

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

In the past, the people that close the loan have been left out of developing this technology.

August 19 International Document Services Inc.

International Document Services Inc. -

There are five separate note offerings with maturities ranging from 2023 to 2060.

August 18 -

All states that had licensing restrictions related to remote work temporarily lifted them due to the pandemic, but whether those changes could become permanent remains to be seen.

August 17