-

Mortgage lenders prefer to invest in improvements to their consumer-facing technology because it offers a better return than similar spending on back-end processes, according to Fannie Mae.

October 16 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

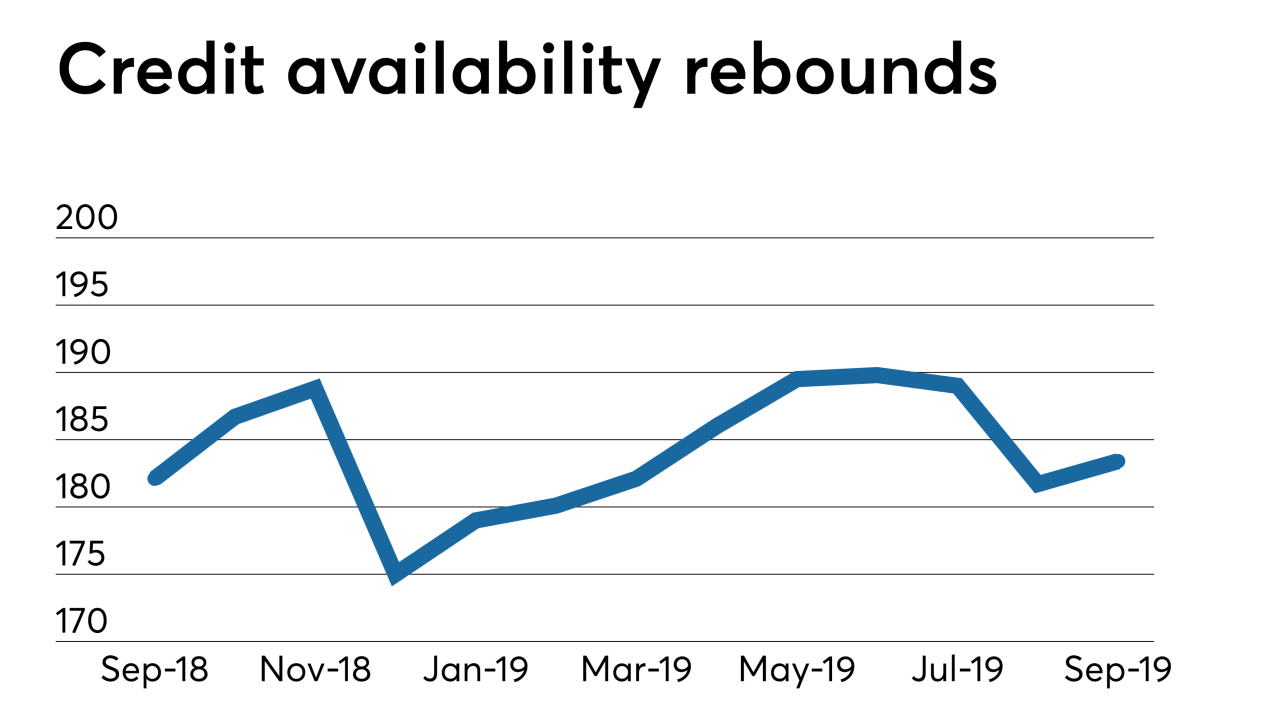

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

Fannie Mae is cracking down on homebuyer education requirements, particularly for first-time homebuyers and purchasers utilizing high loan-to-value mortgages.

October 4 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

Freddie Mac is increasing the number of companies offering merged reports from the credit bureaus through integrations with its Loan Product Advisor automated underwriting system.

September 30 -

Freddie Mac's efforts to improve underwriting could include the use of a technology firm's artificial intelligence-driven consumer-risk modeling software that can expand access to credit, according to the Wall Street Journal.

September 26 -

The recent run of lower interest rates may bode well for today's commercial mortgage-backed securities, unless it's undermined by an increase in leverage, according to Fitch Ratings.

September 25 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

Commercial real estate transaction volume rebounded in the second quarter from a poor first three months of 2019, although property price growth plateaued, according to Ten-X Commercial.

September 20 -

The mortgage industry has put more emphasis on organizing data in a digital manner and presenting it in an easily digestible format.

September 18 -

Freddie Mac is partnering with Finicity to give lenders access to a new automated process that advances efforts to consolidate borrower-authorized data validation checks used in the secondary market underwriting process.

September 18 -

While the critical defect rate for closed mortgage loans fell on a quarter-to-quarter basis, there were increases in income and packaging-related deficiencies, an Aces Risk Management study found.

September 16 -

A mere 7-basis-point increase in interest rates reduced what was a record-high number of borrowers with refinancing incentive by 2 million in a matter of days, according to Black Knight.

September 13 -

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12 -

Stewart Information Services has decided to make some big changes at the top following the dissolution of a planned merger with Fidelity National Financial.

September 10 -

The Federal Trade Commission wants to block the merger of Fidelity National Financial and Stewart Information Services stating the deal would reduce competition for title insurance, including for large commercial real estate transactions.

September 9 -

The Mortgage Industry Standards Maintenance Organization has released a dataset designed to prepare lenders for a new mortgage application and automated underwriting system upgrades at Fannie Mae and Freddie Mac.

September 5 -

New Home Mortgage Disclosure Act data shows debt-to-income ratios have risen but also have been frequently cited among reasons for denials, suggesting lenders are becoming more cautious about this underwriting metric.

September 3 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3