-

In November, 41% of builders reported cutting prices, a record in the post-Covid period, according to Tuesday's report. More broadly, 65% reported using sales incentives, unchanged from the prior two months.

November 18 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Two heavyweights in the US residential real estate market, Compass Inc. and Zillow Inc., will face off in a New York courtroom this week in a legal battle that could reshape the future of how homes are marketed and sold in the country.

November 18 -

Home Depot's bleak forecast provides another warning about the strength of US consumers in the absence of official economic data during the US government shutdown.

November 18 -

Application error findings rose over 15%, the second quarter in a row they have moved higher, the post-closing file review from Aces Quality Management found.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

New-home mortgage applications dropped, but the annual sales pace was the strongest in over a year, the Mortgage Bankers Association said.

November 17 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

Bayview Asset Management and three affiliates reached an agreement in a data breach lawsuit for an incident that impacted 5.8 million customers.

November 14 -

The acquisition agreement is the latest example of merger activity this year focused on the recapture potential held within servicing pipelines.

November 14 -

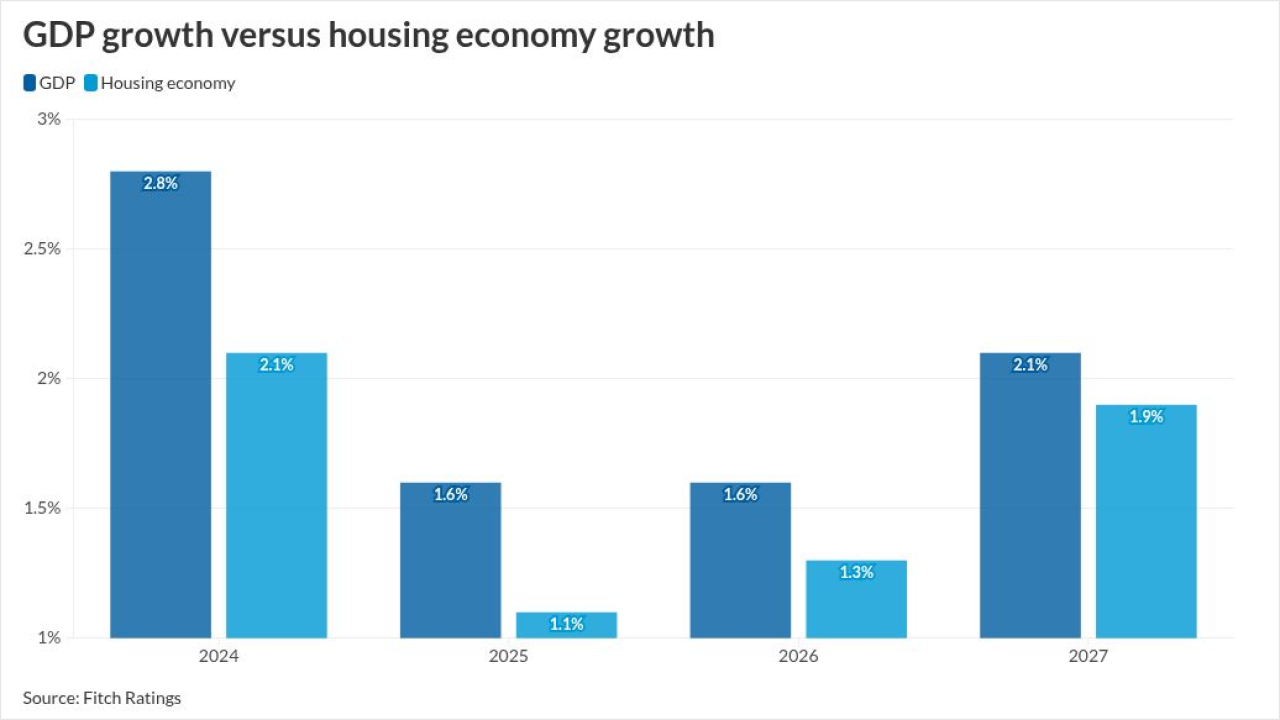

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

The fintech had over $2 billion in home equity line of credit volume in the third quarter and reported growing production in its crypto and non-QM offerings.

November 14 -

With the increase in investor-owned properties, the risk of undisclosed real estate fraud, including occupancy misrepresentation, rose 9% in the third quarter.

November 14 -

Origination has picked up but has limits, retention rates are improving and stakeholders are seeking a recapture standard, experts at an industry meeting said.

November 13 -

The hidden costs of homeownership total nearly $16,000, rising 4.7% in the past year.

November 13 -

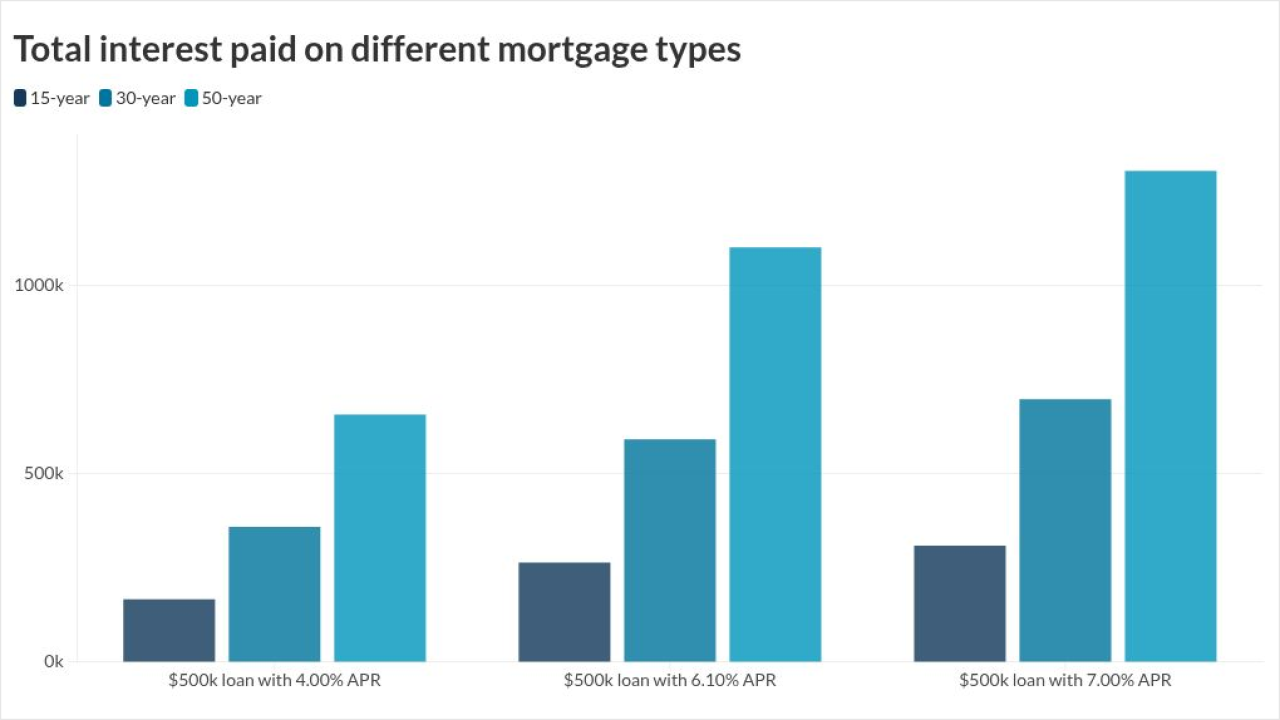

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

For the second consecutive week, the 30-year fixed rate mortgage increased as investors were still sorting through the lack of information due to the shutdown.

November 13 -

The mortgage company, even though it is owned by a bank, has been profitable for the last two years, when considering its originations operations, as it does.

November 13 -

Yields were higher by as much as three basis points, led by tenors more sensitive to changes in Fed policy.

November 13