-

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

While the program is still going strong in spite of the shutdown, many misconceptions about its rules, even in normal times, are holding back use.

November 11 -

Mortgage credit availability increased 2.3% to 106.8 last month, marking the fourth consecutive month of growth.

November 10 -

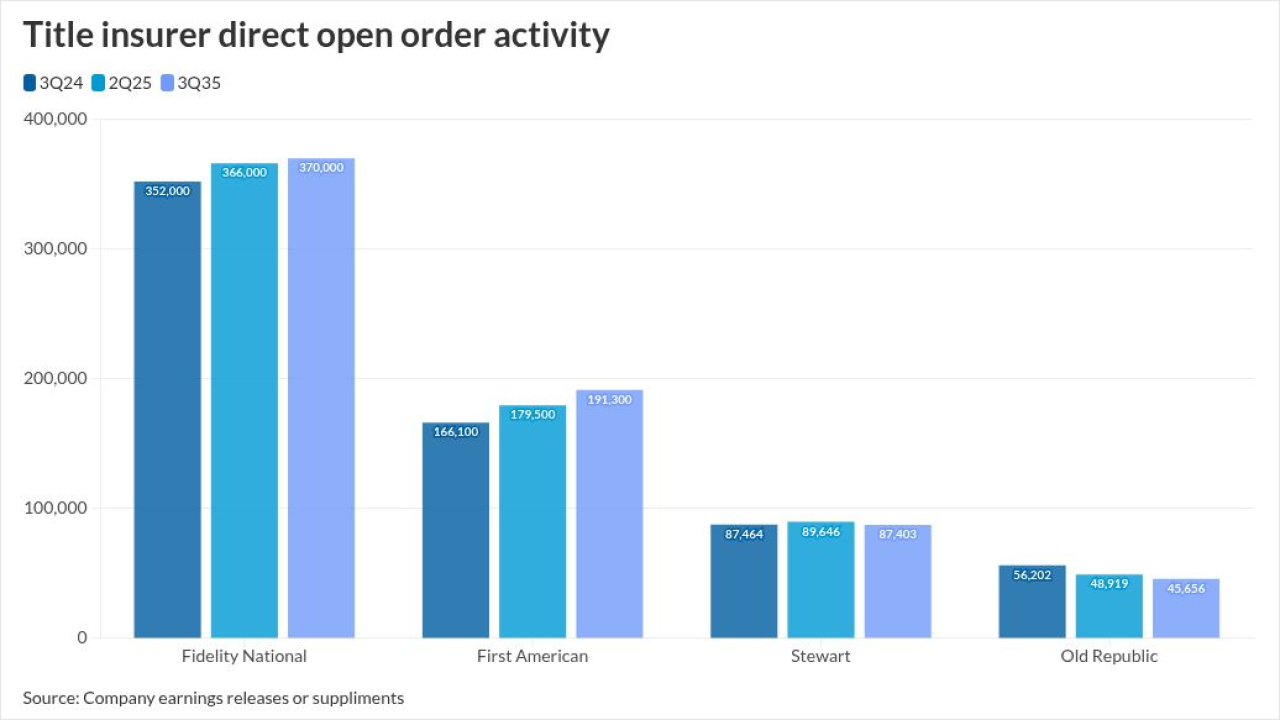

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

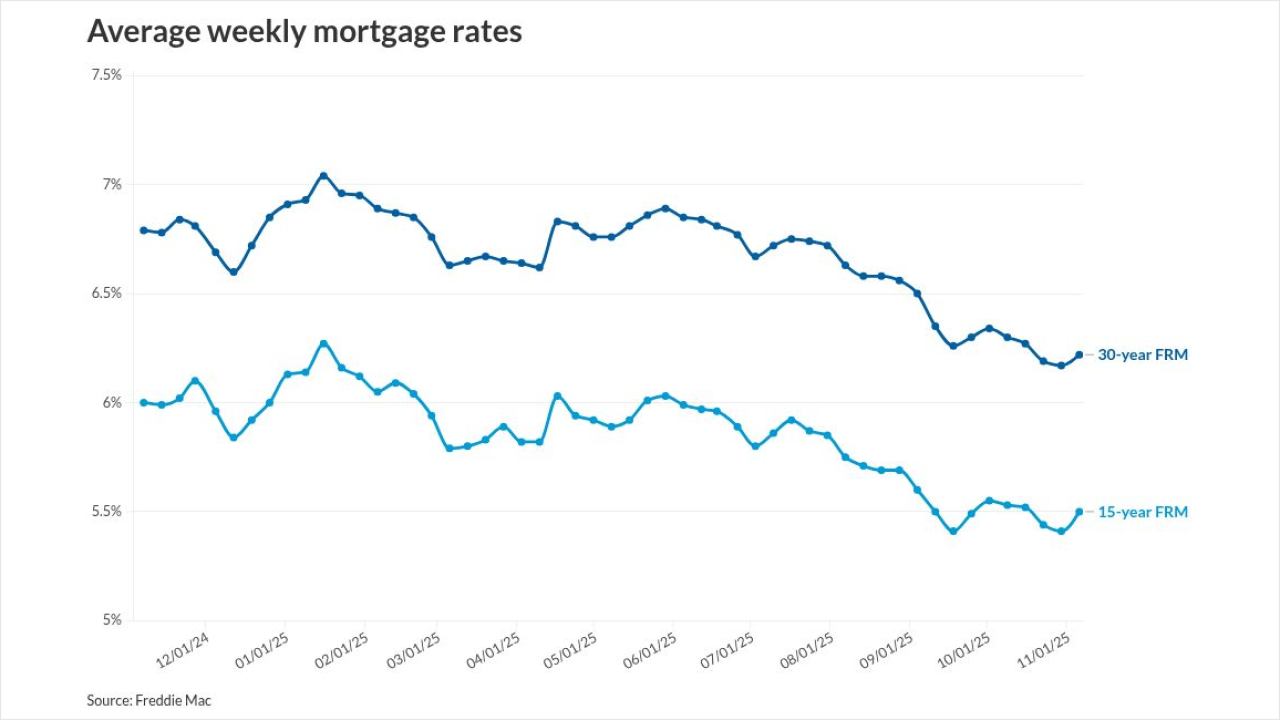

The number of highly qualified refinance candidates rose to 1.7 million, the most in three and a half years, as mortgage rates ease.

November 10 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

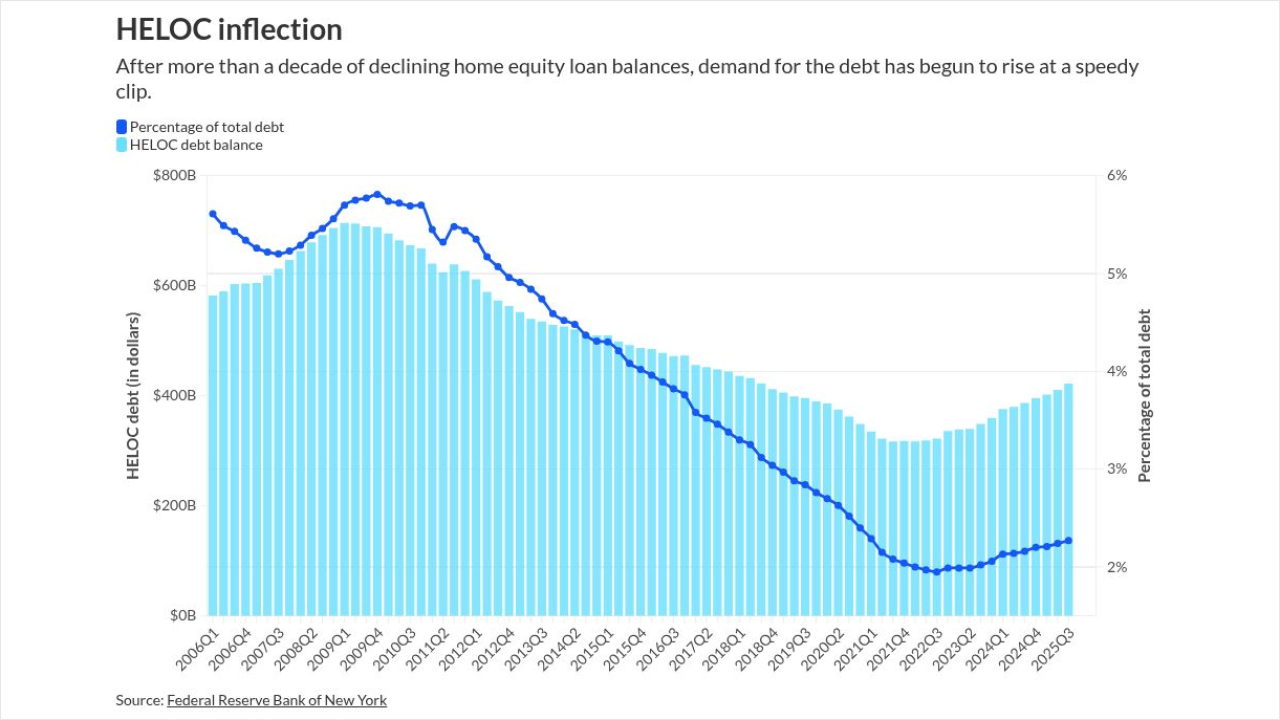

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6 -

The average price of a single-family home increased 1.7% from last year to $426,800 in the third quarter.

November 6 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

The 30-year fixed-rate mortgage rose five basis points from last week to 6.22%, while the 15-year rate increased nine basis points to 5.50%

November 6 -

UWM Holdings set a single-day record for rate locks in September at $4.8 billion, taking advantage of the window of opportunity leading up to the FOMC meeting.

November 6 -

The company posted its best quarter for funded loan volume and shared other green shoots including greater margins on less reverse mortgage business.

November 6 -

In markets across the US, homebuilders sitting on unsold inventory are subsidizing mortgage rates so heavily they sometimes match the record lows last seen during the Covid-19 pandemic.

November 6 -

Industry professionals shared stories of homeowners looking to get out and investors pausing deals, while others cautioned a wait-and-see approach.

November 6 -

The lender reported $33.3 million in net income in the third quarter this year, up from the second quarter and same period a year earlier.

November 5 -

The latest sale consists of close to 1,200 HECMs secured by vacant residential units found in 46 states, according to data provided by the government agency.

November 5 -

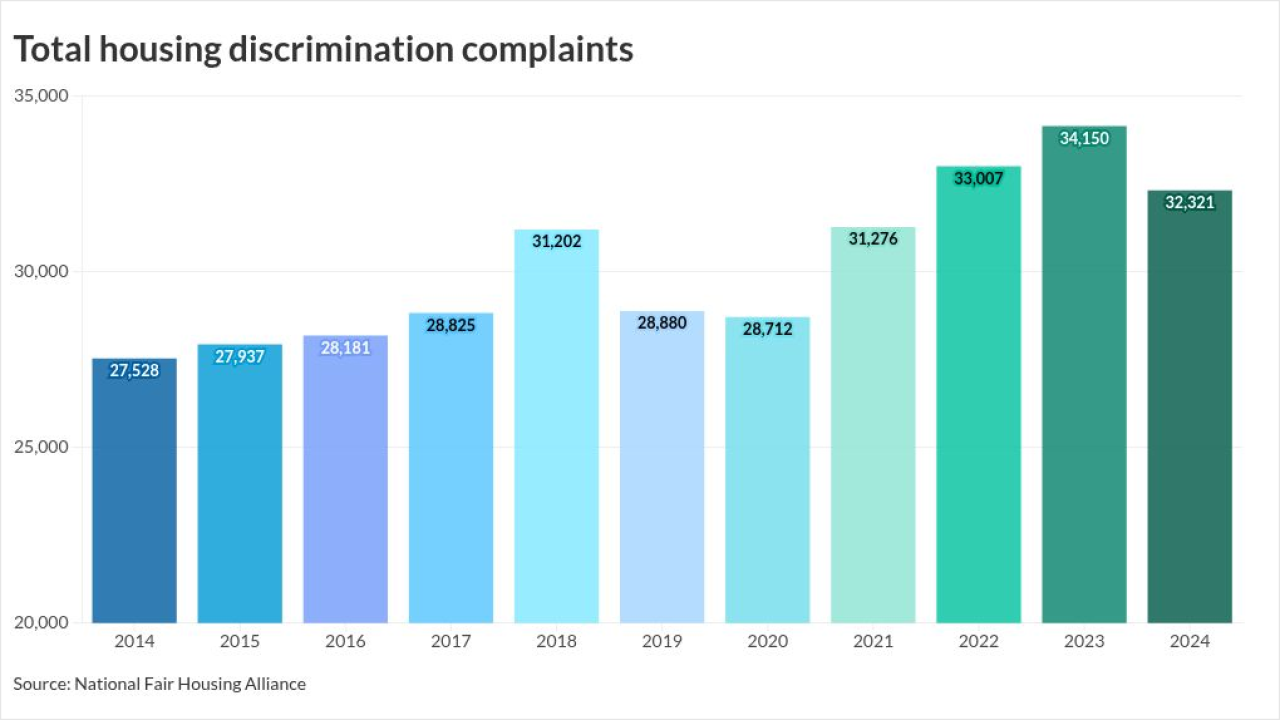

What makes the situation alarming is the government attack on the fair lending enforcement infrastructure, said Lisa Rice of the National Fair Housing Alliance.

November 5 -

Private-sector payrolls increased by 42,000 after a revised 29,000 decline a month earlier, according to ADP Research data released Wednesday.

November 5