-

ETHZilla partnered with Zippy to bring manufactured home chattel loans on-chain as tokenized real-world assets.

December 11 -

Approximately 70% of home purchasers do not get more than one quote in the mortgage process, doing so could reduce their rate by 50 basis points, Zillow said.

December 11 -

After the end of the draw periods that range from two to five years, the amortization begins, during which borrowers have a repayment period ranging from three to 25 years.

December 11 -

The lowest-priced properties purchased by investors typically left them in the red when sold, according to the latest home flipping report from Attom.

December 11 -

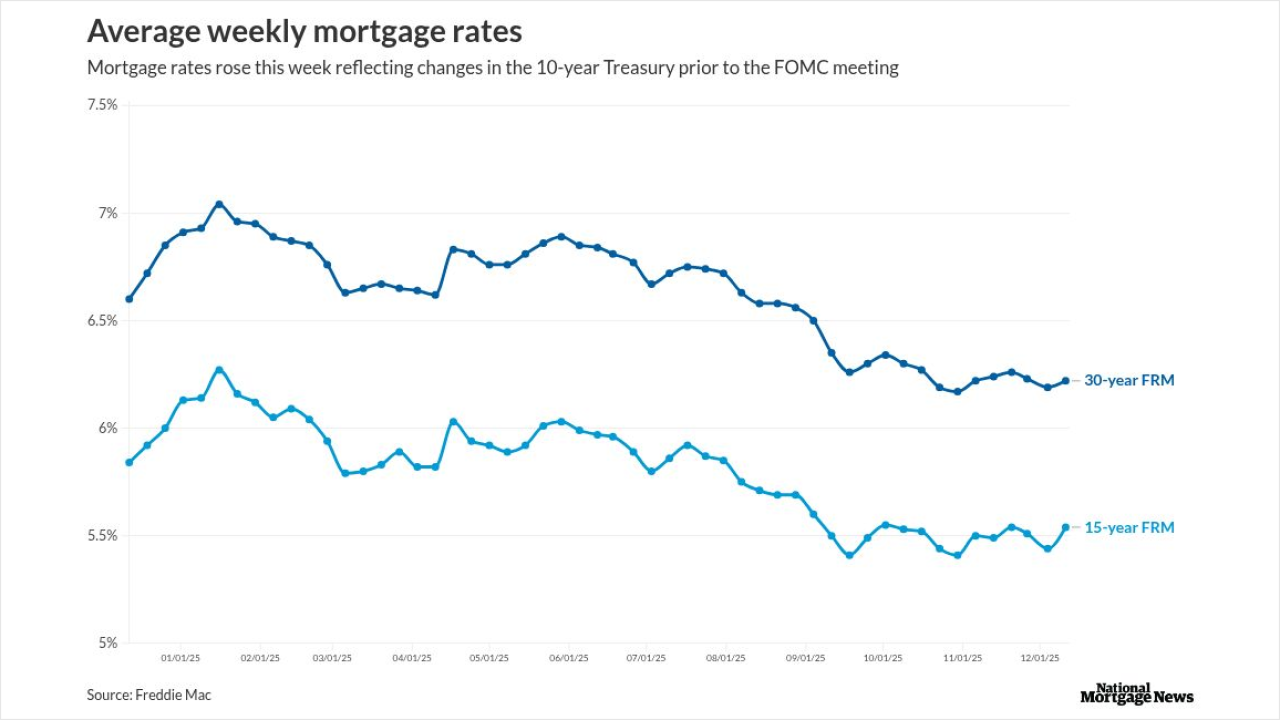

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11 -

A federal judge recommended that an enhanced real estate reporting requirement, which could send paperwork and costs soaring next year, remain intact.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

With the Federal Reserve decision largely factored in, Jerome Powell's comments on future outlook is more likely to influence the housing market.

December 10 -

Hartford, Connecticut, Rochester, New York, and Worcester, Massachusetts, headed the list of the 100 largest metro areas in the country, according to Realtor.com.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

Home equity is becoming a data-driven asset that demands sharper valuation and analytics as lending options expand, according to Clear Capital's EVP of Strategy and Growth.

December 10Clear Capital -

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

Sen. Hassan sent letters to corporate owners of manufactured housing communities, looking for answers on affordability and living conditions for their residents.

December 10 -

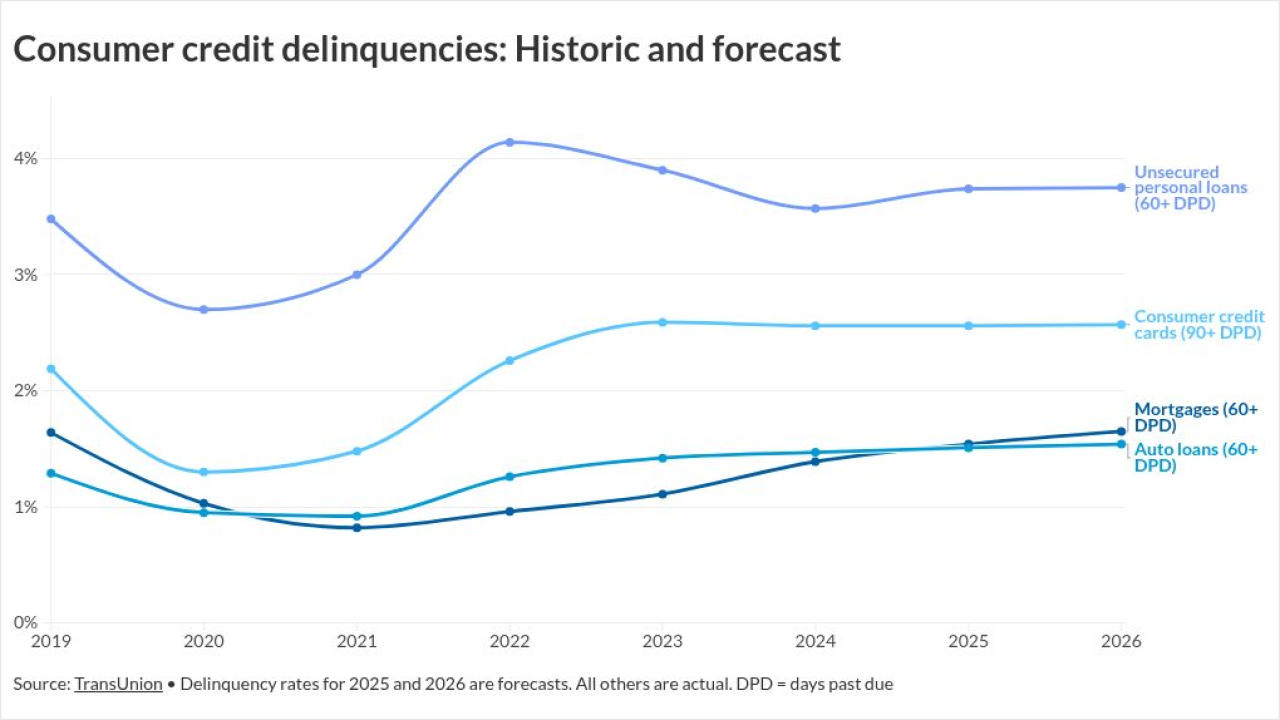

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10 -

The company's latest funding announcement caps off a year of tailwinds that propelled growth for home equity investment platforms and related lending products.

December 9 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9 -

The decision in a New York case that is also undergoing federal review puts pressure on related parties to get things right within a statute of limitations.

December 9 -

An influx of adjustable-rate and cash-out refinance mortgage programs during the month pushed the Mortgage Credit Availability Index 0.7% higher in November.

December 9 -

New rules means sellers and servicers will need to have plans demonstrating proper oversight of their artificial intelligence and machine learning practices.

December 9 -

In a world assailed by extreme weather, homeowners and purchasers need to know their property's vulnerability to wildfire or flooding. Ratings like those Zillow took down are a big improvement on often outdated federal flood maps and state wildfire maps.

December 9