-

Contract closings rose 5.1% to a 4.35 million annualized pace last month, the highest since February 2023, according to figures released Wednesday by the National Association of Realtors.

January 14 -

Over 46% of mortgage transactions examined had at least one significant wire fraud or title risk, with 3.2 findings per transaction, Fundingshield said.

January 14 -

Titl hopes to standardize and connect property records through a centralized, digitized U.S. registry, which would lead to reduced closing times and costs.

January 14 -

Total lock volume increased 2% from November and finished 30% higher than last December, according to Optimal Blue's latest Market Advantage report.

January 13 -

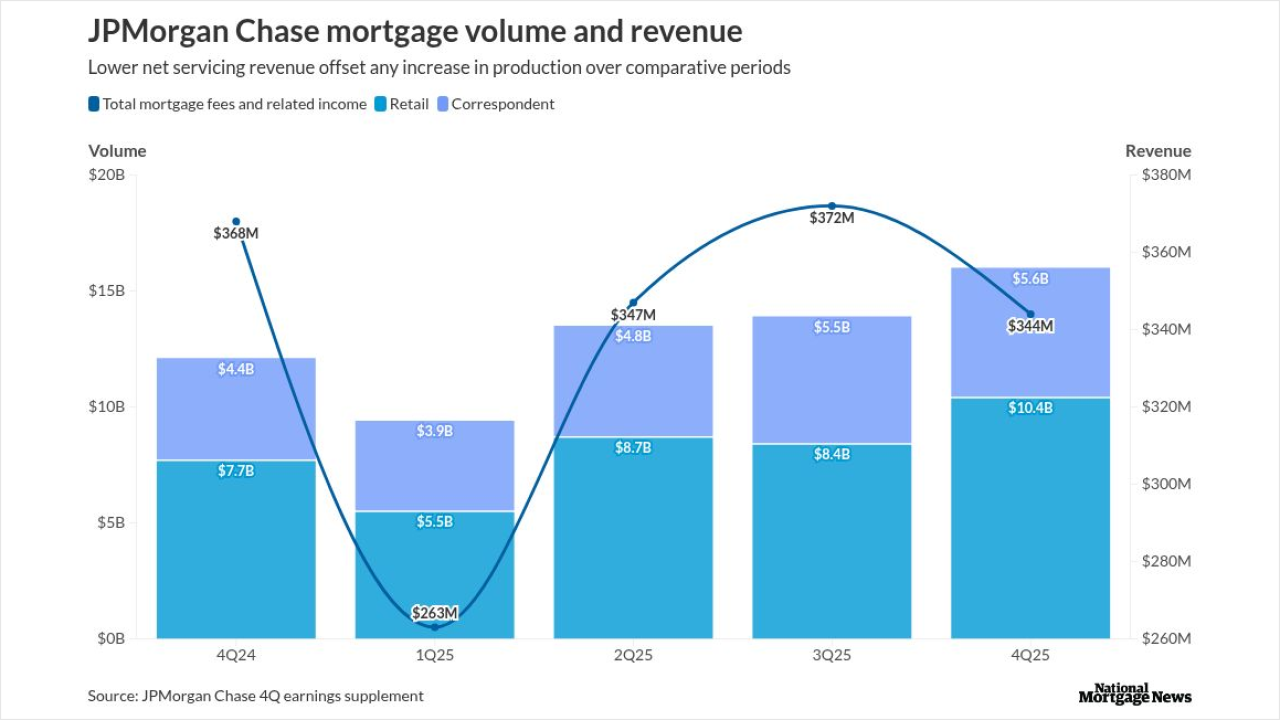

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

A Florida man's racketeering class action case accuses two mortgage employees of conspiring with a homebuilder to facilitate fraudulent construction draws.

January 13 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Sales of new homes in the US were little changed in October near the strongest pace since 2023 as builders lured anxious customers with price cuts and incentives.

January 13 -

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

January 12 -

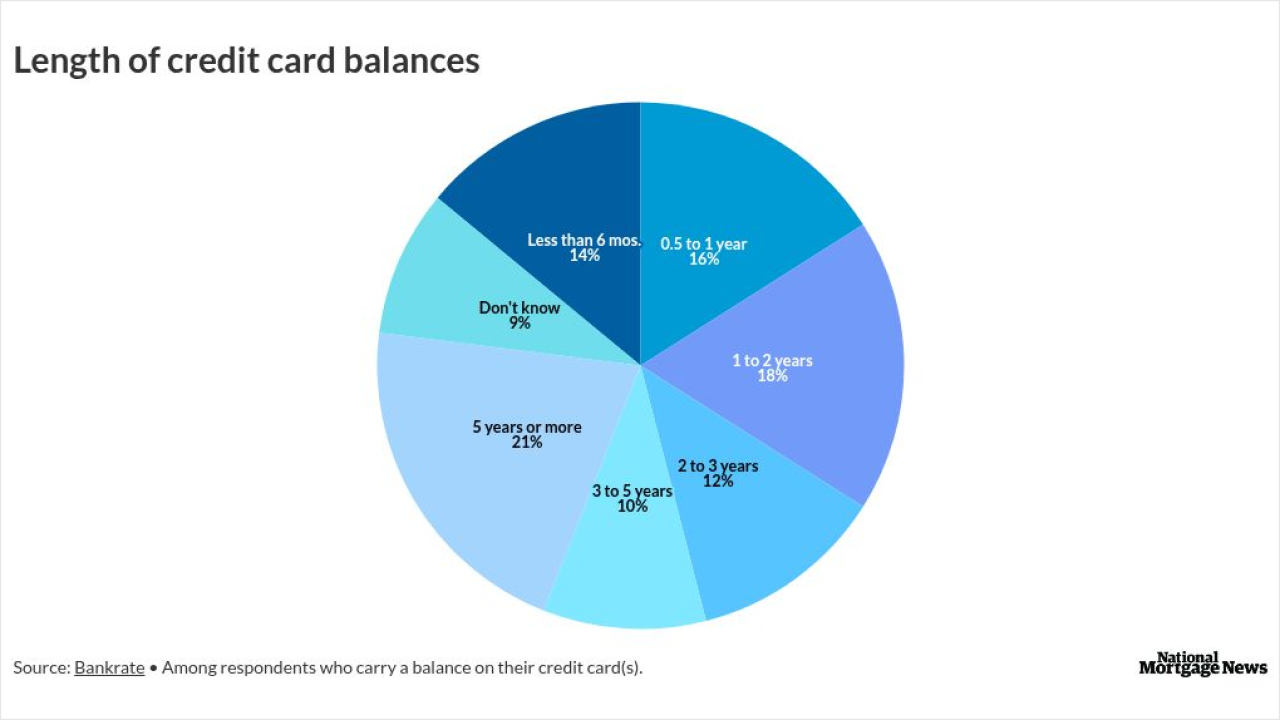

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

January 12 -

Trump's proposed $200B MBS purchase briefly tightened mortgage spreads, but analysts question the long-term impact on mortgage rates and GSE balance sheets.

January 9 -

Home prices are now something Americans can wager on. Polymarket partnered with Parcl to offer prediction markets tied to housing price indices.

January 9 -

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9 -

With ongoing affordability issues, the Federal Housing Administration program will keep taking low down payment market share from the private mortgage insurers.

January 9 -

Housing starts in the US fell in October to the lowest level since the onset of the pandemic as data delayed by last fall's government shutdown showed builders continued to cut back amid still-high prices and mortgage rates.

January 9 -

Rochester, New York, and Harrisburg, Pennsylvania, stood atop Realtor.com's list for the second consecutive year, due to their affordability.

January 9 -

President Trump's concept, which is framed as a potential bipartisan effort, could mean a new route to a goal Dems targeted via foreclosure sale restrictions.

January 9 -

The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

January 8 -

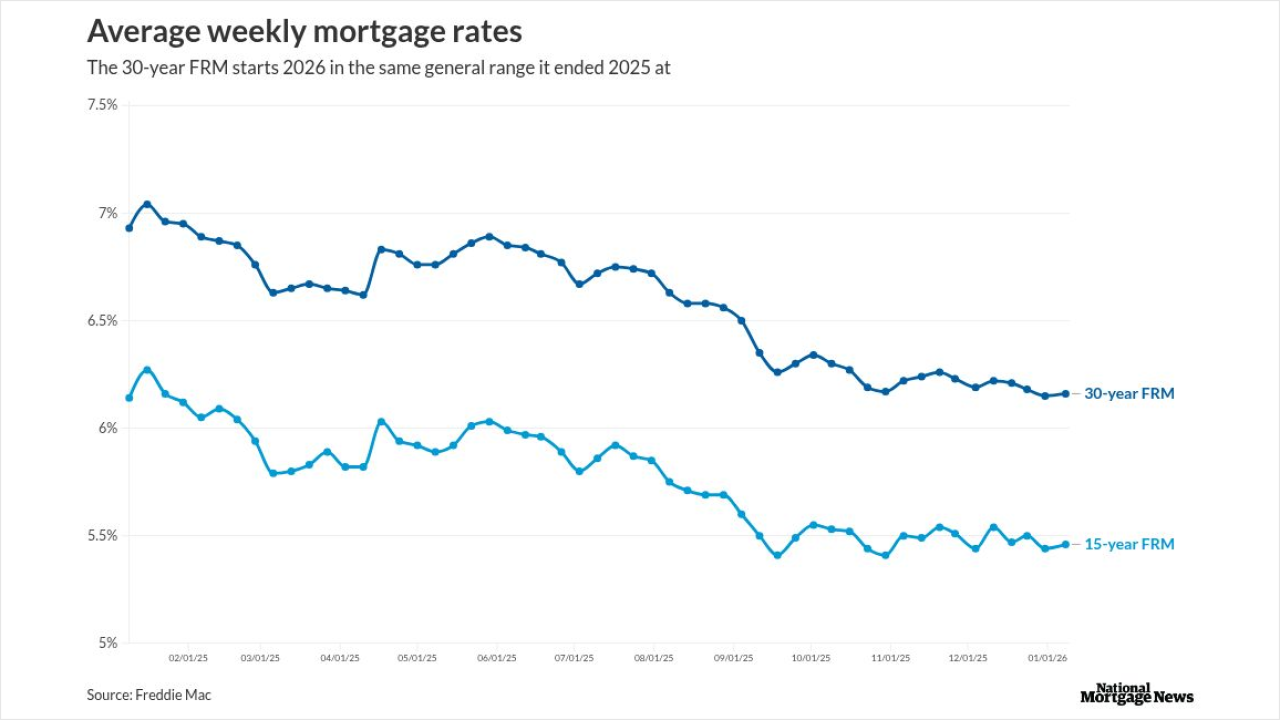

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8