-

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

The Ginnie Mae 2020 report coming out this summer will reveal the path the agency is taking toward working with digital mortgages, an agency executive said at an industry conference.

May 22 -

Impac Mortgage Holdings generated almost $4 million in net income during the first quarter as it continued to downsize to adjust for origination declines and benefited from servicing gains.

May 10 -

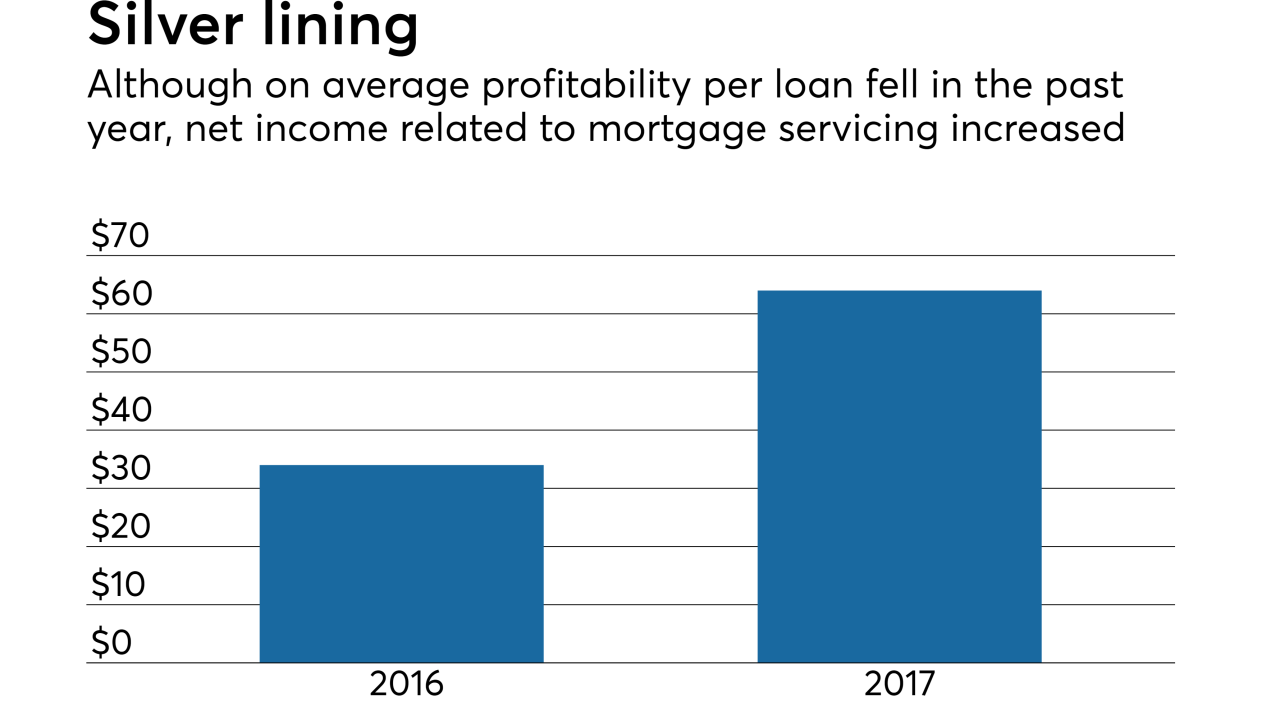

Mortgage servicers growing due to acquisitions or the increased value of servicing in the market could remain under pressure if these strategies don't outweigh other rising costs they face.

May 7 -

Freddie Mac has quietly started extending credit to nonbanks that issue mortgages, a move it says will help the companies maintain access to a crucial stockpile of cash if their home loans go sour.

May 7 -

Nationstar Mortgage Holdings reported first-quarter net income nearly four times higher compared to the fourth quarter of 2017.

May 4 -

Ocwen Financial Corp. got back in the black during the first quarter after selling New Residential Investment Corp. $110 million in economic rights to mortgage servicing.

May 2 -

From tech that ensures foreclosures are processed correctly to implementing robotic process automation, here's a look at seven strategies that servicers can use to stay compliant and on budget.

April 30 -

New Residential Investment Corp. reported a 400% year-over-year increase in net income as its servicing revenue improved dramatically over the previous year.

April 27 -

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24 -

The real estate investment trust is issuing $450 million of five-year notes backed by rights to excess servicing strips of Fannie Mae loans.

April 23 -

However, mortgage growth and servicing income weren't the only reasons profits rose by double digits at the Dallas bank.

April 18 -

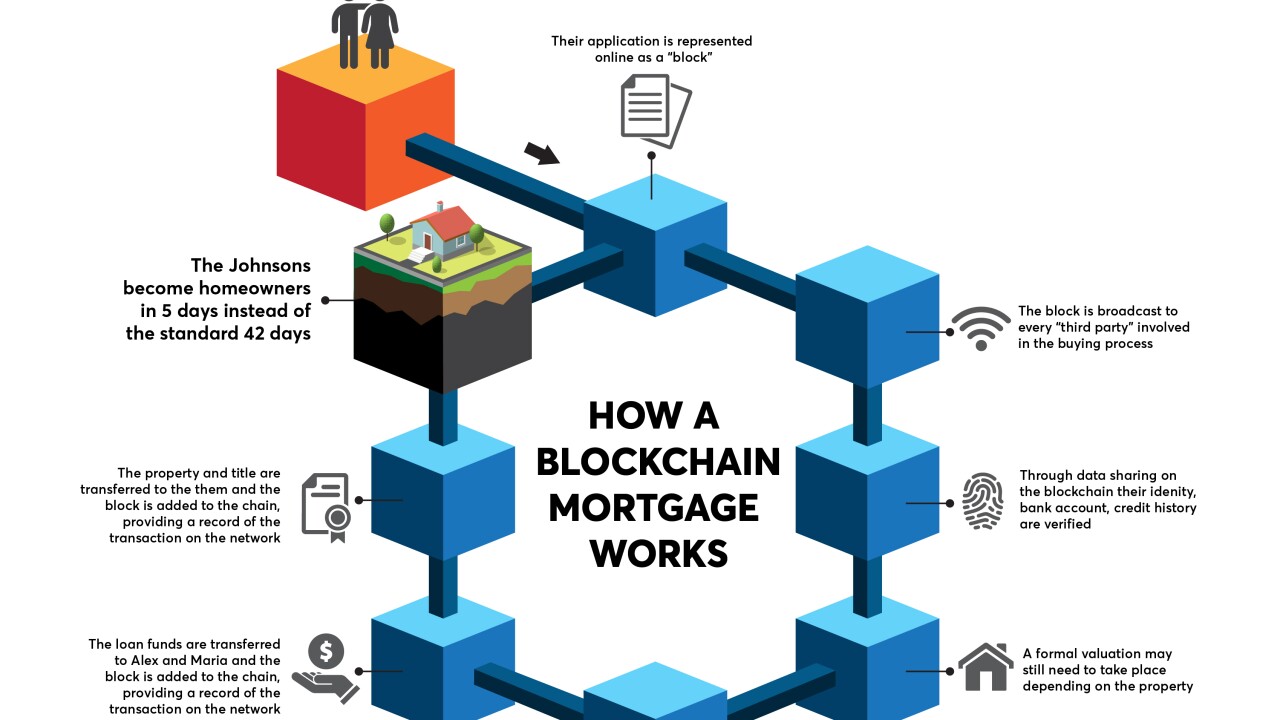

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

First-quarter mortgage banking results at Wells Fargo and JPMorgan Chase were weaker than Keefe, Bruyette & Woods forecast due to lower-than-expected gain-on-sale margins.

April 13 -

Situs subsidiary MountainView Financial Solutions is brokering a $6.1 billion package of government-sponsored enterprise and Ginnie Mae servicing rights.

April 11 -

A pair of the nation's largest banks, Citigroup and Wells Fargo, made changes to their mortgage banking executive teams.

April 2 -

There is an oncoming liquidity crisis that will force consolidation in the mortgage industry as margins tighten and funding sources dry up.

March 28 -

Servicers are still trying to figure out how they can best take advantage of the growing use of electronic notes and other digital mortgage tools by lenders and the secondary market.

March 27 -

Banks would welcome a proposal to loosen Basel III capital restrictions because it would make holding mortgage servicing rights easier and stem the recent exodus of depositories from the servicing business, executives said.

March 26 -

A new settlement with Massachusetts resolves all outstanding administrative actions against Ocwen Financial Corp. by a group of 30 states, but two states' legal actions against the servicer remain outstanding.

March 23