-

Home starts fell more than forecast in August, reflecting less construction of apartments and a decline in the tropical storm-hit South, representing a pause in momentum for a housing market that's been a key source of fuel for the economy.

September 17 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

Anticipated population growth has multifamily investors spending more on apartment buildings despite sales volume dropping by 50% for the first half of 2020, compared to the year-ago period, in Miami-Dade and Broward.

September 9 -

Gov. Gavin Newsom late Monday signed a stopgap measure to rein in evictions, offering limited protections for tenants and aid to landlords hit financially by the coronavirus pandemic.

September 1 -

Fannie Mae's new chief administrative officer position focuses on diversity, inclusion and affordable housing.

August 19 -

Borrowers will likely have to put more assets on the line to get forbearance extensions.

August 13 -

A new Marriott Residence Inn is expected to sprout next to the Millbrae BART station after landing a construction loan that serves as a welcome counterpoint to the pall of economic uncertainty cast by the coronavirus.

August 13 -

Tenants at so-called Class C buildings paid 54% of total rents due in June by the middle of the month, according to a study by LeaseLock.

August 11 -

Boston Common is planning to confront banks and real estate investors as an eviction crisis looms across the U.S., one that's likely to disproportionately impact Black Americans and other minorities.

August 11 -

The collateral pool consists of 59 loans for mostly older garden-style and mid-rise apartment buildings that have undergone recent upgrades and renovation.

August 10 -

A Dallas developer has admitted to paying bribes to a former city councilwoman in exchange for her lobbying efforts and votes to provide $650,000 in taxpayer money for his Fair Park apartment project.

August 10 -

Developer Doug Loose says he is "living in a cloud" after recently securing financing through Frankenmuth Credit Union for a portion of his $4.2 million purchase of a damaged condominium complex in Midland, Mich.

August 10 -

Citizens Bank Financial Group is funding the construction of two apartment buildings in neighborhoods northwest of Center City with a total of $27.5 million in loans, allowing the projects to move forward despite economic headwinds from the coronavirus pandemic.

August 7 -

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

Commercial real estate fundamentals improved in July, but the pandemic continues to affect development projects and is likely to remain a significant challenge for more than a year, according to a COVID-19 impact report by the NAIOP Commercial Real Estate Development Association.

August 6 -

For 32 years, the Bay Area city of Sausalito has used strict zoning restrictions to protect its scrappy industrial waterfront, banning both housing and offices in the 225-acre Marinship district, which stretches for about a mile north of downtown.

August 5 -

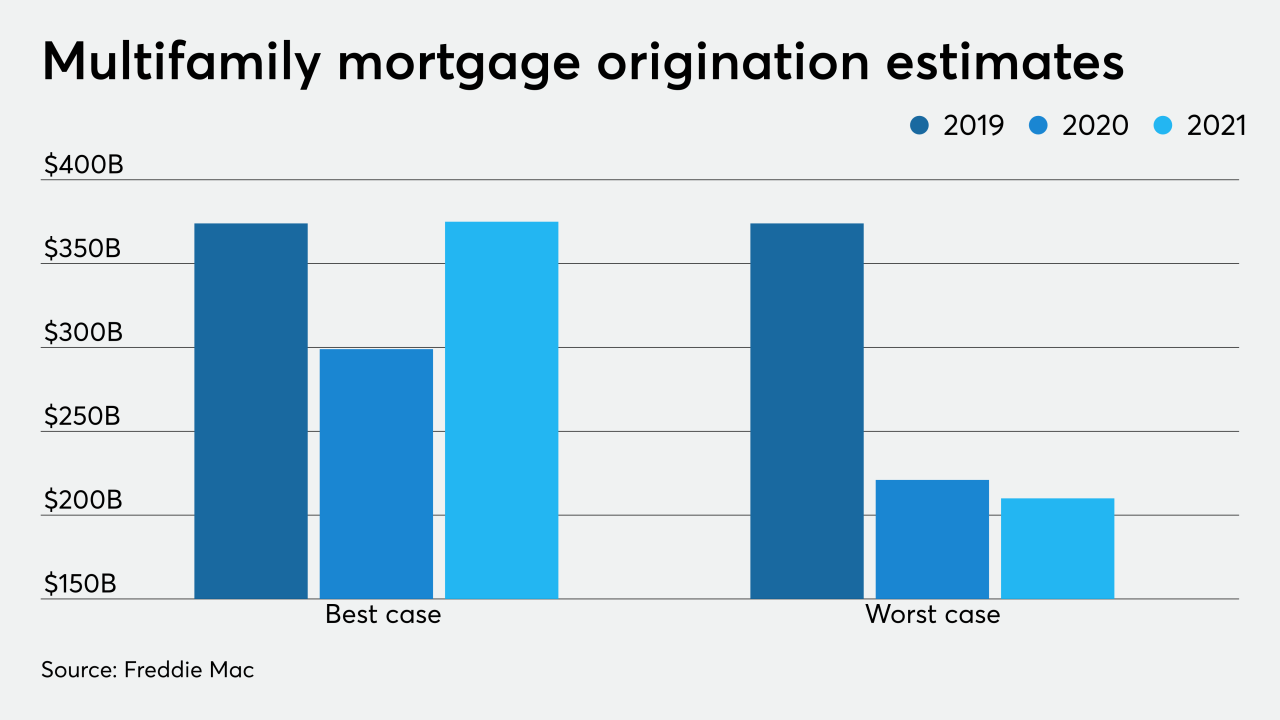

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

The government-sponsored enterprise reported net earnings of $2.55 billion, up from $461 million in the first quarter.

July 30 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22