-

The Affordable Housing Credit Improvement Act last week achieved a milestone by garnering bipartisan cosponsorship by more than half of the 435 members of the House.

March 16 -

Buying a home became slightly more attractive compared to renting in the fourth quarter, as the likelihood of another huge value drop decreased, an index from two Florida universities found.

March 11 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Most of the pool is made up of office-property loans, but also includes a sizeable exposure to hotel and retail properties.

February 27 -

Alabama is fourth in the country for raw vacancy rate with more than 18% of all housing units in the state empty.

February 25 -

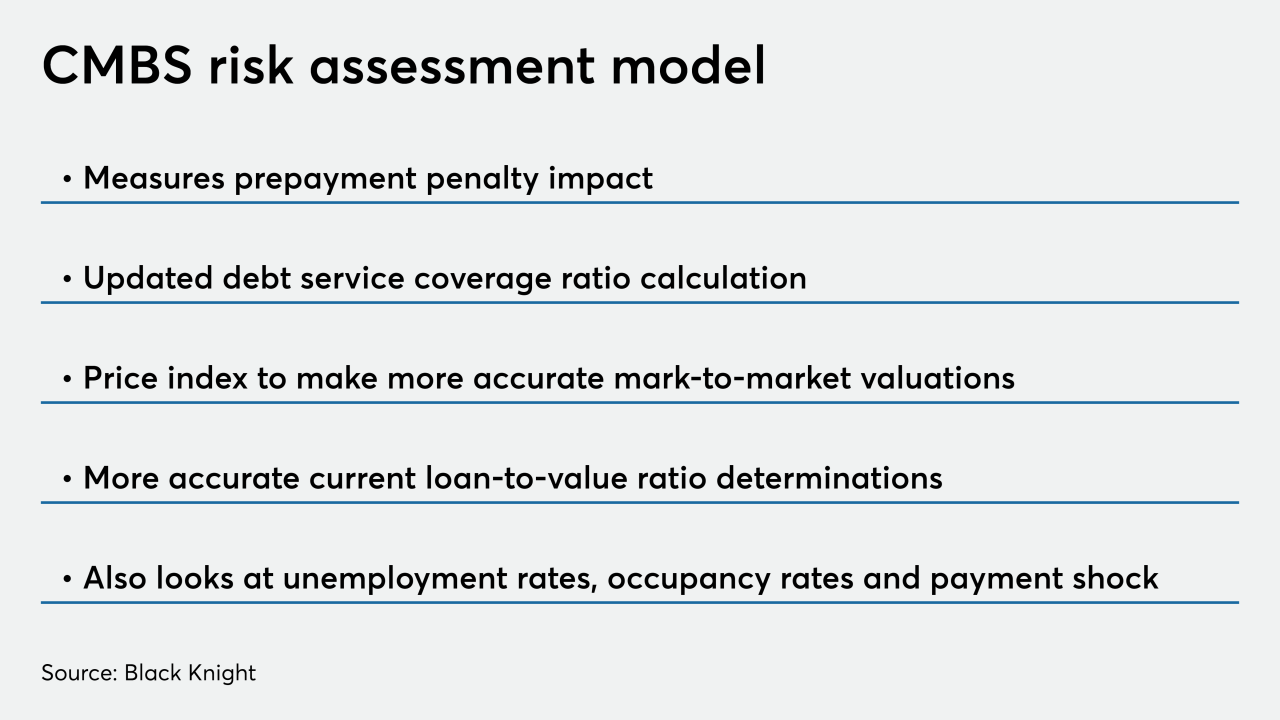

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

New-home construction remained robust in January and applications to build jumped to the highest level since 2007 as low mortgage rates and a solid labor market continued to fuel housing demand.

February 19 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

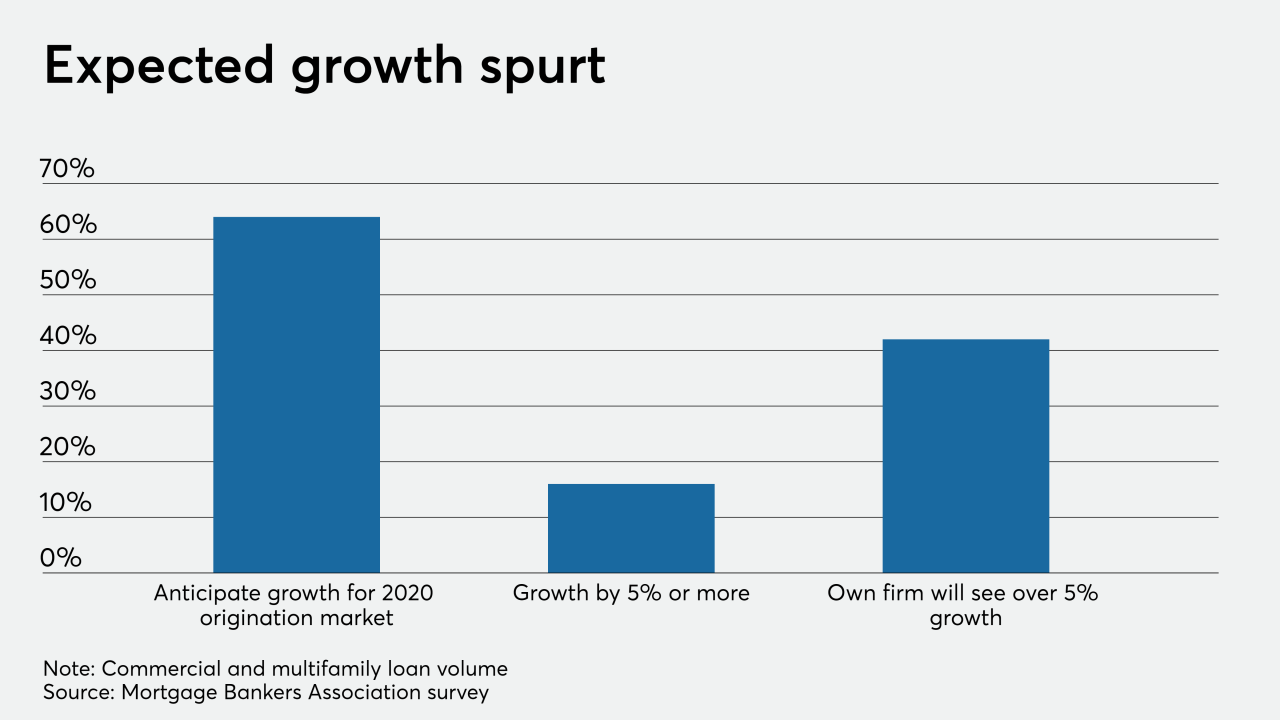

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

The loan participation is part of a debt refinancing package that paves the way for expanding the Parkmerced mega-development.

January 28 -

With more younger Americans renting than buying homes, apartment builders expect their current construction wave to continue.

January 27 -

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

January 17 -

Groundbreakings on new homes surged in December to a 13-year high, giving the housing market momentum heading into the new year amid low mortgage rates, solid job growth and optimistic buyers and builders.

January 17 -

State officials are set to grant a private-equity firm building a passenger train to Las Vegas the ability to issue tax-exempt bonds, while requests for using the funding for affordable housing go by the wayside.

January 14 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

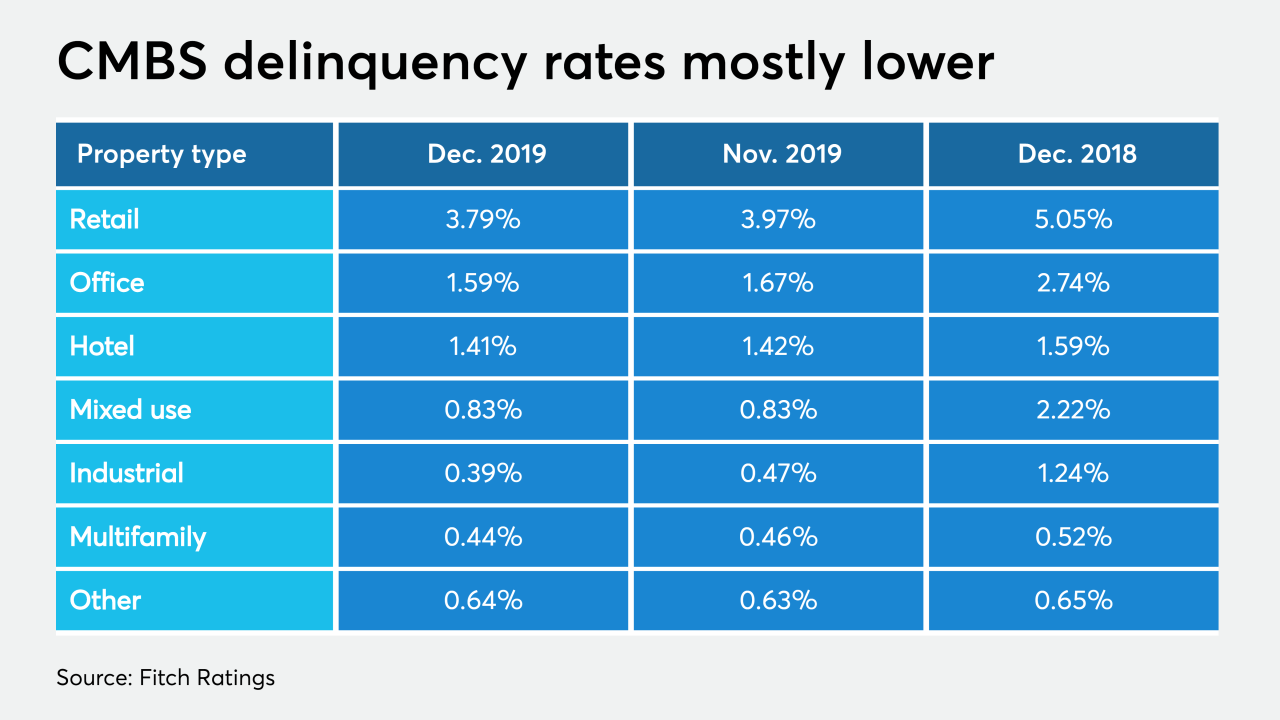

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

A Charlotte, N.C., developer detailed plans to build apartments and commercial space through a federal tax program that has faced scrutiny in recent months.

January 7 -

Bridge REIT LLC is sponsoring a $449.6 million bridge-loan securitization backed mostly by transitional multifamily properties.

January 6 -

For decades, Seattle has been primarily a city of homeowners, but those days may be coming to an end. It's one of the many ways that the city's current population boom has been transformative.

January 6