-

Despite huge demand for housing in central Ohio, home construction has fallen sharply this year.

October 2 -

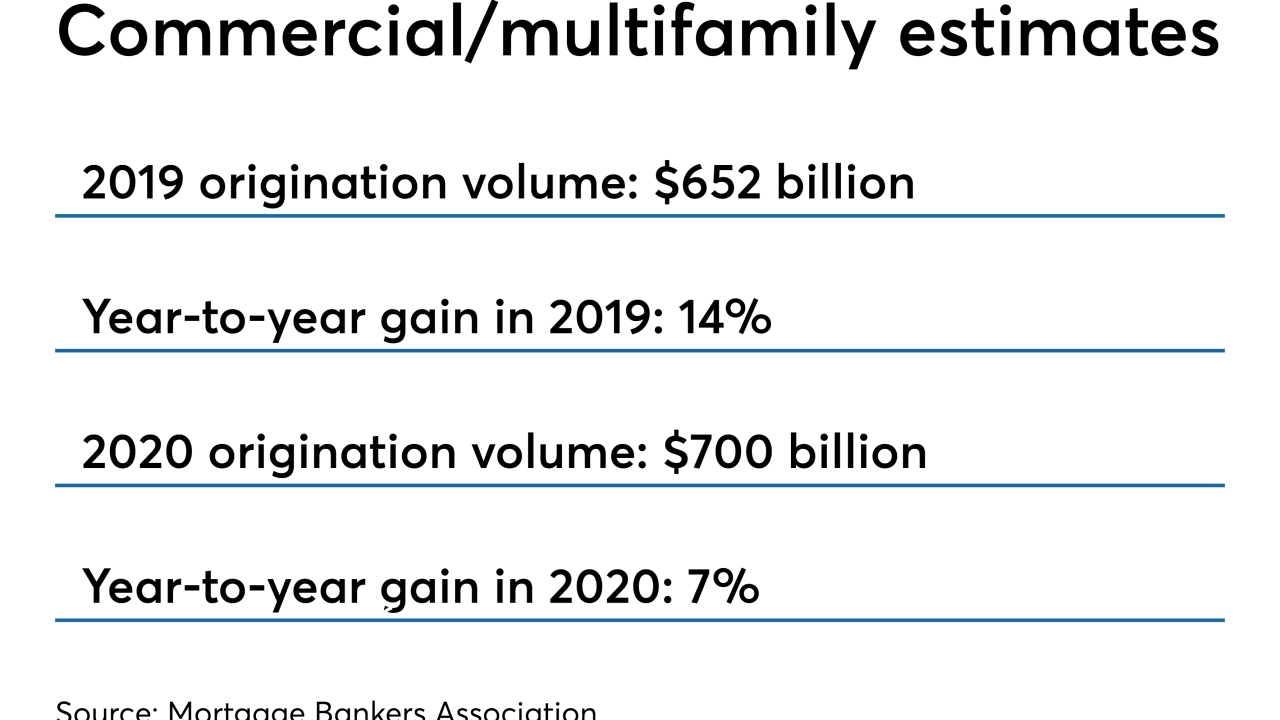

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

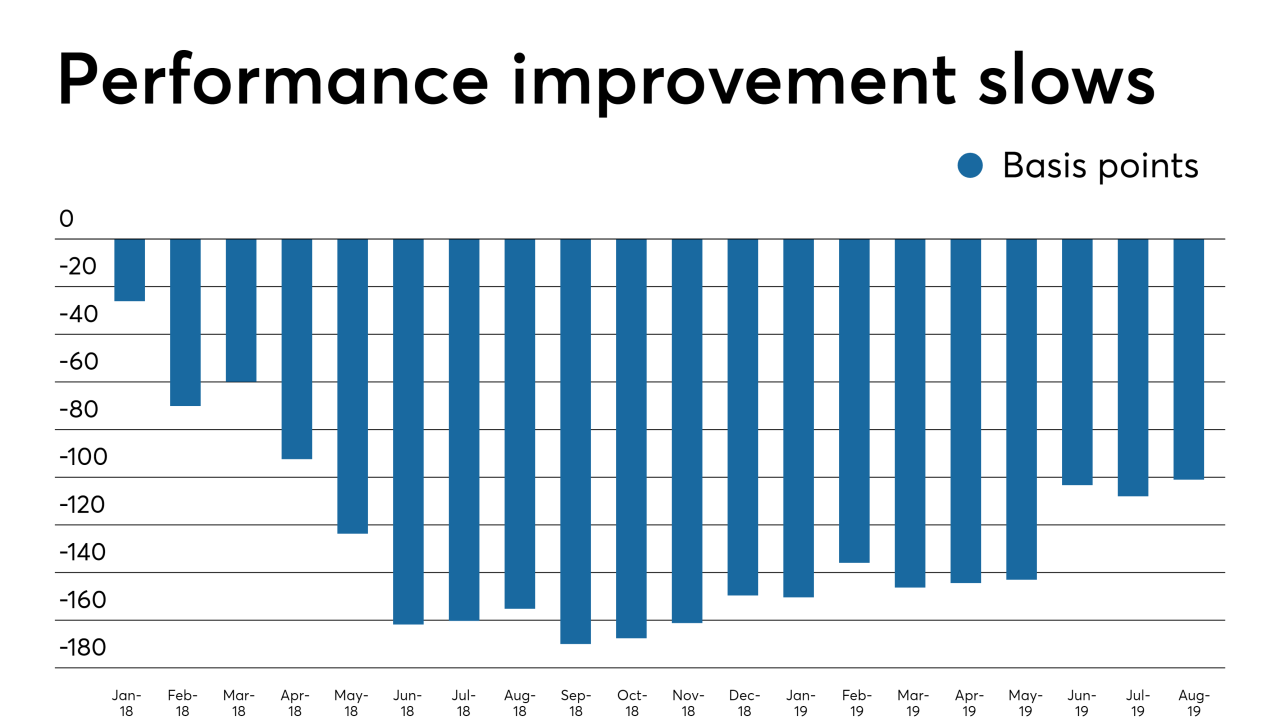

Commercial and multifamily mortgage delinquency rates should stay at historically low levels in the near future even as economic uncertainty over trade affects U.S. businesses, according to the Mortgage Bankers Association.

September 24 -

Commercial real estate transaction volume rebounded in the second quarter from a poor first three months of 2019, although property price growth plateaued, according to Ten-X Commercial.

September 20 -

Home construction surged in August to the fastest pace since mid-2007 on more apartment projects and single-family houses, a welcome sign for the housing sector that has struggled to gain momentum.

September 18 -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

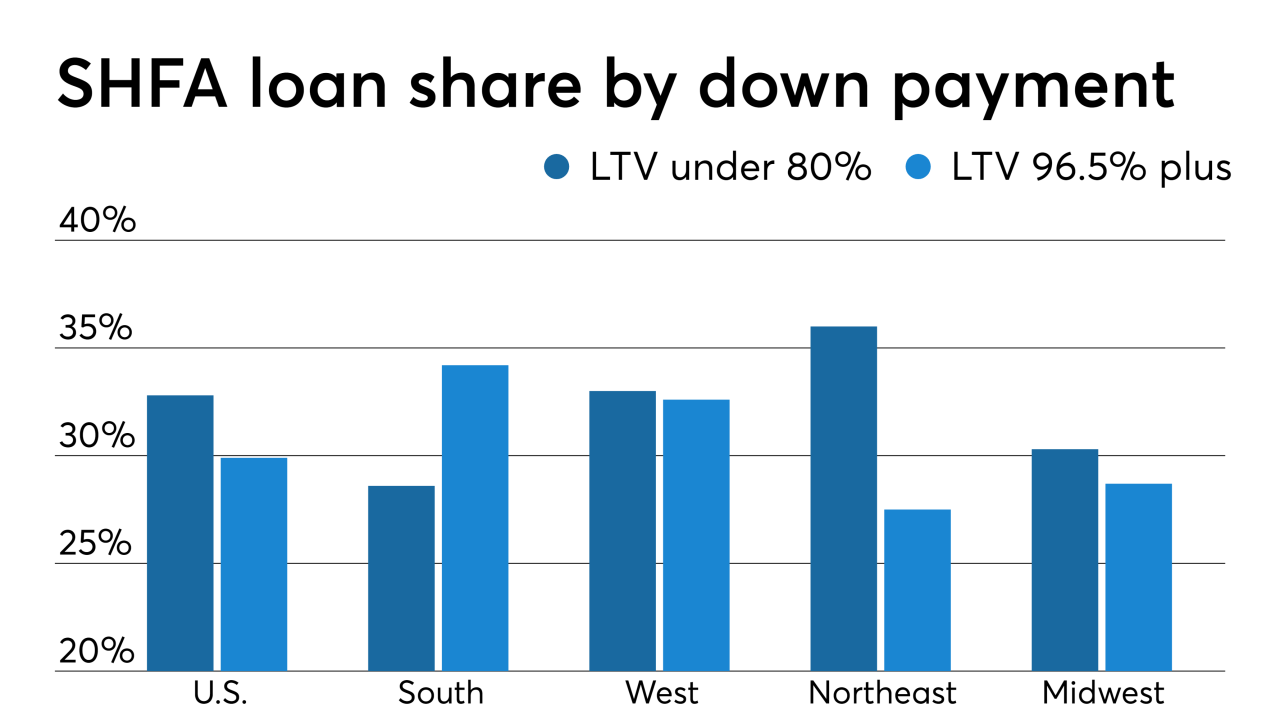

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

Lower interest rates are expected to drive financing secured by income-producing properties to new heights by year-end, according to the Mortgage Bankers Association.

September 10 -

By 2030, about 20% of the U.S. population will be over age 65, up from 15% in 2016, according to the Census Bureau.

September 10 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

Extell Development, facing an Aug. 30 maturity for a construction loan, signed an agreement for a new loan on the New York property, using the unsold units in the 815-apartment project as collateral.

August 30 -

New-home construction unexpectedly fell in July for a third month on another drop in starts of apartment buildings that masked a gain in single-family units.

August 16 -

All of the loans were originated by Greystone, an investment group based in New York that originated multifamily and health care facility loans for Fannie Mae, Freddie Mac, the FHA and various commercial mortgage-backed securities.

August 13 -

Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations.

August 12 -

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

Bankers are downplaying such concerns, but others say a sharp decline in values on rent-regulated buildings means landlords will have less cash flow to acquire new properties.

July 31 -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

New-home construction fell in June for a second month as a drop in apartment building outweighed a pickup in single-family projects.

July 17 -

Life insurance companies increased their mortgage investments to levels higher than historical norms, creating more potential danger for their portfolios in the event of a real estate downturn, a Fitch Ratings report said.

July 15 -

The more than $44 billion in new Ginnie Mae mortgage-backed securities that came to market in June marked the strongest month for the government bond insurer in more than two years.

July 11