-

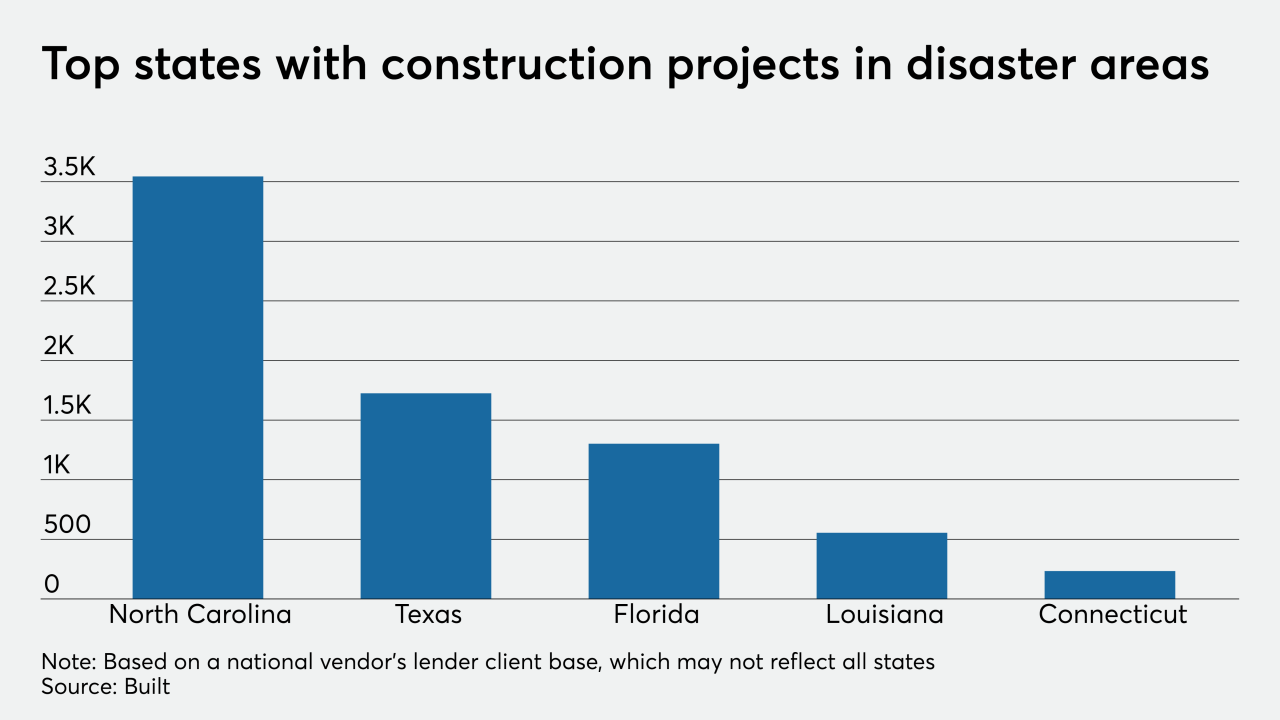

The technology company arrived at this percentage by mapping federally declared disaster areas to the projects it helps lenders manage.

September 3 -

The lightning-ignited Hennessey Fire destroyed 254 single-family homes in Napa County, Calif., making it one of the most destructive in county history, Cal Fire reported.

September 2 -

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

Developer Doug Loose says he is "living in a cloud" after recently securing financing through Frankenmuth Credit Union for a portion of his $4.2 million purchase of a damaged condominium complex in Midland, Mich.

August 10 -

Mortgage insurers had been operating under the belief that rules pertaining to natural disaster delinquencies apply with COVID-19, but now it's in writing.

July 1 -

If delinquency rates rise, all four stand-alone firms would have a capital shortfall.

June 9 -

In addition to the potential wave of mortgage defaults resulting from coronavirus-driven forbearances, hurricane season could put nearly 7.4 million homes worth $1.8 trillion at risk.

May 28 -

County homeowners may be eligible for federal assistance in the form of low-interest loans rather than grants.

May 25 -

Loans with coronavirus-related forbearance have to be reported as current to the credit bureaus but there’s a ripple effect from them that has implications for credit reports and underwriting.

May 22 -

Florida's first-ever — and short-lived — climate change czar set a clear priority for the state: Protect the real estate market.

April 27 -

Treating COVID-19 forbearances as a natural disaster will likely mean the MIs will not need to hold as much capital.

April 22 -

Despite the increased frequency and intensity of natural disasters caused by climate change, just 33% of consumers said it's a major factor in determining when or where to buy or sell a home, according to Redfin.

February 26 -

After the 2017 October fires in Sonoma County, Calif., prices inflated in 2018 as the destruction strongly stoked demand for homes. Last year, the housing market cooled and balanced itself.

February 4 -

The number of large-scale natural disasters continued to proliferate in 2019, creating new situations where local mortgage delinquency rates could stay inflated for the following 12 months, according to CoreLogic.

January 29 -

The largest bank in Puerto Rico said hundreds of millions of dollars of its mortgages and consumer loans are tied to the parts of the island hit by the recent quake or still recovering from two hurricanes.

January 28 -

A recent earthquake is adding to servicing challenges in Puerto Rico caused by multiple natural disasters, power outages and some companies' insufficient use of technology, according to one vendor.

January 13 -

Scores of homes destroyed or badly damaged by Memorial Day tornadoes still sit vacant and abandoned, creating new blight and safety concerns in neighborhoods.

December 30 -

Overall home-loan delinquencies remain near 20-year lows, but in Iowa, Minnesota, Nebraska, Rhode Island and Wisconsin, they are inching up in moves that may be tied to local economic concerns.

November 12 -

A group of 64 House lawmakers is pushing congressional leadership to incorporate premium caps and address a new methodology for assessing risk in flood insurance reform legislation.

November 1 -

California's devastating wildfires have given way to a real estate opportunity: the burn-out lot.

October 29