-

Nonbanks would have to inform the CFPB of any state or local court decisions against them involving consumer financial products, under a new proposed rule. That information would be pooled with data about federal violations and be made available to the public.

December 12 -

Non-depository institutions originated an even greater share of all home loans compared to the year before, according to the Federal Financial Examination Council’s latest analysis of Home Mortgage Disclosure Act data.

June 17 -

But overall improvement in September employment numbers are likely to encourage the Federal Reserve to begin tapering their asset purchases.

October 8 -

The company’s $204 million in net income was down from unusual highs seen recently but still historically strong thanks to the balance between its loan channels and servicing operation, representatives said.

August 6 -

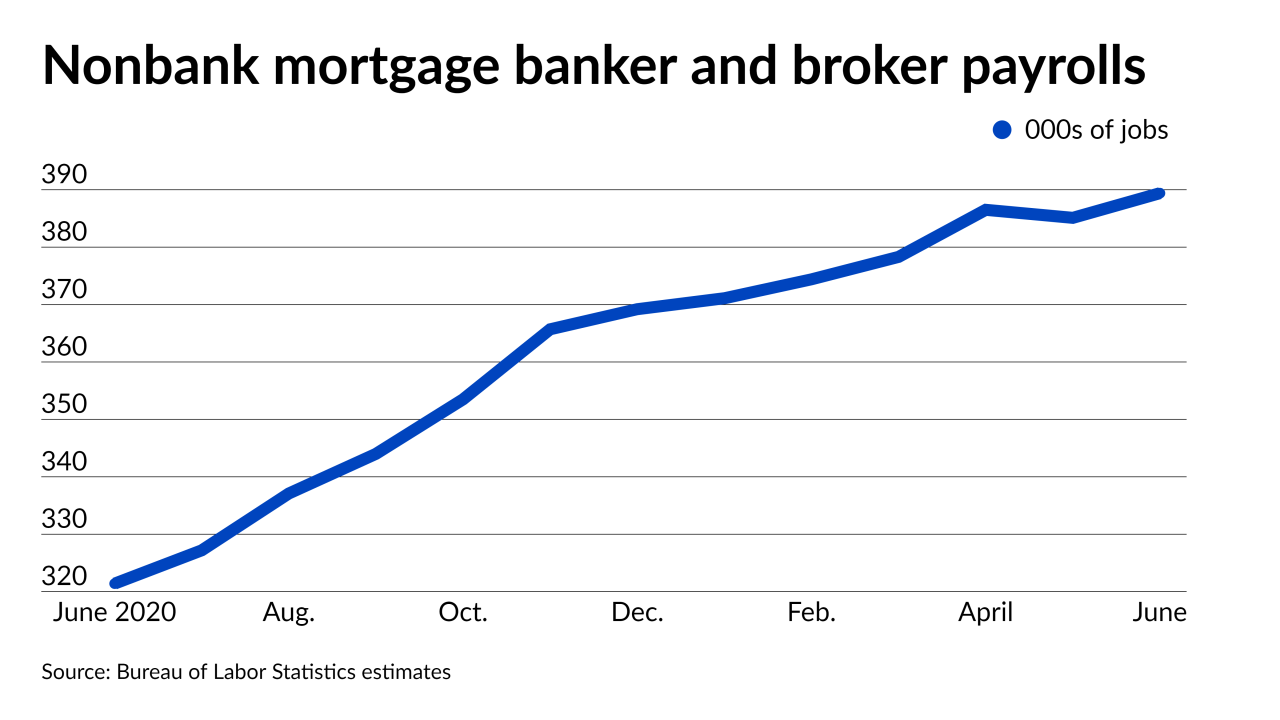

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

The proposal should be withdrawn or reworked around the needs of small players they impose a disproportionate burden on, the Community Home Lenders Association said.

July 30 -

Borrowers reacted positively to the increased interaction and engagement resulting forbearances and payoff requests, J.D. Power found.

July 29 -

While federal regulators attempt to overhaul the Community Reinvestment Act for banks, Congress has shown little interest in applying it to other lenders. But recent moves in Illinois and New York have given some stakeholders hope that state lawmakers will pick up the slack.

July 26 -

The plateau in non-depository estimates for new jobs in the field reported Friday follows anecdotal accounts of reorganization by banks and nonbanks in the past week.

July 2 -

Contrary to the myth perpetrated by many in Washington, IMBs do not pose any real taxpayer financial risk or systemic risk, writes the CEO of Union Home Mortgage and member of the Community Home Lenders Association.

June 28

-

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

In addition to earning ancillary fee income, it provides originators with an opportunity to connect with current and potential clients mired in student loan debt.

June 9 -

The more gradual upward drift in job numbers this year may hint at a slight softening in the market that analysts have flagged.

June 4 -

The company is formally launching a new “non-mortgage” unit that will provide small loans for home improvement projects.

May 10 -

The relatively small addition of 266,000 positions to the broader market in April suggests that income uncertainty, which could impact some borrowers’ ability to qualify for or pay loans, could become a concern among lenders and brokers.

May 7 -

Loans bought on the secondary market have become increasingly important as borrower demand has ebbed and companies have sought to obtain mortgages through additional outlets to maintain production levels.

May 4 -

The head of the Federal Reserve appeared to support Congress’s expanding the scope of the Community Reinvestment Act to unregulated institutions, just as regulators weigh how to modernize the framework for banks.

May 3 -

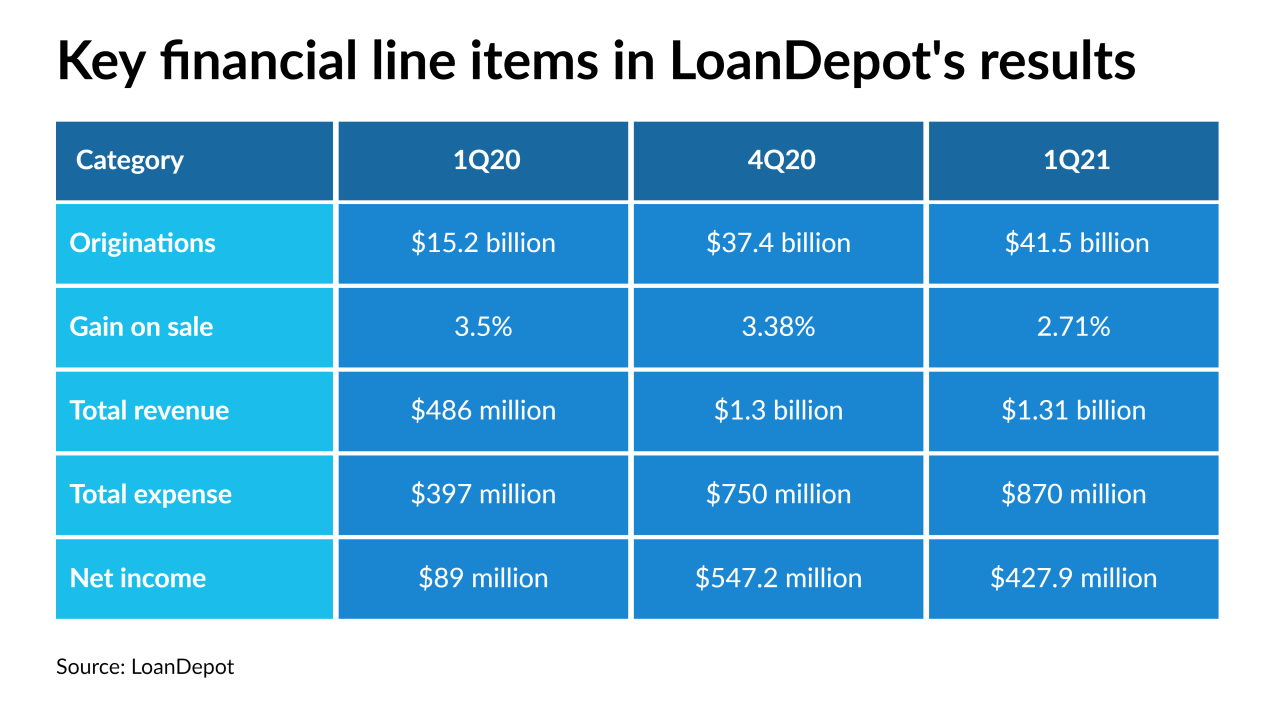

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

Nonbanks claimed more of the top slots based on loan volume, while the origination gains experienced by Hispanic, Black and Native American borrowers were weaker than those of other groups.

April 9 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8