-

Nationstar Mortgage Holdings posted net income of $7 million for the third quarter, its first under the new Mr. Cooper consumer-facing brand.

November 2 -

Walter Investment Management Corp. was supposed to prosper by snapping up mortgage cast-offs from big banks at fire-sale prices. Instead, Walter is belatedly joining the list of companies burned by the U.S. housing crisis.

October 25 -

The Consumer Financial Protection Bureau was created in part to ensure that nonbanks are subject to federal oversight, but the fact is that 99% of banks are exempt from CFPB supervision.

October 11 Community Home Lenders of America

Community Home Lenders of America -

Nondepository mortgage bankers and brokers increased their headcounts in August, but hurricane recovery efforts and other macro factors may stymie additional growth.

October 6 -

The share of purchase and refinance loans originated by nonbanks are at their highest point since at least 1995, according to an analysis of new Home Mortgage Disclosure Act data.

September 28 -

Ginnie Mae will more closely examine liquidity at all issuers in response to complaints by the HUD inspector general that it would be vulnerable to defaults at nonbanks it does business with.

September 27 -

The Trump administration has implemented an apparent role reversal for the Financial Stability Oversight Council, leaving the true intended role of the post-crisis systemic risk body unclear.

September 25 -

While many mortgage lenders focus on updating the front end of the borrower experience, other lenders are making strides on the back end of the process with new electronic closing capabilities.

September 20 -

Nondepository mortgage bankers and brokers employment dipped slightly in July, ending a four-month run of hiring pickups.

September 1 -

The nonbank lender and servicer's long-awaited rebrand comes along with wholesale changes across its entire operation to better emphasize the customer experience.

August 21 -

Walter Investment Management Corp. is in danger of having its stock delisted from the New York Stock Exchange as its average market capitalization remains below required minimums.

August 17 -

Critics of recent False Claims Act enforcement argue the Justice Department is too heavy-handed toward lenders and servicers. But in an industry reputed for shoddy processes during the crisis, perhaps stringent oversight is warranted.

August 11 National Mortgage News

National Mortgage News -

PHH Corp. will pay the Justice Department $75 million to settle a False Claims Act investigation of its underwriting practices on government-insured mortgages and loans sold to Fannie Mae and Freddie Mac.

August 8 -

The year opened with hopes that regulatory and enforcement pressures would abate for the mortgage industry. The reality has turned out quite differently.

August 7 -

The nonbank mortgage sector had its largest one-month employment gain in a year, as independent mortgage bankers and brokers enjoyed stronger-than-expected originations during the second quarter.

August 4 -

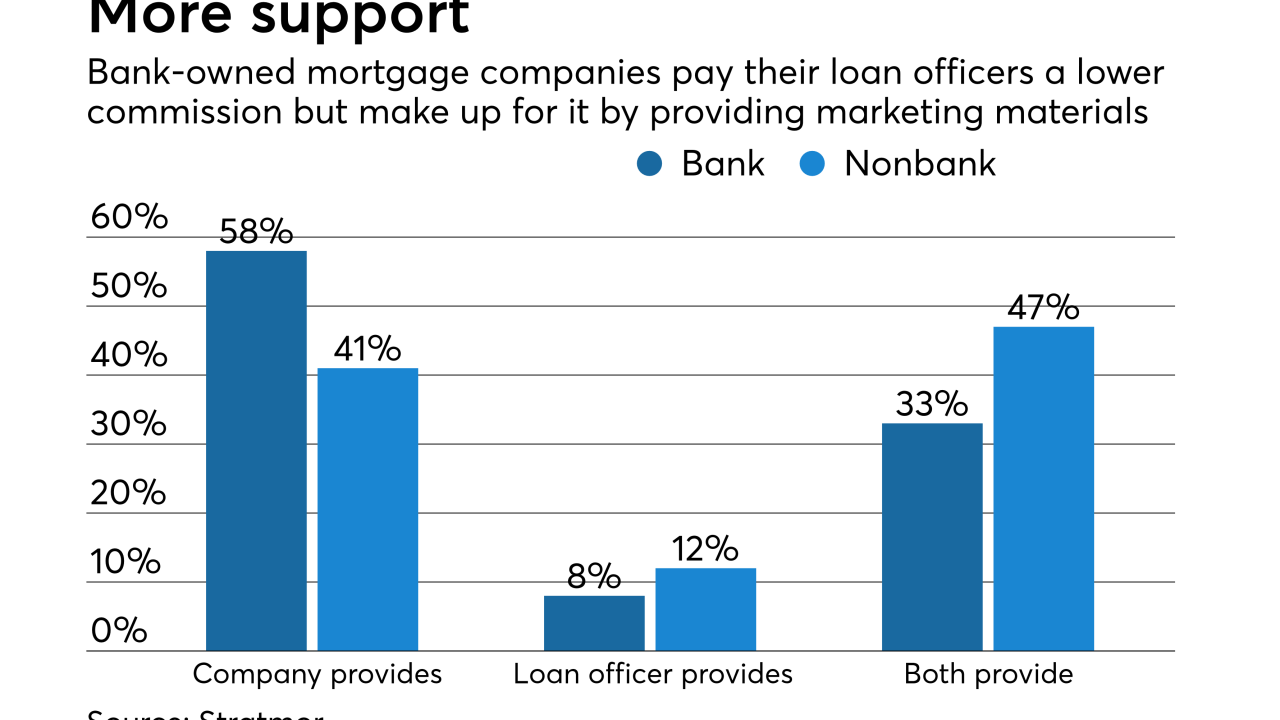

Banks pay their loan officers less than independent mortgage bankers do, but the level of sales support provided negates the difference, a study from Stratmor Group said.

July 28 -

Former Ginnie Mae President Ted Tozer is joining the board of directors at PennyMac Financial Services starting Aug. 1.

July 19 -

It's not only regulation that is hurting profitability, but also banks' failure to adapt to the internet age, according to a recent study.

July 12 -

Employment among nonbank lenders and mortgage brokers grew in May, marking the third straight month of employment gains at a time when housing inventory is tight, refinancing has slowed and home prices are rising.

July 7 -

From the largest banks to the smallest independents, policymakers want to hear the mortgage industry speak with one voice in the critical efforts to reform the government-sponsored enterprises.

June 29 Cunningham & Co.

Cunningham & Co.