-

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

In addition to earning ancillary fee income, it provides originators with an opportunity to connect with current and potential clients mired in student loan debt.

June 9 -

The more gradual upward drift in job numbers this year may hint at a slight softening in the market that analysts have flagged.

June 4 -

The company is formally launching a new “non-mortgage” unit that will provide small loans for home improvement projects.

May 10 -

The relatively small addition of 266,000 positions to the broader market in April suggests that income uncertainty, which could impact some borrowers’ ability to qualify for or pay loans, could become a concern among lenders and brokers.

May 7 -

Loans bought on the secondary market have become increasingly important as borrower demand has ebbed and companies have sought to obtain mortgages through additional outlets to maintain production levels.

May 4 -

The head of the Federal Reserve appeared to support Congress’s expanding the scope of the Community Reinvestment Act to unregulated institutions, just as regulators weigh how to modernize the framework for banks.

May 3 -

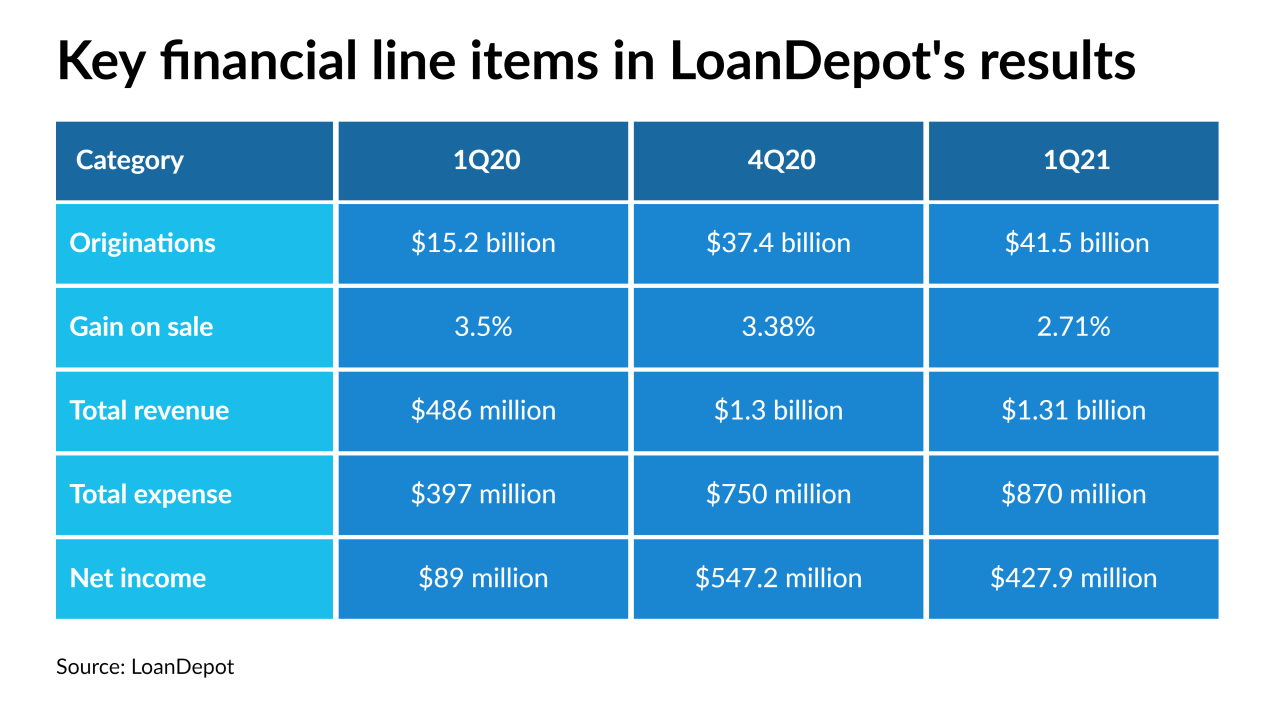

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

Nonbanks claimed more of the top slots based on loan volume, while the origination gains experienced by Hispanic, Black and Native American borrowers were weaker than those of other groups.

April 9 -

The Financial Stability Oversight Council has struggled to find its footing since its creation in Dodd-Frank. The Treasury secretary has signaled a more aggressive role for the panel, including reviving its authority to target nonbank behemoths.

April 8 -

The San Diego-based company produced $10.6 billion in the fourth quarter, and has done $6.1 billion in the first two months of 2021.

March 23 -

A cross-training strategy that hasn’t been widely used since the Great Recession is coming back into vogue among outsourcers.

March 5 -

The offering went down to $14 from an anticipated $19 to $21 per share.

February 11 -

The agreement would generate $250 million in proceeds, which the nonbank mortgage company plans to use to pay down and refinance existing debt, while also investing in its servicing and origination businesses.

February 10 -

Volumes should rise this year but it could become more difficult to get loans for certain property types, the Mortgage Bankers Association said.

February 10 -

2020’s mortgage employment numbers proved to be slightly higher than previously estimated when reconciled with the Bureau of Labor Statistics’ annual business census.

February 5 -

The acquiring company does business under the name Excelerate Capital and will extend that name to Castle in order to expand its footprint.

February 3 -

This is the third nonbank mortgage company offering in a row to decrease its size, but the reductions were more severe than the others.

January 29 -

The mortgage lender will promote its brand, products and services through MLB-related television or radio ads, in addition to digital outlets.

January 26 -

The Financial Stability Oversight Council could determine that a broad range of mortgage companies should be subject to “heightened prudential standards,” said Andrew Olmem, a partner at Mayer Brown and a former senior economic adviser to the White House.

January 25