-

Craig Strent of Apex Home Loans saw potential in blending his mortgage banking services with the strategy of financial advising, finding strong partners and a niche in helping clients through one of life's most difficult transitions.

May 31 -

Recent legislative proposals to make piecemeal changes to the government-sponsored enterprises could set broader GSE reform on the wrong path.

May 26 Community Home Lenders of America

Community Home Lenders of America -

Caliber Home Loans in Irving, Texas, has agreed to acquire Fairfield, Calif.-based First Priority Financial.

May 25 -

Staying on top of credit underwriting rules is essential for Rosalie Rains of Capital Financial Advisors, and when things get slow she can always turn to the two-color flier she made when she first started originating loans.

May 24 -

The secondary marketing agency wants to model how servicers' available cash might stand up to shocks because interruptions to that liquidity have been a common problem among those that failed.

May 22 -

ISGN Corp. has completed the sale of its business process outsourcing unit to Firstsource Group USA, a subsidiary of the Indian firm RP-Sanjiv Goenka Group.

May 20 -

From the Common Security Platform and Freddie Mac loan sales to new accounting rules and what direction mortgage rates are headed, there was plenty to debate during this week's MBA Secondary Conference in New York.

May 19 -

Ditech Financial will shift a St. Louis-area servicing platform to start doing new loan originations during the third quarter.

May 16 -

Joseph Chacko works with H1B visa holders in ethnic communities, and uses his knowledge of agency guidelines and immigration policy to offer foreign workers a place to put down roots.

May 16 -

Redwood Trust is broadening what kinds of prime jumbo mortgages it will accept and its appetite for non-qualified mortgages.

May 12 -

Stonegate Mortgage Corp. expanded its loss year-over-year following a decline in mortgage servicing rights assets.

May 11 -

Savvy salespeople live by the motto ABC: Always Be Closing. Here's a look at loan officers featured in the Top Producers Rankings who took that mantra to new heights by posting triple-digit increases in their annual mortgage origination volume.

May 11 -

HomeBridge Financial's Michael Stallings took a desire to help military veterans and grew that into a hearty business focused on bringing other veterans the cornerstone of homeownership.

May 10 -

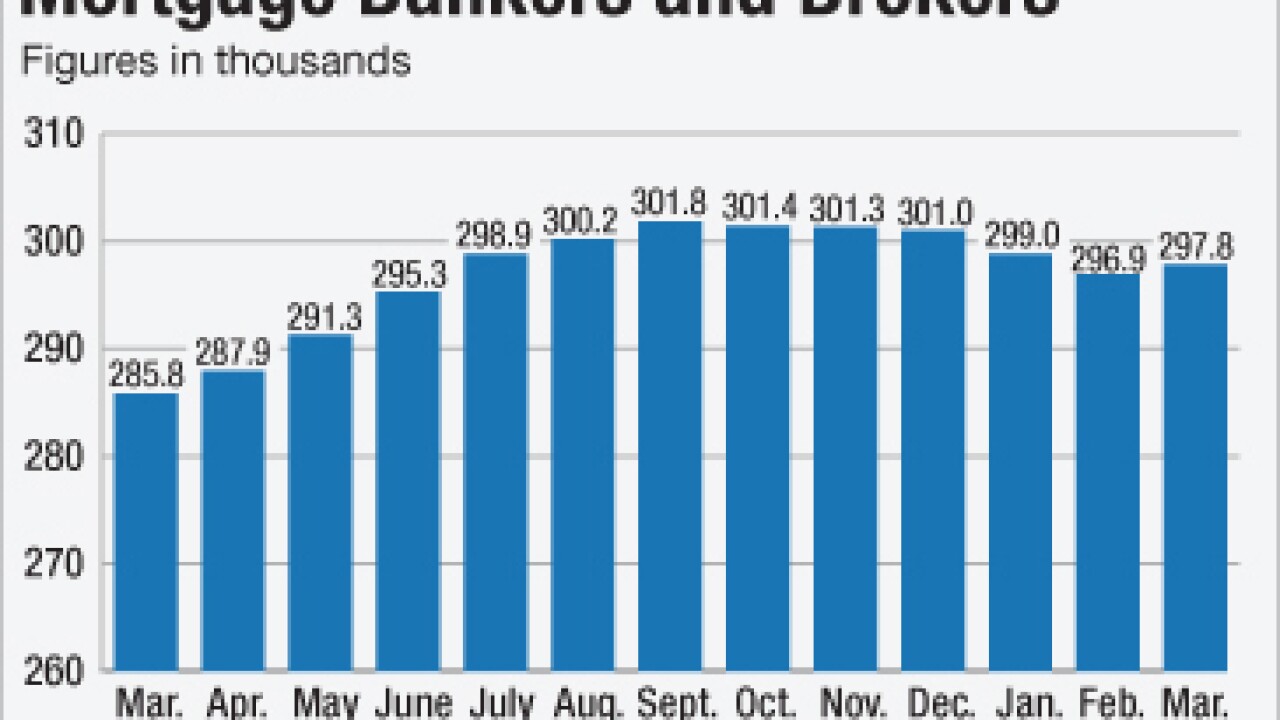

Forecasters expect stronger originations in the second quarter as home buying outpaces refinancings.

May 6 -

The mortgage upstarts that transformed the industry after the U.S. housing crash are now facing their own shakeout.

May 4 -

Walter Investment Management Corp. sank into a deeper $172.7 million net loss during the first quarter, as lower interest rates caused pressure on the company's mortgage servicing rights valuation.

May 3 -

Posting educational videos on YouTube and social media helped Cherry Creek Mortgage's Kelly Zitlow land a spot on Lifetime Network's "Designing Spaces." The unique opportunity let her share knowledge about mortgages and extended her marketing reach.

May 3 -

A downturn in origination volume, offset in part by improved gain-on-sale margins, has led to a slump in mortgage banking revenue, according to Keefe, Bruyette & Woods.

May 2 -

Servicing rights are high-yielding assets, making them attractive investments for hedge funds, real estate investment trusts and banks.

May 2 -

With consumers generally averse to risk, financial institutions have an opportunity to rethink what it means to make bets in line with their customers' well-being.

May 2