-

Financial companies from Quicken Loans to SoFi will be advertising in Sunday's game a rare sight in recent years despite the estimate $5 million price tag.

February 4 -

The near future may find more banks ceasing to originate residential mortgages in an effort to stop the slide in stock prices.

February 2

-

The final deadline for all Top Producers Survey responses is here. All entries must be submitted online by 6 p.m. EST Monday, Feb. 1.

February 1 -

Walter Investment Management Corp. has acquired a servicing platform and other assets from Residential Credit Solutions.

January 29 -

D.R. Horton is expanding its entry-level Express Homes brand amid first-time buyers' growing demand for both homes and mortgages.

January 26 -

American International Group announced $3.6 billion in new costs to fill a reserve shortfall and said it will hold an initial public offering for its mortgage insurer and sell an adviser network as CEO Peter Hancock seeks to boost returns and protect his job after criticism from activist investor Carl Icahn.

January 26 -

Brokers and small lenders are being crushed under the weight of heavy regulation, leaving loan officers little choice but to shoulder the burden themselves or move to an organization that can handle the regulatory requirements.

January 15 TD Bank

TD Bank -

Independent mortgage lenders are expecting a wave of consolidation prompted by excessive compliance costs, a tepid housing recovery and the need for more capital to grow their businesses. Roughly 20% to 25% of independent companies could be eliminated or change hands in less than two years.

January 13 -

Employment at nonbank mortgage lenders and brokers was down in November, according to the latest Bureau of Labor Statistics data.

January 8 -

The Federal Reserve's interest rate increase has commercial real estate debt and equity financing players even more upbeat about their prospects in 2016.

January 7 -

Forget bigger is better. Several private-equity-backed lenders are making loans to small landlords, who represent the biggest chunk of the home-rental market and get less help from Fannie Mae and Freddie Mac than they once did.

January 7 -

Rather than relying on a formal marketing services agreement to get business, loan officers now have to prove that they can provide realty agents and consumers the best mortgage experience.

January 4 -

National Cooperative Bank has formed a partnership to invest $40 million in an effort to provide loans for resident-owned manufactured home communities.

December 18 -

Mortgage stocks for the most part saw price per share gains in the wake of the Federal Open Markets Committee decision to raise short-term rates.

December 16 -

Mortgage lenders and servicers weary from a raft of regulatory changes in recent years may see some respite in 2016, but still face some tough issues ahead. Here's the most pressing.

December 14 -

Ditech has renewed its sponsorship of Kevin Harvick's No. 4 car which races for the Stewart-Has Racing team on the NASCAR Sprint Cup circuit.

December 11 -

Seven years after the housing bubble collapsed, Wall Street's appetite for riskier mortgages is returning.

December 8 -

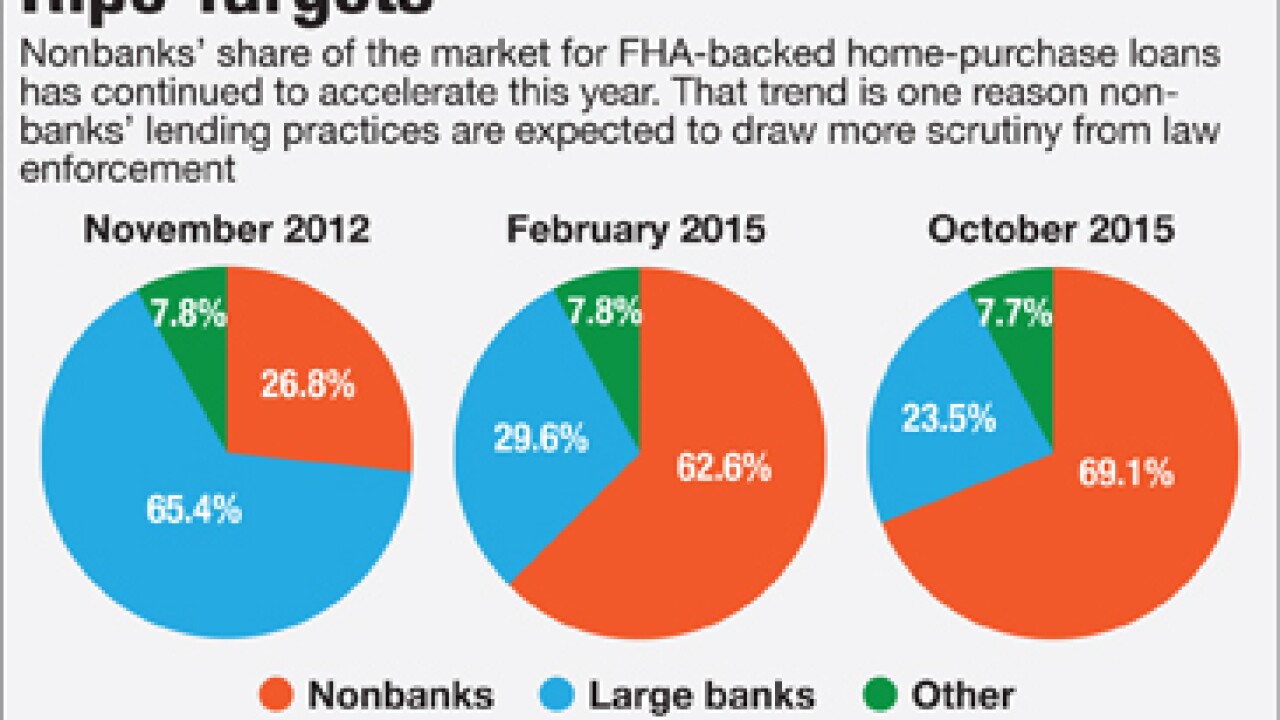

Two independent mortgage banks agreed to settlements in the past week with the Justice Department for failing to meet Federal Housing Administration guidelines. The cases are a warning to nonbank lenders that they need to beef up self-reporting of deficiencies, and they remind large banks about the legal risks associated with FHA lending.

December 7 -

There are no easy fixes to Nationstar's myriad problems including a plunging stock price and increased regulatory scrutiny but Chief Executive Jay Bray says the turnaround starts with a commitment to improving customer service.

December 7 -

Poppi Metaxas, the former chief executive of Gateway Bank in Oakland, Calif., was sentenced to 18 months in prison for perpetrating a scheme involving mortgages.

December 4