-

Jay Venkateswaran, business unit head of banking and financial services at WNS Global Services, said the best lenders are preparing now for expectations of increased business at least two quarters in the future.

October 7 -

The majority of non-core work, such as accounting, IT and HR functions can be offloaded to a third party as a means for lenders to shave expenses.

December 29 -

The outspoken former Trump administration official recently made headlines when he referred to the mortgage industry as a “ticking time bomb.”

July 11 -

The business opportunity comes at a time when lenders are looking to save money because of tightening margins.

April 18 -

The company wants to redeploy resources into the wholesale mortgage channel that accounts for three-quarters of its production volume.

February 14 -

Rocket, already the nation's No. 1 lender, is looking to increase market share

October 29 -

One year after its internal merger, the fintech and fulfillment services provider’s COO Debora Aydelotte discusses the company’s support for community banks and its placement in the ranking of Best Fintechs to Work For.

April 6 -

Also, private money is expected to return to the mortgage securitization market, according to lenders who responded to an Altisource survey.

February 5 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

Computershare Loan Services has agreed to acquire a loan fulfillment and secondary marketing unit owned by LenderLive Holdings in order to broaden its services along the full mortgage lifecycle.

August 20 -

As mortgage brokers gain more leverage in the market, concerns about borrower poaching and retention are making channel conflict with lenders more prevalent.

March 12 -

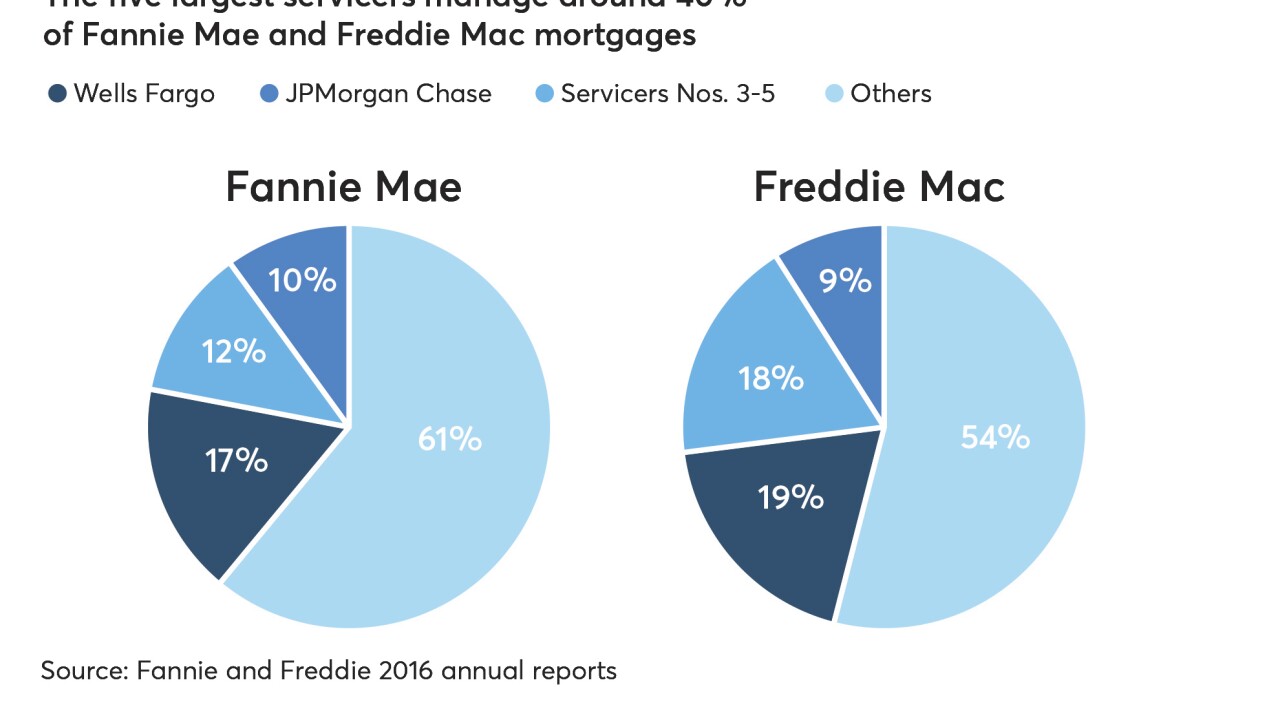

Wary of concentration risk, secondary market participants are backing initiatives to give more players a piece of the action.

February 6 -

PHH Corp.'s net loss grew in the third quarter as the company took a hit from the costs of its transformation to being a subservicer and portfolio retention originator.

November 8 -

PHH Corp. lost $46 million in the second quarter as it continues efforts to exit mortgage origination and servicing and instead focus on subservicing.

August 8 -

Former EverBank Chairman and CEO Rob Clements now has those same positions at LenderLive Holdings, a Denver-based provider of outsourced mortgage services.

July 18 -

Nationstar Mortgage has returned its overseas call center operations to the U.S., a move that will add 500 jobs at the company.

June 21 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

New entrants in mortgage servicing are rethinking how business is done, creating more division between holders of mortgage servicing rights and the entities that actually manage loans.

June 13 -

The onslaught of regulatory actions against Ocwen may open the door for Nationstar to pick up a massive subservicing portfolio from the beleaguered servicer.

April 27 -

Citi has named David Chubak as head of global retail banking and mortgage for the global consumer bank, replacing Jonathan Larsen, who

resigned late last year .April 20